Special to the Financial Independence Hub

Stock market volatility can and will happen, which can really spook many investors.

To help with that, should you use an all-weather portfolio for changing market conditions?

Would an all-weather portfolio be best long-term?

How would I build an all-weather portfolio using Canadian ETFs?

Read on and find out our take, including the pros and cons of this all-weather investing approach.

The portfolio is designed for all seasons

If you prefer a more passive approach to investing, building an all-weather portfolio may be right for you. While this portfolio is designed to perform well during all seasons of the market, from an economic boom or bust and the messy stuff in between, we’ll see below that this approach is not without some flaws and drawbacks – just like any investing approach. Further, you could be missing out on some important aspects or assets for investing entirely.

Understanding how an all-weather portfolio works can help you to decide if this path could be right for you, or even if a blended all-weather approach could make much more sense.

What Is an All-Weather Portfolio?

Just as the name sounds, an all-weather portfolio is a portfolio that’s built to do well, regardless of changing market conditions.

This investing approach was popularized by Ray Dalio, a billionaire investor and founder of Bridgewater Associates, the largest hedge fund in the world. At the time of this post, Bridgewater currently manages over $140 billion in assets.

(FYI – this sounds very impressive of course, but we don’t invest in hedge funds and neither should you!)

Dalio’s all-weather philosophy is largely this:

Diversify your investments, hold specific asset classes in certain allocations, such that the portfolio can perform consistently throughout most economic conditions.

This includes periods of increasing volatility, rising inflation, and more. More specifically, this portfolio strategy is designed to help investors ride out four specific types of events:

- Inflationary periods (rising prices)

- Deflationary periods (falling prices)

- Rising markets (bull/booming markets)

- Falling markets (bear/busting markets)

How an All-Weather Portfolio Works

Based on back-testing, essentially Dalio and his Bridgewater team came up with a model after studying the relationship between asset class performance and changing market environments. The result of this relationship crystallized the following asset class allocation that would investors to benefit whether the market is moving up or down or sideways.

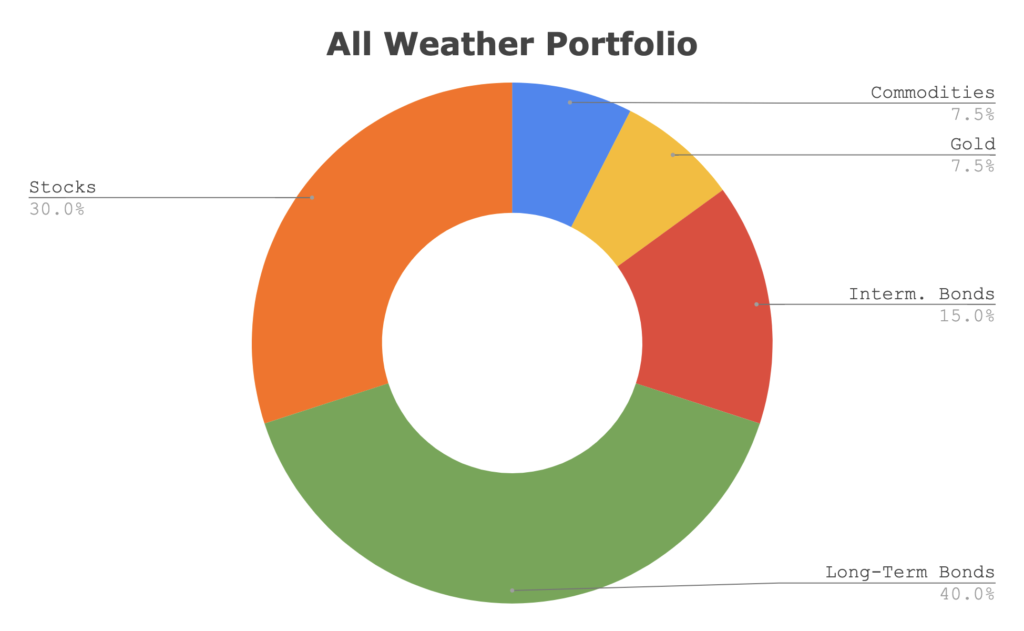

Here is the asset class breakdown:

We’ll provide more detailed funds to mimic this portfolio in a bit.

