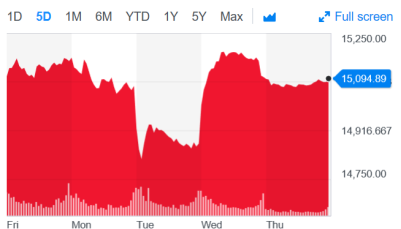

And here’s the performance of the Canadian Markets (TSX Composite), 2018 year to date:

While that might look like a wild ride it’s all more of a kiddie coaster compared to the real thing such as the Leviathan at Canada’s Wonderland in Vaughn, Ontario. That coaster makes the 12 Scariest Rides according to tripsavvy.com.

Canadian markets are down by about 5% for the year. Once again: Kiddie Coaster. Serious stock market roller coaster rides will take you down by about 30%, 40%, even 50% or more. Yup, in a major correction you might have to watch your monies get cut in half if you’re in an all-stock portfolio. That 50% haircut has happened twice in the last 20 years. Many of us have been ‘lucky enough’ to invest through the two biggest market corrections since the Depression of the 1920s/1930s.

Those real roller coaster rides taught us some valuable lessons. Some investors did lose a lot of money through those corrections. Why? Because they invested outside of their risk tolerance level. They took on too much risk. They were not emotionally prepared to watch their investment portfolio drop by 40%, 50% or more. They perhaps needed some of those shock absorbers known as bonds.

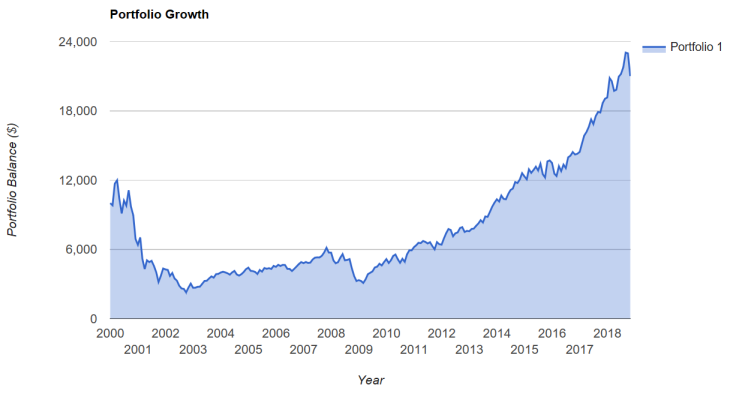

Those of us who were heavily invested in the tech-heavy indices such as the Nasdaq 100 (QQQ) or science and technology funds had to watch those investments drop by some 80%. Imagine watching every $100,000 fall to $20,000. Of course, many would jump off that roller coaster before hitting the bottom. Here’s a roller coaster ride that would make the list of Scariest Investment Rides. This is the QQQ ticker Nasdaq, chart courtesy of portfoliovisualizer.com. Full disclosure: I was ‘on’ that ride, and I don’t want to talk about it. Once again the stock market can teach us some expensive lessons.

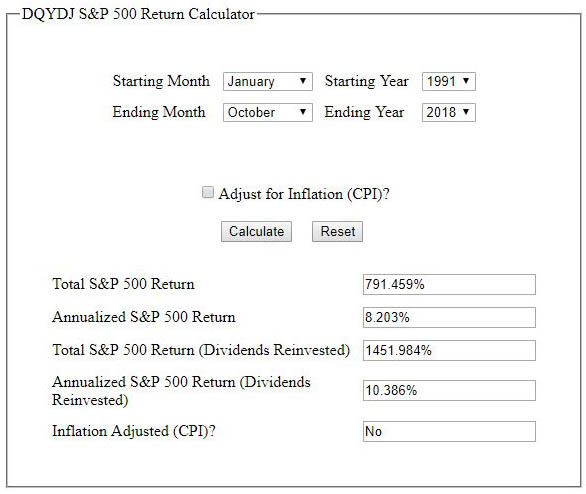

We can see that investors who did hang on were eventually rewarded with positive returns, even more than a doubling of their initial investment. In fact, if an investor had been consistent and had kept investing on a regular schedule through those ups and downs they could have seen returns approaching 9% annual.

Buy. Hold. Add.

We might say that the risk assessment is deciding what roller coaster ride you can handle. Continue Reading…