By Mark Seed, myownadvisor

Special to the Financial Independence Hub

The markets are down, inflation remains hot, and interest rates are moving higher.

Are you worried?

I’m really not that worried.

I’ve been preparing for higher interest rates for years, well before the pandemic.

Case in point: this post is literally from five years ago.

Where am I going???

Well, readers of this site will know I’m a big fan of companies that reward shareholders with dividends.

And why not love dividends?

Although I use a few indexed products in my investment portfolio, for extra diversification just in case, getting paid on a consistent, growing basis from Canadian and U.S. stocks: that’s a beautiful thing. I got another raise this week that I’ll link to below!

Digging deeper, I’m not that worried about the markets or inflation right now. There is a reason why dividends matter to me. Why do dividends really matter?

Beyond the Canadian dividend tax credit, beyond consistent payments and ever growing income I’ve experienced to date, dividends help me stick to my plan.

There is no financial advisor in my plan, nor fees paid to any advisor in my plan.

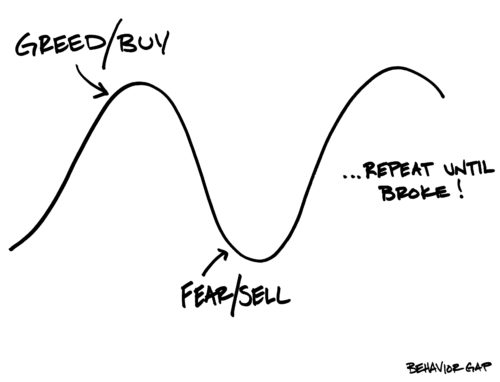

There is no day trading, there are no wasted fees or losses for trading.

There is no wild market speculation, I’m not trying to time anything.

I focus on my savings rate for investing and I invest more money when I have it. It’s that simple.

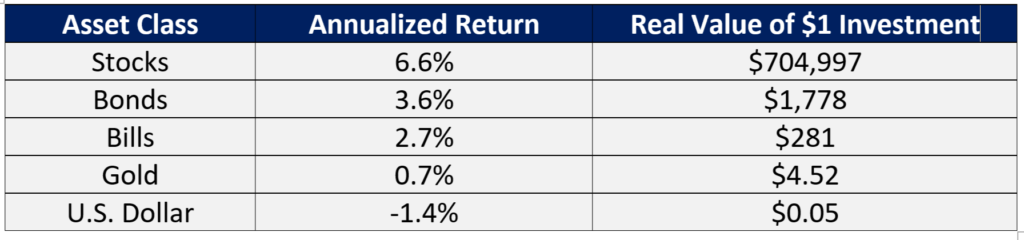

Recall that dividends paid is real money paid from real company profits. Buying and holding an established company that has paid dividends for decades is a good sign (at least from a historical perspective) that this company had enough cashflow to reward shareholders and stay in business.

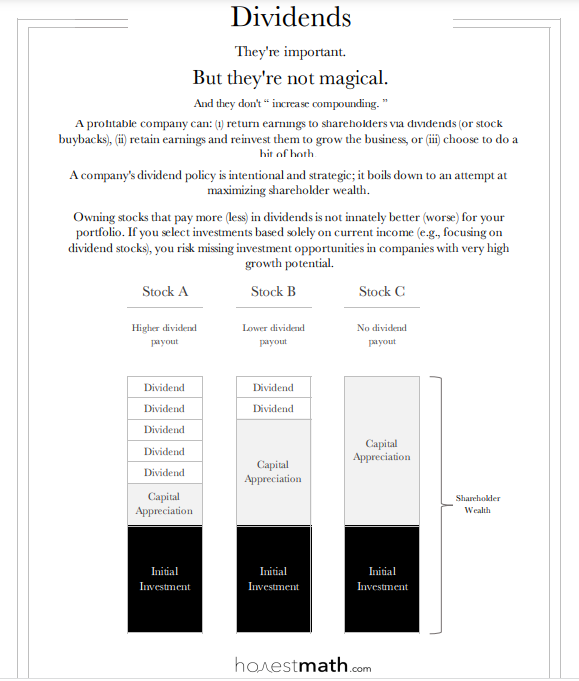

Companies that don’t pay dividends tend to use their money for other means, grow their business; make acquisitions or buy back shares, pay down risky debt, therefore driving the stock price higher over time.

These are not poor management decisions by any means: far from it. There are lots of ways shareholder value is created and to be honest, acquisitions, share buybacks and other company reinvestments could be better company decisions in the long-run!!

When it comes to the capital gains versus dividend income debate, there really isn’t a debate to be had, since every dollar you earn in capital gains from a stock is worth just as much as your dividend dollar paid. I love the graphic shown at the top of this blog.