By Bob Lai, Tawcan

Special to the Financial Independence Hub

Long time readers will know that my wife and I are deploying a hybrid investing strategy – we invest in both dividend paying stocks and index ETFs. It is our goal to have our portfolio generating enough dividend income to cover our expenses. When this happens, we can call ourselves financially independent and live off dividends. By constructing our portfolio and selecting stocks that grow dividends each year organically, we believe our dividend income will continue to grow organically and keep up with inflation so we don’t have to ever touch our principal.

In the past, I have done a few simulations showing that living of dividends is possible and that dividend income is very tax-efficient in Canada. But simulations are full of assumptions and the numbers can change. Wouldn’t it be nice to showcase someone that is living off dividends already?

As luck would have it, Reader B, a fellow Canadian, recently mentioned that he retired in 2004 at age 55 and has been living off dividends since. I was very intrigued by B’s story when he told me that he worked as a civil engineer and his wife worked as an administrator.

I fell off the chair when he told me that he and his wife started investing with $10,000 and have amassed a dividend portfolio that generates over $360,000 in dividends each year!

That’s $30,000 a month! Holy cow!

While working, they had above average salary (B made ~$110k and B’s wife made ~$90k in today’s money). The high household income has certainly helped them build the dividend portfolio. But I believe a lot of it is due to B and his wife’s living modestly – not a lavish lifestyle but not penny pinching either.

After a bit of emailing exchanges, he agreed to answer my questions about his experience with living off dividends (it took a bit of convincing haha!). I truly believe B’s knowledge will help a lot of dividend growth investors.

Note: B’s original reply was over 11,000 words not including my comments (our email exchanges were very long too). I went through his answers and edited some parts out. For ease of reading, I have decided to split the post into two posts.

I hope you’ll enjoy this Q&A as much as I did.

Living off dividends – How I’m receiving $360k dividends a year and paying almost no taxes

Q1: First of all, B, thank you for participating. It’s wonderful to learn that you and your wife have been retired since 2004 and have been dividend investors for over 36 years.

A: Thank you, Bob, for giving me the opportunity to share my 36 plus years of dividend investing experience and results with you and your readers. After following your blog, I realized that we and many others were on the same dividend investing path. The only difference being that I was a few more years along in the investing journey. I felt others might benefit from my experience with dividend investing.

You’re on the right path, Bob, and given your rate of progress to date by the time you reach my age (72) you will certainly attain your dividend income goals and likely well beyond. So I wanted to encourage you to continue along the dividend investing path. It’s a very sound and profitable strategy.

I’m more than happy to share with others a few of my ideas on dividend investing and how it can be done in a tax-effective manner.

Q2: How long have you been investing in dividend paying stocks?

A: I started investing in stocks in 1985. After the initial period of learning the ropes and finding my way in the investing and stock market world, it was only in 1990 after subscribing to a weekly investing newsletter that I finally saw the investing light and found that dividend investing was right for us.

So I guess you could say I’ve been traveling along the dividend paying stock road for some 31 years now. And we’ve been comfortably supplementing our lifestyle with an ever increasing stream of dividends since we retired in 2004 to the present day.

Diving into the dividend portfolio

Q3: How much dividend income are you getting each year? Can you provide a detailed breakdown across non-registered and registered accounts?

A: As of April 30, 2021, my wife and I are receiving $360,000 in combined pre-tax dividend income annually – that’s $30,000 per month – and still growing.

Our combined assets are distributed as follows:

- RRIFs: 8.2%

- TFSAs: 1.9%

- Non-Reg Dividend Income Accounts: 85.5%

- Other Short-Term Liquid Assets: 4.4%

So the amount we have in registered tax-sheltered plans totals 10.1% and is decreasing annually in compliance with RRIF mandatory withdrawal requirements.

These figures illustrate a problem that can develop gradually over time – a severe imbalance between registered and non-registered accounts caused by the low contribution limits governing registered savings plans. Allowable contributions to registered plans are capped.

If one’s savings levels exceed the cap limits by a significant amount, then the balance between registered and non-registered accounts can tilt heavily towards the latter. The effect is that registered plans then become less and less significant in the overall account mix. This unbalanced effect means that we now have only 10.1% of our assets in tax sheltered accounts while 85.5% is held in “unsheltered” non-registered accounts.

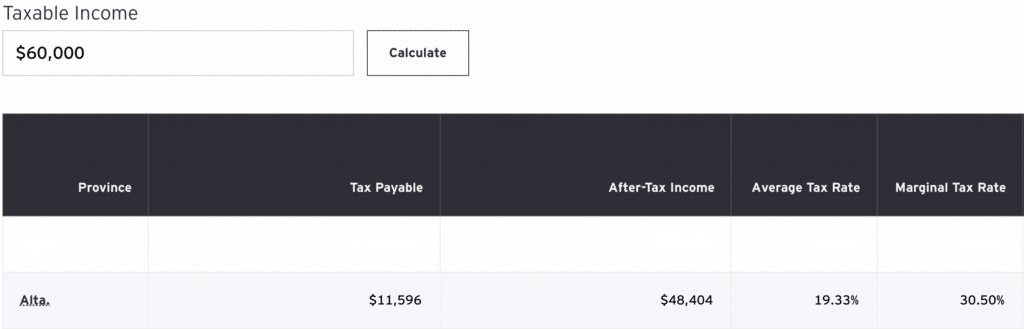

So that makes it critical to find ways to ensure that holdings in non-registered accounts are as tax efficient as possible. The most optimum way to achieve tax-efficiency under such conditions is to focus on buying and holding Canadian dividend paying stocks in non-registered accounts.

