By Graham Bodel, Chalten Advisors

Special to the Financial Independence Hub

“Not to fear, we have found a manager based in our very own Canada that is able to consistently beat the pack.”

Standard & Poor’s has done a brilliant job over the last few years of shining the light on the fund management industry by publishing its SPIVA (S&P Indices Versus Active Funds) Scorecards, which report on the performance of actively managed mutual funds relative to their benchmark indices.

We’re not spoiling anything by telling you the results don’t usually come out favourably for active managers: the performance data has been fairly consistent and compelling for years.

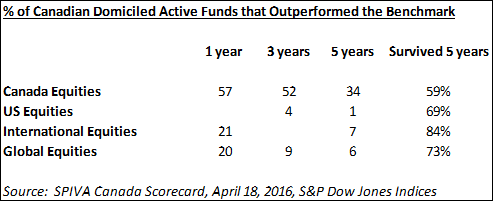

The latest SPIVA Canada Scorecard for the year ended December 31, 2015 came out on Monday and at first glance there may be reason to cheer, especially for those fund managers focused on domestic stocks.

While 57% might not seem very convincing, it’s certainly a better result than US domestic equity managers, only 25% of whom managed to beat the benchmark last year (Source: SPIVA US Scorecard).

Of course, 2015 was a year where the Canadian stock market performed worse than any other developed market globally in USD terms and was only able to squeak past Russia and Brazil. If you’d been one of the few lucky Canadians to properly diversify outside of Canada last year, you would have been disappointed with active fund management as only 21% of Canadian funds managing International Equities (outside North America) were able to outperform their benchmark.

The longer the time period, the worse the results

Not many people invest for just one year. Most investors’ time horizons are much longer, usually measured in decades.The longer the time period you look at, the worse the results get, especially for those trying to manage stock funds focused outside of Canada.

Adding to the challenge is that there is very little persistence so you can’t rely on past performers to repeat. S&P also recently published a persistence scorecard for US fund managers which showed that of those domestic equity managers that performed in the top quartile for the year ending September 2013, only 4.3% were able to stay in the top quartile consistently through the year ending September 2015. Only 20% could even maintain a top half ranking. Actually the data shows you’d be better off picking losers than you would winners.

Not to fear, we have found a manager based in our very own Canada that is able to consistently beat the pack and, bucking the trend, relative performance gets stronger over longer time periods. In fact, over the last five years it beat 99% of its competitors trying to pick US stocks and even had the lowest fees. The name of this under-appreciated manager? MR. MARKET.

The evidence shows again and again that it doesn’t pay to try to beat the market and globally diversified market returns are now available in Canada for a very low cost using ETFs and low cost mutual funds.

Graham Bodel is the founder and director of a new fee-only financial planning and portfolio management firm based in Vancouver, BC., Chalten Fee-Only Advisors Ltd. This blog is republished with permission: the original can be found on Bodel’s blog here.