Special to the Financial Independence Hub

We decided to take Social Security at age 62. We know there are as many ways to consider this decision as there are days in a year. And many experts advise against taking social security “early” so that you get a bigger check at full retirement age.

It is hard to argue against that.

We have always lived an unconventional lifestyle and the fact that so many experts agree on waiting for payment gives us pause for thought. Here is our logic.

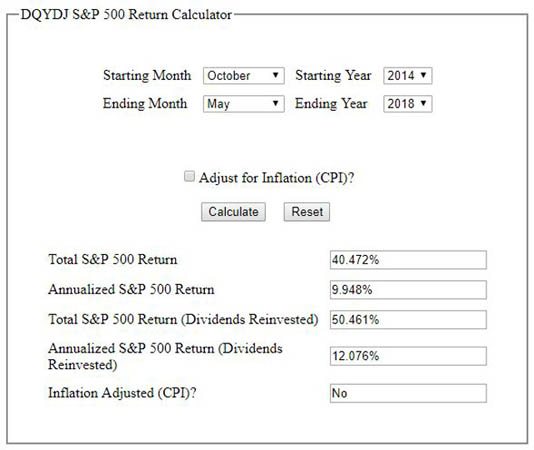

First, the S&P 500 index has averaged over 8% per year, plus dividends, since we retired in 1991. If we take social security early and invest it, we won’t be losing the 8% per year the experts claim is the annual increase of waiting – although one is guaranteed and the other is not. Maybe the markets will trend sideways or go down or even up, no one knows.

For the last 27 years we have lived off of our investments through up and down markets, so investing the monthly check is definitely an option. More likely, we will just not spend our stash and look for opportunities in the markets as our cash positions grow. Plus we have control of the money at this point, adding to our net worth.

Next let’s look at some numbers.

11 years to break even

For easy math, say at 62 you are going to receive $1000.00 per month in benefits, but if you wait until you are 66, your payment will be $1360 ($1000 x 8% for the four years you have waited). Sounds great, right?

However, you would have missed receiving $48,000 dollars in payments from the previous 48 months. How long is it before you make that money back? Using this example it would take 133 months or a little over 11 years ($48,000 divided by $360) and that would put us at 77 years of age, just to break even. In that time frame, the Social Security we are receiving plus our investments should grow far outpacing the extra money received by waiting.

For some people deferring until their full retirement age could make sense, especially if they do not have the assets to support themselves, are poor at handling money or if they are still working. However, this is not our situation and therefore we decided to take the money and run.

It’s really a question of who you think can handle your money better; You or Uncle Sam?

Update: The illustration above shows the return of the S&P 500 Index since we took Social Security at 62.

Billy and Akaisha Kaderli are recognized retirement experts and internationally published authors on topics of finance, medical tourism and world travel. With the wealth of information they share on their award winning website RetireEarlyLifestyle.com, they have been helping people achieve their own retirement dreams since 1991. They wrote the popular books, The Adventurer’s Guide to Early Retirement and Your Retirement Dream IS Possible available on their website bookstore or on Amazon.com.

Billy and Akaisha Kaderli are recognized retirement experts and internationally published authors on topics of finance, medical tourism and world travel. With the wealth of information they share on their award winning website RetireEarlyLifestyle.com, they have been helping people achieve their own retirement dreams since 1991. They wrote the popular books, The Adventurer’s Guide to Early Retirement and Your Retirement Dream IS Possible available on their website bookstore or on Amazon.com.

.