One thing you’ll realize from the portfolio above is the all-weather portfolio takes a much different approach than age-based allocations (i.e., more bonds as you get older in your portfolio), the traditional 60/40 balanced portfolio, or other popular couch potato approaches. It essentially ignores an investor’s personal need for changing risk appetite. A drawback we’ll discuss more in a bit.

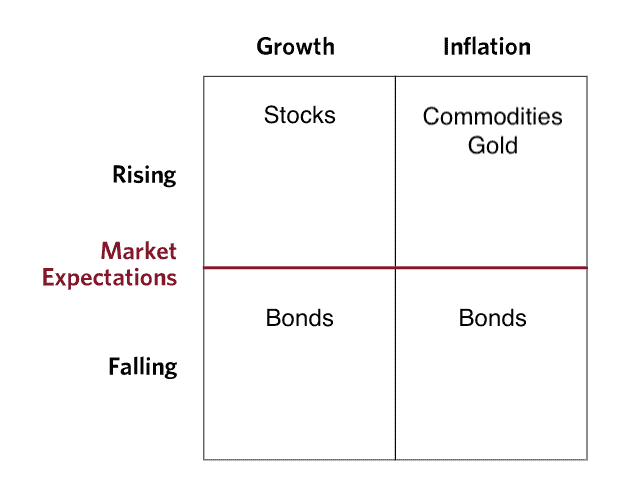

The theory of the All-Weather Portfolio is that:

- The equity portion will thrive in bull markets.

- Commodities and gold should support the portfolio for inflation.

- Bonds will help investors when stock market growth is suffering…

You get the idea.

More clearly, here is a growth-inflation grid on this subject as a good reminder:

In terms of equity sectors, you can also see what stocks might do better (or worse) during any inflationary period in particular from My Own Advisor’s site on this inflation subject.

How has the All-Weather Portfolio performed?

