By Aman Raina, SageInvestors.ca

By Aman Raina, SageInvestors.ca

Special to the Financial Independence Hub

We have passed the half-year mark and so I thought it would be a good time to check back into my ROBO portfolio to see how it’s doing and if there is anything interesting going on.

I was all good to go on writing a very pedestrian update as the portfolio had not undergone any significant changes in over a year. Then I got a couple of emails.

About a month later I received a follow-up email with some more explanations.

The emails paint a picture of some minor changes and tinkering.

Changes? Lordy there were a few.

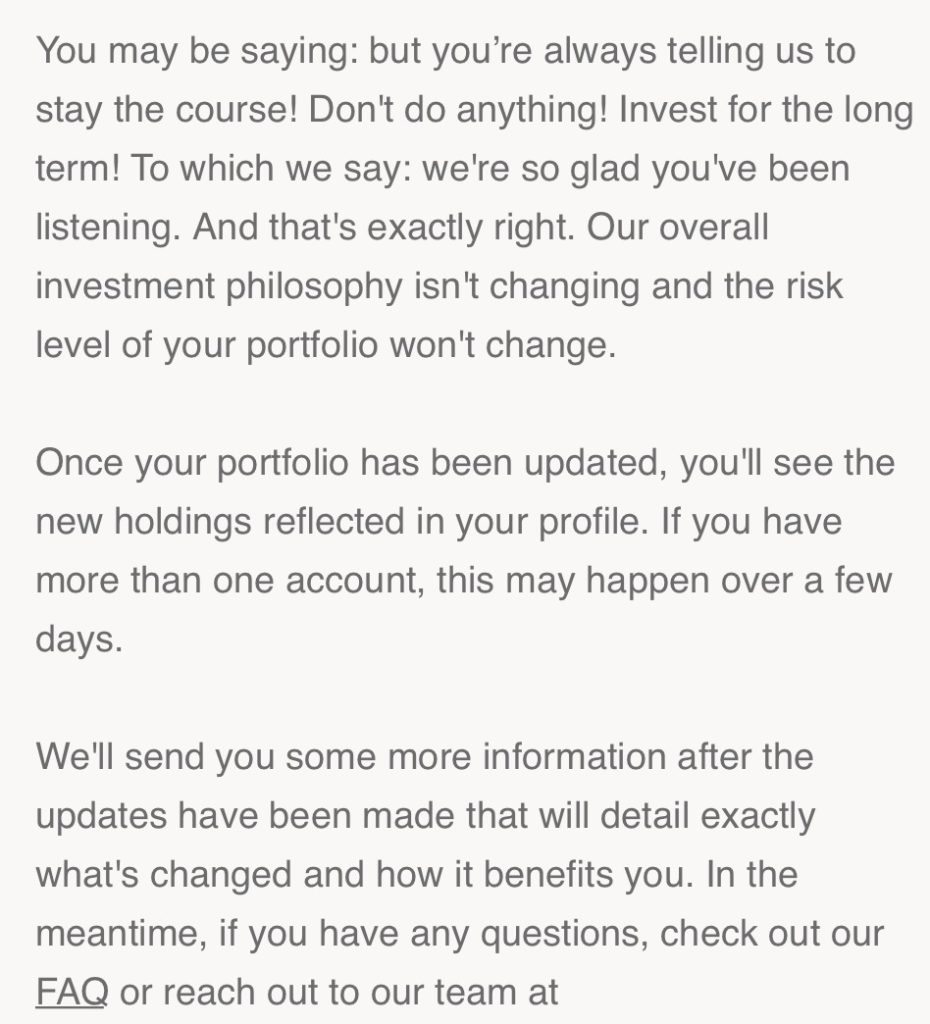

After remaining static for about a year and a half, the ROBO made some very significant changes in the portfolio. The asset mix of 85 per cent stocks and 15% bonds remained, but the allocations were altered quite dramatically. Here’s the breakdown along with the allocations in the past.

Caption: Asset allocation of my ROBO portfolio since inception

Allocation to US stocks fell from 32.5% to 26.5%

- Allocation to Canadian stocks fell from 22.5% to 10.5%

- Allocation to Emerging Market stocks increased from 10% to approximately 16%

- Allocation to other Foreign Stocks increase from 15% to 32%

- The bond allocation changed from domestic government and corporate bonds to Government and US bonds.

This marks the 3rd significant change in my portfolio’s asset allocation in the 4 1/2 years I’ve had the portfolio. I think we can clearly say this portfolio has not been passively managed.

The changes are pretty dramatic, but actually welcome. Regular readers of this blog know I’ve been a bit critical on the ROBO’s concentrated exposure to US and Canadian stocks. Prior to this adjustment, almost 55 per cent of the equity component was in US/Canadian stocks, which I thought was pretty high. Granted, it has been a winning move as the results have been quite strong. I have been concerned that the portfolio is pretty exposed if the markets were to take a major downturn. It seems ROBO has gotten the message and re-calibrated the portfolio. This is a good thing to see, although again I wonder why it took so long. I also wonder if this rebalancing was more of a market timing action or an asset reallocation action? Hard to say.

The other change involved the rotation of ETF products. ROBO decided to use different ETF products. Here’s the summary.

Bonds

- Sold BMO Mid Fed Bond Index (ZFM) and bought Mackenzie US Government Bond ETF (QTIP)

- Sold iShares Core Canadian Bond ETF and bought BMO Long Fed Bond ETF (ZFL) .

This is ROBO’s latest tinkering of the Bond component of the portfolio. Continue Reading…