By Louis Wheeler

For Financial Independence Hub

It is possible to amass enough money to buy a car, renovate one’s house, or go on a dream vacation without borrowing money to finance the exercise. When one wants to make such a large purchase, one should lay down a plan, change one’s spending pattern, and dedicate oneself.

Guidelines for Saving up for big Expenses

Planning for a big project can be financially exhausting. Here are some things one needs to do to save for their next purchase:

Know your objective and establish a budget

First, identify the amount you wish to save and how long you want to achieve that. Subtract the number of months available before the target date from the total amount and divide the result by the number of months available to discover how much must be saved every month. This will also provide you with a specific, achievable task at hand.

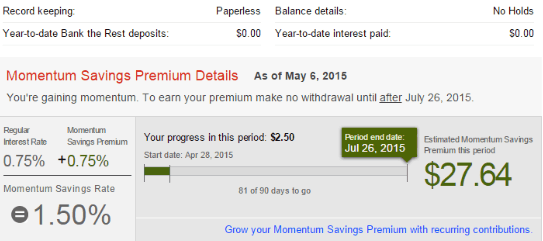

Get a new checking or better yet, a high-interest savings account.

You should use another account and open it simply for this particular purchase. The money needs to be kept in separate accounts to avoid converting them to other assets by mistake, as well as to be able to monitor performance. You might want to consider selecting a high-yield savings account for further growth. You can open a high interest savings account at koho for your next big project.

Cut back on non-essentials

Take your current spending habits and determine which ones can be sacrificed quickly. Micro-level decisions include eating out less, canceling subscriptions, or looking for cheaper or free entertainment options.

Automate your savings

Ensure you create a recurring payment method from your main checking account to your savings account on paydays. Automating makes saving very easy and guarantees that no time is given to destroy the plans that you have in mind.

Boost income with side gigs

Perhaps moonlighting, part-time work, or even some freelancing kind of occupation. Any additional money earned can be added to the savings amount, which can be achieved without too much sacrifice of daily expenses. You can also earn some extra cash by selling unwanted items or offering services such as pet-sitting, tutoring, or freelance writing.

Monitor and adjust

Review your savings plan every month to see if it is still realistic. Life gets in the way sometimes and unexpected expenses may arise, so be prepared to make necessary adjustments to your savings plan accordingly. It’s important to continuously monitor your progress and make changes as needed to stay on track towards reaching your target date. Continue Reading…