By Billy and Akaisha Kaderli, RetireEarlyLifestyle.com

Special to the Financial Independence Hub

When preparing for retirement, designing your portfolio for income is over-rated. Oh, it feels good bragging about how much money you make each year, but then you also quiver about the taxes you owe each April.

What’s the point?

To make it – then give it back – makes no sense.

In today’s interest rate environment people are being forced to adjust their thinking.

Our approach 3 decades ago

When we retired over 32 years ago, having annual income was not on our minds. Knowing we had decades of life-sans-job ahead of us, we wanted to grow our nest egg to outpace inflation and our spending habits as they changed too. Therefore, we invested fully in the S&P 500 Index.

500 solid, well-managed companies

The S&P Index are 500 of the best-managed companies in the United States.

Our financial plan was based on the idea that these solid companies would survive calamities of all sorts and their values would be expressed in higher future stock prices outpacing inflation. After all, these companies are not going to sell their products at losses. Instead they would raise their prices as needed to cover the expenses of both rising resources and wages, thereby producing profits for their shareholders.

How long has Coca-Cola been around? Well over 100 years and the company went public in 1919 when a bottle of Coke cost five cents.

Inflation cannot take credit for all of their stock price growth as they created markets globally and expanded their product line.

This is just one example of the creativity involved in building the American Dream. The people running Coke had a vision and have executed it through the years. Yes, “New Coke” was a flop as well as others, but the point is that they didn’t stop trying to grow because of a setback.

Coca-Cola is just one illustration of thousands of companies adapting to current trends and expanding with a forward vision.

Look at Elon Musk. He has dreams larger than most of us can imagine.

Sell as needed

Another benefit we have in designing our portfolio in this manner, is that when we sell shares for “income,” they are taxed at a more favorable rate as a long-term capital gain. Dividend output is low, our tax liability is minimal, yet our net worth has grown.

We are in control of our income stream.

Our suggestion is not to base your retirement income on income-producing investments but rather to go for growth. You can always sell a few shares to cover your living expenses.

Money Never Sleeps

Just because you retire, your money doesn’t have to.

In the words of Gordon Gecko from the 1987 movie Wall Street, “money never sleeps.” And your money definitely won’t once you leave your job.

Reading financial articles about what if retirees run out of money, we get the impression that the authors do not understand that once retired, your money can – and should – continue to work for you.

Working smart not hard

Once you walk out of the 9-5 for the last time, that doesn’t mean your investments are frozen at that point. The stock market is still functioning and now your “job” is to become your own personal financial manager. Actually, you should have been doing this all along, but if not, start now.

You need to get control of your expenses by tracking your spending daily, as well as annually. This is so easy – only taking minutes a day – and this will open your eyes as to where your money is going. Not only that, but it will give you great confidence to manage your financial future. Every business tracks expenses and you need to do the same. You are the Chief Financial Officer of your retirement.

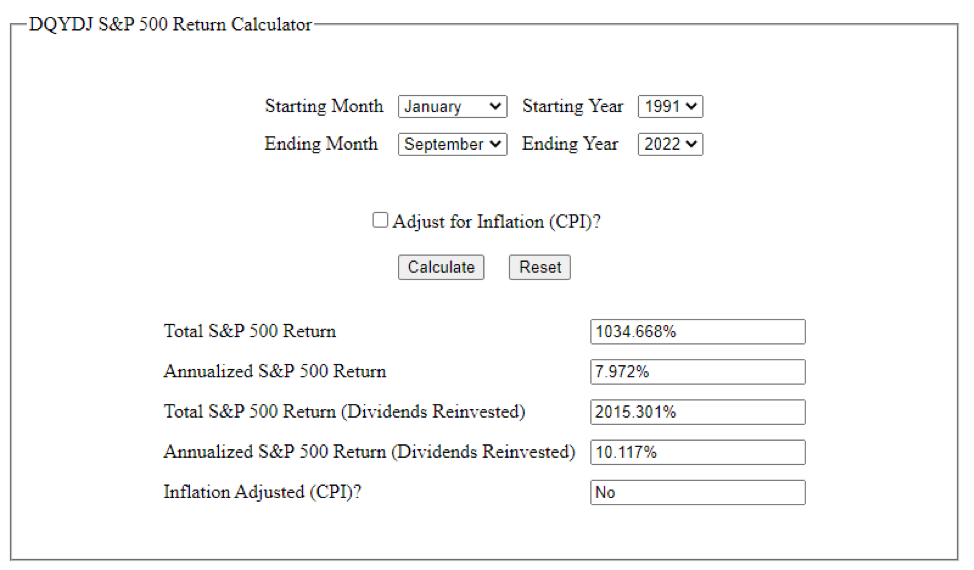

The day we retired the S&P 500 index closed at 312.49. This equates to a better than 10% annual return including dividends. We know that we have stated this before, but it’s important.

Chart of S&P Market Returns January, 1991 to September 2022

That’s pretty good for sitting on the beach working on my tan.

Making 10% on our portfolio annually while spending less than 4% of our net worth has allowed our finances to grow, while we continue to run around the globe searching for unique and unusual places.

But what if you’re fifty?

You need to take stock of your assets and determine what your net worth is, with and without the equity in your home. Selling the house and downsizing may be a windfall for you, again utilizing the tax code to your benefit. Continue Reading…