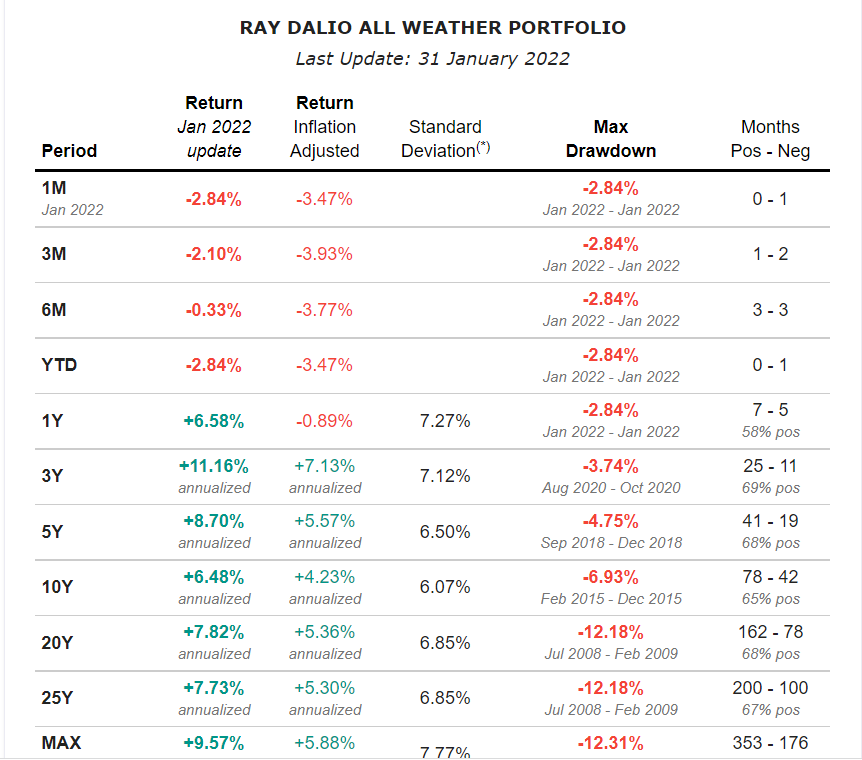

Well overall actually…

We’ll link and reference a few tables below but surprisingly, even after a huge decade-long bull-run (when stocks provided high returns from 2010-2020 overall, in a high growth environment) this portfolio did well although it did underperform the S&P 500 index given it only has a 30% allocation to stocks.

All tables from:

http://www.lazyportfolioetf.com/

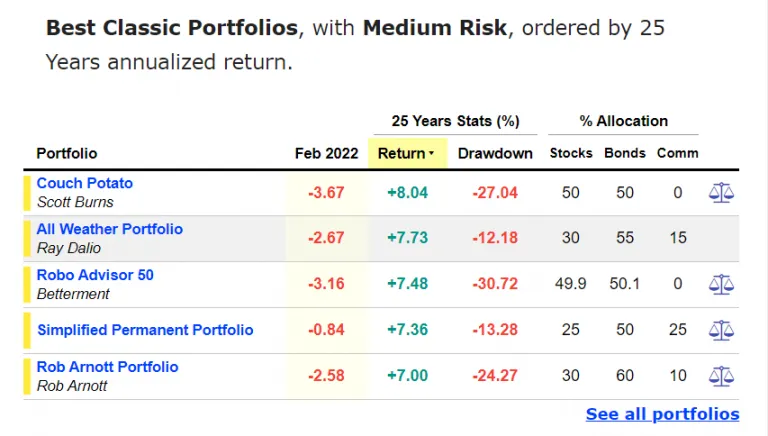

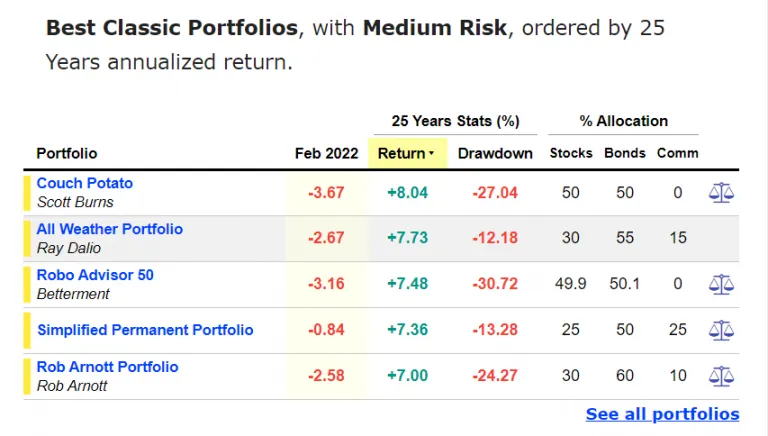

And this one, when comparing the All-Weather Portfolio against other popularized passive investing strategies.

What about the Canadian comparison?

Leveraging the tables above, you’ll see below that some long-standing Canadian passive ETFs stack up rather well when compared to the All-Weather Portfolio, although some of these ETFs are certainly not a true apples-to-apples comparison:

iShares XIU – TSX 60 stocks

- 10-year = 9.24% and since inception (1999) = 7.87%

iShares XBAL – 60/40 Traditional Balanced Portfolio

- 10-year = 6.35% and since inception (2007) = 5.43%

*All data points above relevant to the time of this post.

