By Erin Allen, VP, Online Distribution, BMO ETFs

(Sponsor Content)

As an investor, diversification is crucial to reducing risk and achieving long-term growth. International investing is a great way to diversify your portfolio, but it can be challenging for Canadians to navigate the complex world of foreign stocks and currencies. One solution is to use exchange-traded funds (ETFs) for international investing.

Benefits

There are many advantages to using ETFs for international investing. First, they provide exposure to a broad range of international markets, including developed and emerging markets. This diversification can help reduce risk (when one market zigs and another zags) and increase returns over the long term.

Second, ETFs are typically more cost-effective than other forms of international investing. They have lower fees than traditional mutual funds, and you can invest in them for no commission at many online brokerages in Canada.

Third, ETFs provide transparency and ease of access. You can easily track the performance of your international ETFs and adjust your portfolio as needed. Additionally, most ETFs are denominated in Canadian dollars, so you don’t have to worry about currency conversion fees or fluctuations.

Considerations

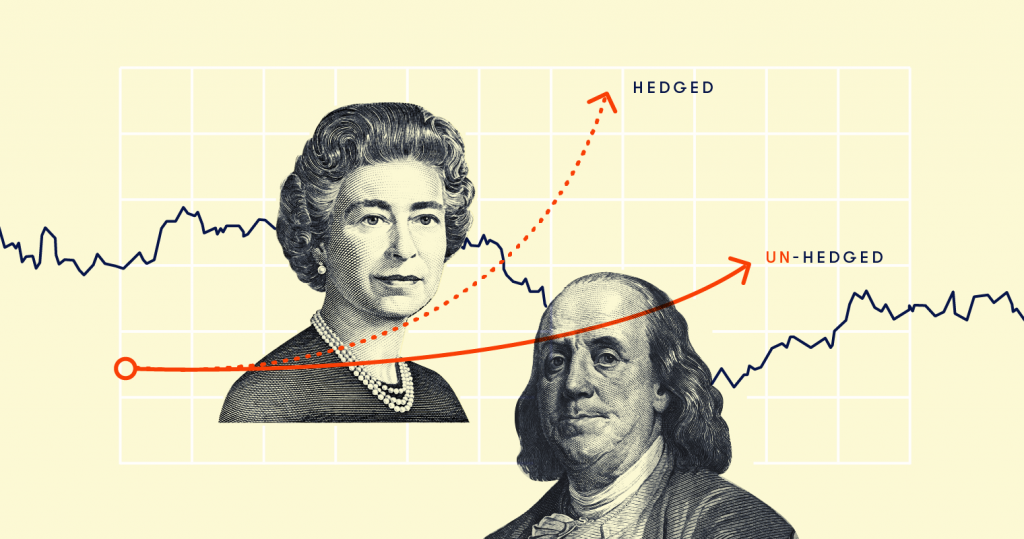

- Currency: Currency returns are an important factor impacting investors purchasing a non-Canadian asset. Foreign currency fluctuations can affect the total return of assets bought in that currency when compared to the Canadian dollar. ETF providers offer both hedged and unhedged options, giving Canadian investors more tools to efficiently execute their investment strategies. The objective of currency hedging is to remove the effects of foreign exchange movements, giving Canadian investors a return that approximates the return of the local market. Continue Reading…