We will continue to shift portions of our “other” assets toward Canadian dividend income as we go forward.

Our non-registered accounts are producing the entire $360K dividend income stream referenced above. The annual yield on market value is 4.2%. The actual yield on cost is much higher than the market yield. Our portfolio has returned nicely over the years.

Our annual mandatory RRIF withdrawals are the minimum required by age and proceeds are immediately re-invested in more dividend stocks and held in our non-registered accounts. We do not touch our TFSAs and contribute the maximum allowable amount each year.

Tawcan: My jaw dropped when you told me about your $360k a year dividend income. That is absolutely amazing!

At 4.2% yield that means the market value of your portfolio is over $8.5M! Obviously your yield on cost would be much higher than that given you have invested over 30 years. Regardless, I’m betting that the cost basis of your non-registered portfolio is in the multi-million dollars range. It is very impressive considering you and your wife only made around $200k a year in today’s money.

The Dividend Investing Philosophy

Q4: Can you give us an idea of your general approach to dividend investing?

A: My dividend investment philosophy can be summed up as: “To buy gradually over time, high-quality Canadian tax-efficient dividend paying stocks and hold them indefinitely.”

I buy stocks gradually in roughly equal amounts and spread the purchases over time. I never invest large lump sums all at once. I’ll take an initial position in a stock, usually in the $10K value range, and then return again at an opportune price point and buy some more (i.e. dollar cost-averaging).

High quality stocks are selected – conservative large cap stocks – most often dividend aristocrats – minimum 2% yield with the odd exception for superior growth stocks or those with growth potential. Great focus is placed on buying dividend aristocrats and stocks in the TSX Composite 60 Index with a nod toward following the Beat the TSX strategy.

Tawcan: Funny B mentioned the BTSX strategy. Check out Matt, the brain behind Beating the TSX strategy, and his family’s amazing story about traveling the world with 4 kids.

I exclusively buy only Canadian stocks – no USA stocks – none – no exceptions. The only US stocks I would consider are those that have a TSX listing and can be purchased in Canadian dollars for tax efficiency reasons.

Tawcan: It’s interesting that you only hold top Canadian dividend stocks and no US or international dividend paying stocks or ETFs.

All our stock buys must be held in non-registered accounts – contributions can not be made to RRIFs and our TFSA contribution room is maxed out. My wife and I also invest in REITs and they require special attention (more on that later).

All stocks we buy must pay a dividend. As mentioned, I usually insist on a 2% yield or higher – but not too high. One never wants to over-reach for yield, which is often the warning sign for an impending dividend cut. If a stock does eliminate its dividend, then it’s automatically gone from our portfolios and we move on to another stock that does pay a reliable dividend.

Once a stock is safely and appropriately tucked into our portfolios, we just sit back and hold it “forever.” One can then enjoy living off the ever increasing dividend income stream while watching the stock appreciate in capital value over time. We still hold stocks that we bought back in 1985 like BMO and BCE.

On very rare occasions, it may be advisable/necessary to sell a stock for the following reasons:

- When a stock’s prospects have taken a downward turn.

- In the event of a takeover bid – friendly or otherwise – one often has little choice but to sell.

- For tax-loss selling purposes. We seldom pay any capital gains income tax at all. When we do realize a capital gain from a stock sale, then we’ll sell another stock (or partially sell) to realize an offsetting capital loss. But tax-loss selling is not usually done at year-end along with “the herd.” After waiting the mandatory 30 days and if the stock remains a solid investment, then we will often buy the stock back – hopefully at a lower price.

Under a buy and hold strategy, there is not a lot of opportunity for capital gains. By not selling, no capital gain is realized and so capital gains tax can be deferred indefinitely.

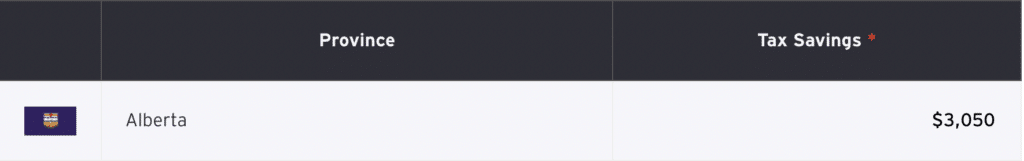

On the other hand, dividend income can be extremely tax efficient when you are income splitting between two people. We’ll get into the specifics a bit later.

Q5: You mentioned that REITs require special attention. What did you mean by that?

A: Not all REITs are equal in terms of tax efficiency when held in a non-registered account where taxes on REIT distributions can vary from 0% to 53.53% (in Ontario). Therefore, the most tax-efficient place to hold a REIT is in a registered account. Continue Reading…