When I got an activity tracker several years ago I was horrified to learn just how sedentary my lifestyle had become. I’d drive to work, park my butt at a desk for eight hours, drive home, park my butt on the couch for a few more hours, and go to bed. It was mindless laziness.

I fit right in with the average North American, who walks an average of 3,000 to 4,000 steps per day.

Steps to improve my steps

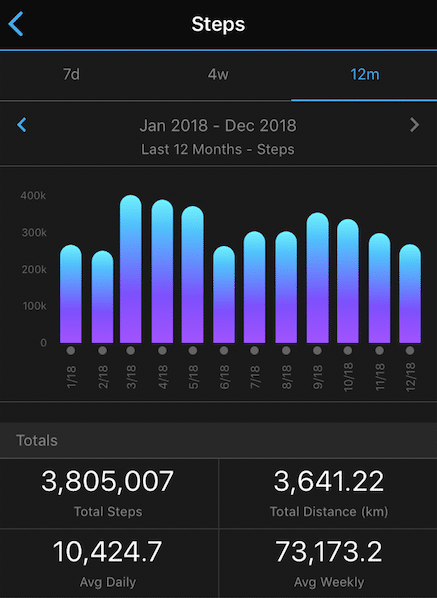

My activity tracker suggested a goal of 10,000 steps per day. I was motivated by the step counter and helpful nudges to get myself moving. I started parking in a free lot about 1 kilometre away from work, adding an extra 3,000 steps to my day (and saving $50 per month in parking fees!).

My new walking routine got me up to an average of 7,000 steps per day, but still not close to my goal. Then, following my wife’s lead, I got into running three to four times per week. The extra activity helped me reach my goal – not every day, but on average throughout the week. Funny enough, I still find motivation from my activity tracker as it nudges me to reach and surpass my daily move goals.

The hyper-attention and daily nudges helped me get my butt in gear and become a healthier person.

Curbing my Screen Time

Similarly, Apple sends iPhone users a new weekly report called Screen Time that shows how much time you spend on your phone. You’ll see which apps you use most often, how many times per day you pick up your phone, how many notifications you receive per day and from which application.

The report can be an eye opener if you’re into mindless scrolling through social networking sites like Facebook, Twitter, and Instagram. Twitter is the biggest attention sucker for me. Hey, it’s where I get my news!

I also get a lot of notifications and can conclude from the report that I receive about 30-40 emails per day from work. Not cool. Because of those notifications I tend to pick up my phone 65-70 times per day to either check my email, respond to a text, or check Twitter.

The week the Screen Time report first came out I spent six hours per day on my phone. I’ve got that down to less than four hours per day and try to design rules around curbing my screen time. That means turning off unnecessary notifications and keeping my phone in another room when I go to bed.

Again, these nudges had a positive effect on drawing my attention to a negative behaviour and making a conscious effort to curb it.

Negative Stock Market Attention

Back when I was a stock-picker I obsessively checked my portfolio, and read every market headline. I scoured the internet for news about my individual stock holdings and searched for analyst opinions (only the ones that confirmed my own opinion, of course).

But just like in the previous two examples, all this attention and information made me want to act. My oil stocks were getting killed and I wanted to get out. Sobeys made a mess of its Safeway acquisition and I wanted to get out. The general market would fall by 5-10 per cent and I felt like I needed to do something – like contribute more money than I had planned, or hold off on adding new money until things “settled down.”

Nudges worked against me. I’d get email alerts when Fortis or Great West Life missed their earnings targets. What should I do with this information?

The Globe and Mail app would send helpful push notifications like, “markets plunge on European/China/Russia fears,” or,“Dow posts worst day ever.” A smart investor is supposed to act on this, right? Shift their portfolio to safer assets? Buy gold?!?

Don’t just do something, stand there!

I switched to indexing four years ago with a simple two-ETF portfolio of global and domestic stocks. Now that I own thousands of companies I no longer pay attention to the fortunes of one or two. I find myself paying less attention to market headlines in general.

I make my monthly contributions automatic and only check my portfolio when the cash balance is large enough to make a trade. I figured instead of tinkering with my portfolio daily and reacting to news I’d be better off taking a two-decade nap and letting compounding do its thing.

I make my monthly contributions automatic and only check my portfolio when the cash balance is large enough to make a trade. I figured instead of tinkering with my portfolio daily and reacting to news I’d be better off taking a two-decade nap and letting compounding do its thing.

Related: How and when to rebalance your portfolio

Your long-term investing plan has no time for daily market noise. Yes, we may be entering a bear market. Or it’s just a run-of-the-mill market correction. Nobody knows for sure.

We do know that yesterday [late December] the Dow and S&P 500 had historic gains. If you happened to act on your fears and exit the market, thinking it was on its way to a 40-50 per cent meltdown, you missed out on that important rally. In fact, many of the largest one-day gains occur during down markets.

Final thoughts

Technology can help bring attention to a negative behaviour and turn it into a positive outcome. But those nudges and alerts can also work against you.

When it comes to investing often the best course of action is to do nothing and stick to your plan. Daily gyrations smooth out over a period of several months, and over several years the trajectory of the stock market tends to point up and to the right.

Many so-called experts question the value of robo-advisors during a downturn such as this, saying that investors would be better off with a human advisor. But from what I’ve heard during tumultuous times, the robos send helpful nudges via text and email explaining what is happening and why fluctuations in the market are part of a normal investing experience.

For investors that can be calming reassurance in the face of negative headlines screaming for your attention.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on on Dec. 27, 2018 and is republished here with his permission.