For definitions of indexes in the chart, visit this glossary.

By Rick Harper, Head of Fixed Income & Currency, WisdomTree

Special to the Financial Independence Hub

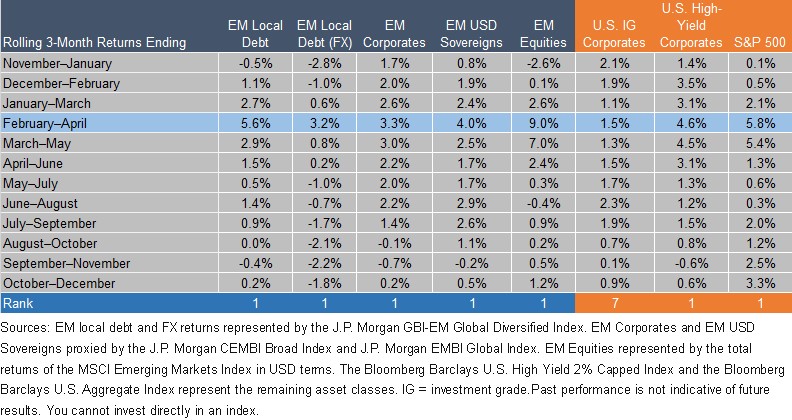

So far this year, emerging market (EM) bonds, currencies and equities have outperformed many corresponding U.S. asset classes. The EM rally stands in marked contrast to EM disappointments in January the past three years and is all the more surprising given struggles in both Mexico and Turkey. Investors can now look forward to an investment window that recently has been characterized by EM outperformance and strong absolute returns. Over the last 11 years (the inception of the local debt index1), the three-month investment window from February 1 through April 30 has, on average, produced the strongest returns for EM assets, in particular EM local debt and EM equities,2 and generated the fewest and the smallest shortfalls.

As seen in the table above, EM performance within the February-through-April window is distinct from other three-month investment windows. EM local debt, corporate,3 USD-based sovereigns4 and equities all post their most consistent performance during the window. While other windows tend to be lifted by greater one-time gains, the gains during the early spring period tend to be consistent, and losses are less frequent and shallower in scope.

A Spotlight on EM Local Debt

Among the bond sectors, EM local debt shines brightest during this period, generating substantial excess returns versus EM corporate and EM USD sovereigns. Positive contribution from foreign exchange (FX) is a significant piece of this excess return performance. The local bond returns are robust but still lag both EM corporate and USD-denominated sovereign bonds in isolation. In particular, the falling rate environment has been a very supportive tailwind for much longer-duration USD sovereign debt market proxies. The estimated 3% boost from FX gains pushes local debt to the fore. Continue Reading…