By Dale Roberts, cutthecrapinvesting

Special to Financial Independence Hub

How often should you rebalance your portfolio? There’s good news on that front as less is more. We’ll take a look at a very telling chart from Frederick Vettese. And I take another look at the very telling perfomance table for the core Tangerine Portfolios. In this post I will also take you through my top observations of the week – by way of my Twitter / X Tweets. That includes – bonds vs GICs, big dividends under attack, my U.S stock portfolio returns, and what’s in store for the Canadian banks.

Courtesy of Fred Vettese in the Globe and Mail, a look at rebalancing a core ETF portfolio.

Here’s the link for those who have a Globe subscription.

On April 1, 2013, $1,000 was invested in each of four exchange-traded funds: a U.S. stock ETF, denominated in Canadian dollars (stock symbol XUS), a Canadian stock ETF (XIC), an international stock ETF (XEF) and a Canadian bond ETF (XBB). The initial asset mix is therefore 75-per-cent equities and 25-per-cent bonds.

Fred’s test showed almost identical results for rebalancing every quarter and once a year. That suggests that you can save yourself some time and effort (and perhaps trading costs) by rebalancing just once a year.

We can also see that when the unbalanced portfolio performed better during a period of robust stock returns. That said, the portfolio risk level has increased.

I have been evaluating portfolios for many years (decades) and more often find that rebalancing once a year often leads to greater returns. It allows a successful asset to go on a greater run before the money is moved to the under performing asset.

You might also consider rebalancing based on thresholds – perhaps when an asset is 5% or more about your target allocation.

The lessons of the Tangerine Portfolios

I had another look at the index-based Tangerine Portfolios. As you may know I was an advisor and trainer with Tangerine for several years. Those are a wonderful solution for those who want lower-fee managed portfolios and investment advice.

You can also have a look at the Tangerine Global ETF Portfolios.

There are many lessons that can be learned or observed from the returns of the portfolio models. I offered some ideas in this Twitter thread.

While you can check out that thread, and yes you should follow me on Twitter / X I will strip out the main lessons (shown below).

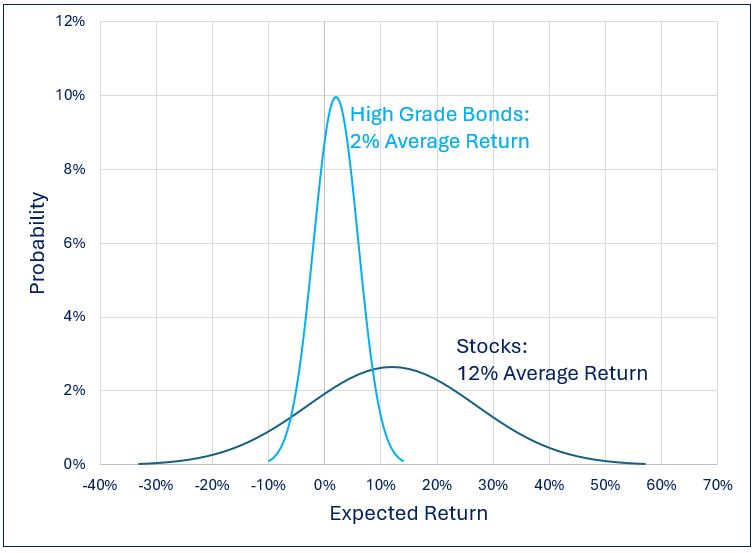

Lesson 1: Risk and returns

Investors were rewarded for taking on more risk. The risk/reward proposition.

An all-equity portfolio might earn in the area of 9% annual, while a balanced growth model is more 7%’ish and a balanced model more 6%’ish. Keep in mind that the start dates for the balanced portfolios was terrible – just before the financial crisis in 2008. Continue Reading…