Building an All-Weather Portfolio in the U.S. is rather simple, since many articles break down exactly how this portfolio is constructed. Again, the target asset mix is:

- 30% stocks (domestic stocks)

- 55% bonds (domestic bonds)

- 15% hard assets (gold and commodities – domestic-focused)

This makes the composition of the U.S. All-Weather Portfolio like this for long-term performance tracking:

- VTI – Vanguard Total Stock Market (30%)

- TLT – iShares 20+ Year Treasury Bond (40%

- IEI – iShares 3-7 Year Treasury Bond (15%)

- GLD – SPDR Gold Trust (7.5%)

- GSG – iShares S&P GSCI Commodity Indexed Trust (7.5%)

Source: http://www.lazyportfolioetf.com/allocation/ray-dalio-all-weather/

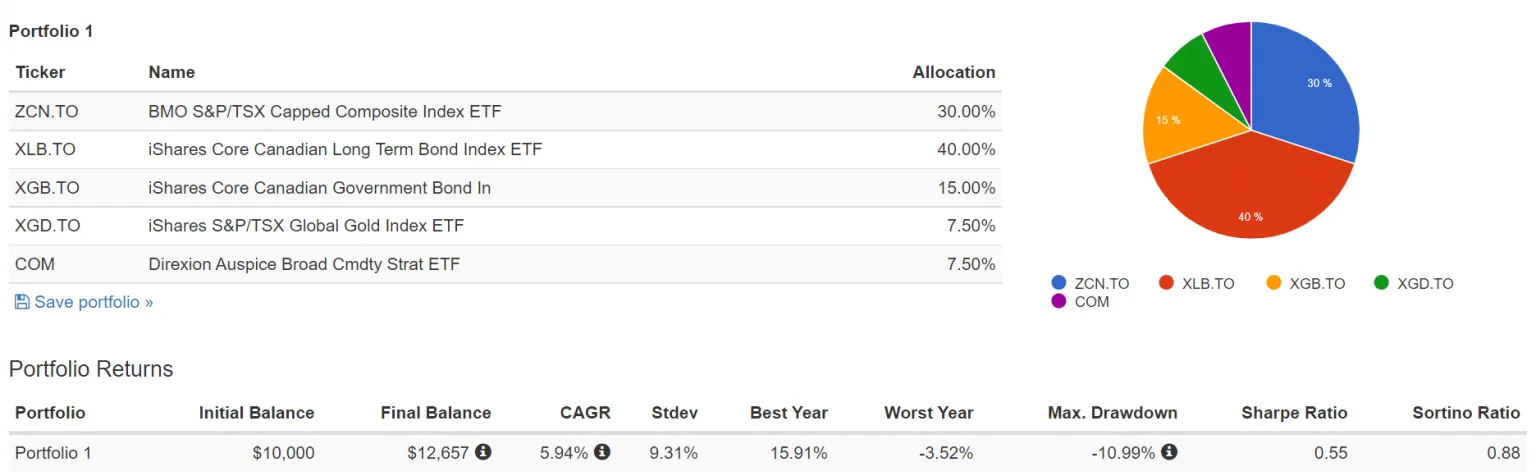

Making the following assumptions, a Canadian All-Weather Portfolio could look something like this:

- ZCN – Canadian Total Stock Market ETF (30%) – you could also use any other broad-market low-cost ETF that tracks the entire Canadian equity market (VCN, XIC, others).

- XLB – Long Term Bond Index ETF (40%) – we feel owning XLB or any equivalent (e.g., Vanguard Canadian Long-Term Bond Index ETF (VLB.TO)) would be good, given most bonds in such funds mature about 20 years out (aligned to TLT in the U.S.).

- XGB – Government Bond ETF (15%) – given IEI tracks U.S. treasuries (whereby IEI average maturity is about 5 years) we feel XGB might be suitable here. Most XGB holdings mature in <10 years. While using a short-term bond ETF might be OK, it would be skewed because funds like XSB, VSB include about 20% corporate bonds including those from Canadian banks. Then again, you could consider Canadian real return bonds.

