By Devin Partida

Special to Financial Independence Hub

Most investments share a fairly straightforward purpose: making money.

However, the past few years have seen an uptick in impact investing. While financial returns still play a role in this practice, the additional goal is to make a positive difference in the world.

According to Wikipedia, impact investing refers to investments “made into companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return.” It’s about alining an investor’s beliefs and values with the allocation of capital to address social and/or environmental issues.

Impact investors want their funds to go toward causes they believe in. Historically, that’s been more easily said than done, but new technology makes it more accessible and reliable than ever. Here’s a closer look at how.

Facilitating Easier Investments

Like in all investments, Technology streamlines the trading process when impact investing. Digital platforms provide a single point where users can look through sustainable or socially conscious options to find an opportunity in less time. The same apps let people invest with a few taps of the screen, bypassing the time and intermediaries of conventional transactions.

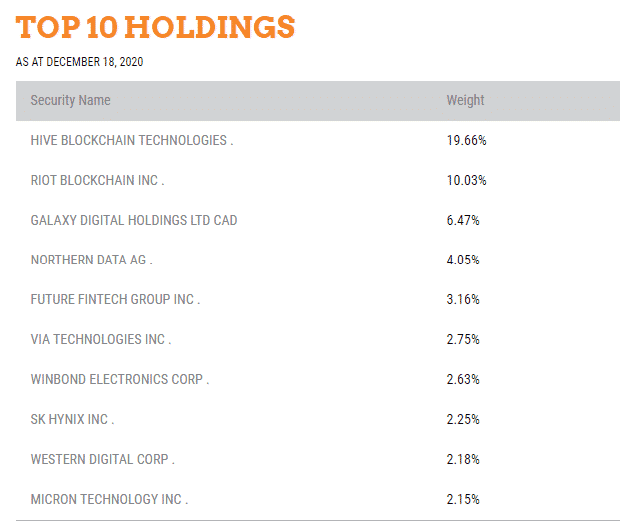

Financial technology (fintech) also enables faster, smoother payments once users decide on an investment. Blockchain is one of the most promising innovations here, as even international transactions take just four to six seconds on these networks. Tech like this also reduces processing costs.

Such speed and cost-effectiveness mean impact investing is a more accessible practice. People who are interested but worried about the cost of third-party fees or don’t know where to begin can work around these concerns.

Providing new Impact Investing opportunities

Similarly, fintech provides new ways to get into impact investing. On a surface level, trading apps offer live news and cover deposits to make finding and jumping on unique opportunities easier. Beyond that, tech has democratized the finance industry to let people invest in causes they care about outside the conventional market system.

Peer-to-peer networks are a great example. Crowdfunding platforms like GoFundMe let anyone create a place for others to donate to or contribute directly to social impact. These opportunities are often more targeted than traditional investing. You couldn’t fund someone’s surgery on the stock market, but you can do so easily online.

Maximizing Transparency

New technologies also make it easier to ensure impact investments actually go to the causes they intend to. That’s important because 71% of young investors would turn down a significant sum of money if it meant supporting a company with a negative social or environmental impact.

Blockchain is a big difference-maker because the records are virtually impossible to change. Consequently, companies using the technology in their operations can provide proof of their sustainability or social impact. For example, diamond producer De Beers uses blockchain tracking for tamperproof assurance that its gems are ethically sourced.

The rise of digital data also means finding details on a business’s operations is more straightforward than ever. Similarly, it lets organizations provide specifics on their environmental and social efforts. This transparency helps investors determine if an opportunity aligns with their goals to boost trust in their investments.

Streamlining Impact Reports

Along similar lines, fintech can help impact investors see how their funding affects the causes they support. Many of these platforms were born online and can provide easily accessible updates on how the companies they highlight make a difference. For example, The Impact Crowd requires crowdfunding projects to submit reports at least once a year so users see what their funds do. Continue Reading…