By Penelope Graham, Zoocasa

By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

It’s no secret that purchasing a home is the largest financial investment for many households, and having a realistic budget is key to maximizing affordability. However, despite the years of careful saving and planning most prospective buyers undertake, there’s one closing cost that can present considerable sticker shock: land transfer tax.

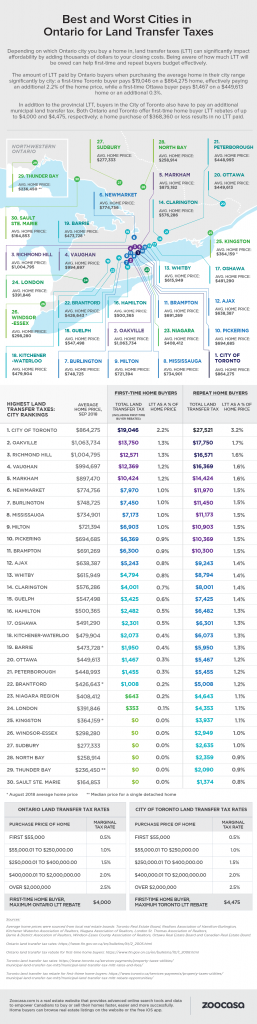

Charged by the provincial government (as well as at the municipal level in the City of Toronto), this levy is calculated based on the total purchase price of the home. It must be paid in cash before the transaction can be completed, and cannot be covered by a home loan or rolled into a mortgage.

Because LTT is based on home price, this means buyers in Ontario’s priciest markets shell out much more for it than others. In fact, according to a recent cost analysis by Zoocasa, a buyer in Toronto would be taxed $27,521 for a home priced at the September average of $864,275. That’s an additional 3.2% of the total purchase price.

In Sault Ste. Marie, however, where the average home price clocks in at a relatively more affordable $164,853, said buyer would pay only $1,374 in tax, representing just 0.8% of the total home price.

However, buyers in the majority of Ontario’s more moderately-priced markets can expect to pay between $5,000 and $7,000 in LTT; someone perusing Kitchener homes for sale, which come at the average price of $479,904, would pay $6,073 in LTT. A buyer of Hamilton real estate would be taxed $6,482 on the average home price of $500,365.

Check out the infographic to the left to see how LTT can vary in housing markets across Ontario:

LTT rebates available for first-time home buyers

Fortunately for those climbing onto the property ladder for the first time, there is some relief from land transfer tax in the form of rebates: The Ontario government will refund $4,000, while the City of Toronto offers $4,475. As well, first-time home buyers paying less than $368,360 on their home – the provincial threshold for LTT – will avoid paying it altogether, a reality in markets such as Saut Se. Marie, Thunder Bay, North Bay, Sudbury, Windsor-Essex, and Kingston.

Top 5 Ontario cities where you’ll pay the most Land Transfer Tax

1 – City of Toronto: $27,531

2 – Oakville: $17,750

3 – Richmond Hill: $16,571

4 – Vaughan: $16,369

5 – Markham: $14,424 Continue Reading…