By Christopher Gannatti, Associate Director of Research, WisdomTree Investments

Special to the Financial Independence Hub

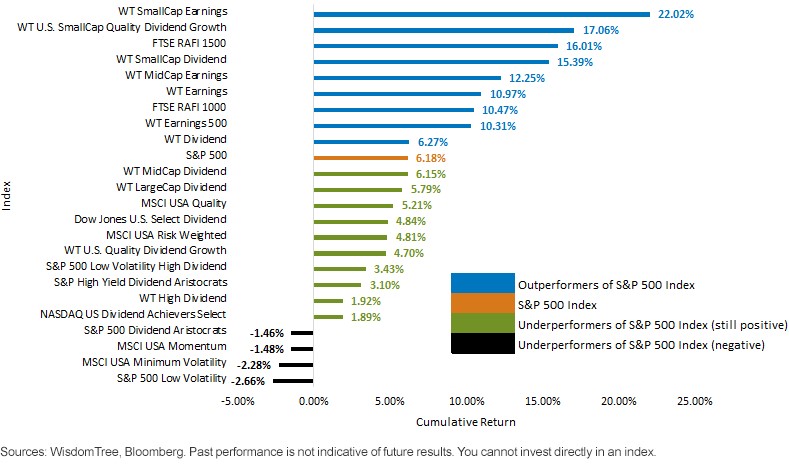

One of the biggest stories in 2016 was rising interest rates, most specifically that the U.S. 10-Year Treasury Note went from 1.36% on July 8 to 2.44% on December 31.1 While it may be too early to know if the greater than 30-year bull market in bonds (in other words, a longer than three-decade secular trend of falling rates) is over, 2016 did offer an interesting case study of smart beta strategies, many of which had only been in live calculation during falling rate periods.

How Strategies won as Rates rose

In the recent rising rate periods in 2013 (May 2, 2013, to December 31, 2013, when the U.S. 10-Year yield went from 1.62% to 3.03%)2 and 2016, a few big themes became clear:

- Small Caps: One aspect of small-cap companies is their ability to respond quickly to trends of improving growth, which is typically apparent during periods when the 10-Year yield is increasing. Additionally, they tend to have cyclical exposures regarding sectors instead of more defensive exposures. Also, if the U.S. dollar is strengthening (not unusual when the 10-Year yield is rising), these firms do not tend to have exports as their dominant source of revenue and therefore have less of a competitive headwind.

- Earnings: Rising rates tend to place strategies with higher valuations at risk, because one impact of rising rates is to lower the current valuation multiple of equities. WisdomTree’s earnings strategies are designed to provide lower price-to-earnings (P/E) ratio exposures to the market segments upon which they focus. It’s also notable that they tend to naturally be under-weight in the more defensive sectors of the market (Utilities and Telecommunication Services are two big examples) that usually tended to do better during the falling rate periods that directly preceded the rising rate period.

How Strategies Lost as Rates Rose

• Low Volatility/Minimum Volatility: It’s important to realize that the word “volatility” relates to both upside and downside market movements, seeking to lower both of them. Continue Reading…