- XGD – Global Gold Index ETF (7.5%) – this long-standing iShares ETF is huge, with billions in Assets Under Management (AUM); it is helpful it is diversified including Canadian companies making up >60% of the holdings.

- COM – Direxion Auspice Broad Commodity Strategy ETF (7.5%) – you might not have heard of this fund, but managed out of Calgary for a few years, this fund holds a broad basket of 12 commodities, including precious metals, agriculture products such as grains and sugar, and energy such as crude oil and gasoline. While COM has a modest MER, it has been on a tear over the last year. We chose COM to align with GSG from the U.S. All-Weather Portfolio but in more practical terms, you might also consider REITs or a collection of alternative investments for this 7.5% allocation as you wish.

Our Canadian All-Weather Portfolio could be:

Reference: Portfolio Visualizer

Is an All-Weather Portfolio right for you?

Is an All-Weather Portfolio right for you?

Here are our thoughts and some considerations:

- Whether you choose this approach, or something else, it’s important to consider your personal investment risk, the timeline for investing and overall goals. This may mean the heavy bias to bonds in this particular approach may or may not align to your long-term income investing needs for any retirement plan given our recent 40+ year bond bull-market is essentially dead in the water. Past performance is not indicative of future results!

- Rebalancing can be costly. Meaning, to juggle these 5 ETFs (or more?) in your desired asset allocation and location could be time-consuming to you and costly with transaction fees and/or complex for tax-loss harvesting in taxable accounts. While portfolio rebalancing is of course very smart, we feel with so many options available to DIY investors like ourselves you needn’t bother with this approach.

- Taking any domestic approach can be costly. Even though My Own Advisor has done very, very well with his portfolio, he was open to sharing some lessons learned with his diversification here. Keeping too much of a home bias can reduce total returns. Historically speaking, investing in the U.S. market has been rewarding to many long-term investors and there is little reason to believe that will change. As such, keeping upwards of 50% of your portfolio invested in the U.S. market could be wise long-term. The rest could be from Canada from there. When it comes to various sectors, commodities, energy and other sectors can be great inflation protection tools – even though no one sector over time is 100% foolproof and immune to declines.

- While any All-Weather Portfolio sounds appealing, it can lag in performance when compared to other investing approaches depending on the investing timeline. While such a portfolio may help you with market volatility, we feel market volatility is the premium you pay for investing – it’s just part of the overall journey. Assuming and knowing that, you’re likely best to (again) own more stocks than bonds and consider a cash wedge to manage any poor sequence of returns, including riding out any market volatility. This way, you can pounce on equities when they fall in price or correct! Some sectors and stocks in those sectors are on sale right now!!

Summary – Should you use an All-Weather Portfolio?

At the end of the day, we see some advantages with any All-Weather Portfolio but more disadvantages using this approach to invest. Namely, we believe investors need to live with a bias to stocks over bonds for long-term investing success. This is because the stock market has been a proven winner over time. Also, for the coming years and decades potentially, interest rate risks and higher inflation is something to get used to. Bond yields and interest rates have an inverse relationship. Dedicating 55% of your portfolio to bonds is very likely to expose you to more interest rate risk. Higher inflation will be very problematic for you with a lower stock allocation, with bond yields where they are.

These of course are just our predictions for the financial future and things we are trying to guard ourselves against. Your mileage may vary.

In closing, a well-diversified, low-cost ETF portfolio (or a well-designed portfolio mixed with dividend stocks and low-cost ETFs), if executed well, should offer both resistance from market volatility and great long-term positive returns. There is never a perfect portfolio however and please be very skeptical of any advisor or expert who tells you otherwise.

Cashflows & Portfolios is a free resource providing a beginning-to-end guide for Do-It-Yourself investors. The journey begins with how to budget and generate cash flow; how best to invest that cash flow; onto using the nest egg to fund the next phase of life – retirement. The site is owned and managed by Mark and Joe, established personal finance bloggers in Canada. This blog originally appeared on CAP in March 2022 and is republished on the Hub with their permission.