By Del Chatterson

Special to the Financial Independence Hub

Your financial advisor is probably not recommending it and you may be naturally averse to more borrowing, but it is hard to ignore the basic principles of financial leverage from Finance 101. (The principles have not changed, since I first taught the course in 1972!)

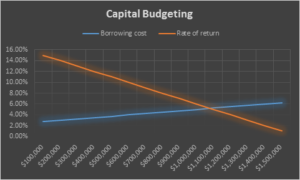

As explained in a chapter on Capital Budgeting, companies and investors should continue to invest in projects until the marginal cost of capital equals the marginal rate of return: assuming you select projects in order from the highest return to the lowest return and that the cost of borrowing increases with the total amount of loans outstanding.

So in the example chart shown to the right, you would borrow and invest up to $1.0 million, which is the point where the expected rate of return declines to meet increasing cost of borrowing at about 5%.

So in the example chart shown to the right, you would borrow and invest up to $1.0 million, which is the point where the expected rate of return declines to meet increasing cost of borrowing at about 5%.

You may have confirmed the theory from your own experience. Your current portfolio has a few investments that are achieving better than 10% or 12% returns, most congregate around the long-term average of 7% to 8% and a few continuing disappointments are returning below 5%, or worse. Your lowest cost of borrowing is probably the mortgage you signed in 2015 at 2.5% or a car loan at 1.9%, but your subsequent borrowing for a personal line of credit is at 3.25%.