A Retirement Income Solution: How Milestones Retirement Insights helped one Alberta Couple Save $16,500 annually

By Ian Moyer

Special to Financial Independence Hub

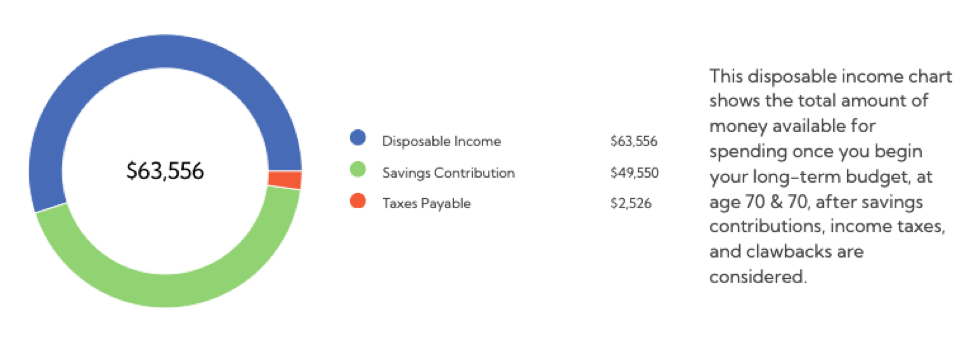

Retirement is meant to be a time of relaxation and enjoyment, but for many Canadians, managing retirement income efficiently can be a major challenge. This was the case for a couple in Alberta, aged 70 and retired for five years. They were concerned about depleting their savings too quickly and needed a tax-efficient withdrawal strategy to better sustain their retirement lifestyle.

The Problem: Overspending Without a Plan

The couple had a mix of financial assets, including:

- RRSPs: $400,000 remaining

- TFSAs: $75,000 remaining

- Joint Non-Registered Savings: $50,000 remaining

They were spending $80,000 a year without a clear withdrawal strategy, leading to inefficiencies and over-taxation. This lack of guidance was costing them $16,500 annually, money that could have been used to enhance their lifestyle.

The Solution: A Tailored Withdrawal Strategy

The Solution: A Tailored Withdrawal Strategy

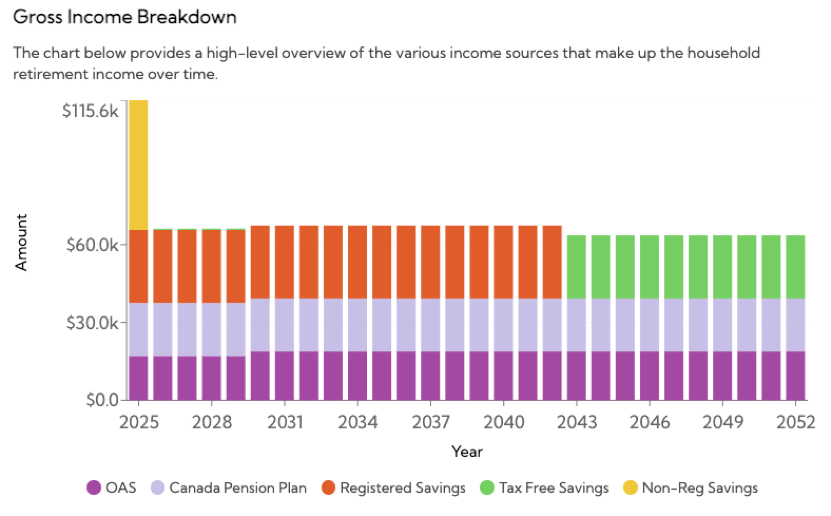

Using Milestones Retirement Insights, they were able to restructure their withdrawals to maximize after-tax income while preserving their savings for the long term. Here’s how:

- Prioritizing TFSA Withdrawals: We tapped into their tax-free savings account first, allowing them to access funds without triggering additional taxes.

- Splitting RRSP Withdrawals Over Time: By drawing from their RRSP in smaller increments, we kept their income within lower tax brackets.

- Non-Registered Savings for Gaps: Joint savings were used strategically to fill gaps, minimizing tax exposure while ensuring consistent income.

- Optimal RRIF Conversion: We structured their RRSP to RRIF transition to further reduce taxes and take advantage of pension income splitting.

Key Consideration: RRSP to RRIF Conversion

When you reach retirement, a registered retirement savings plan (RRSP) has the option of converting to a registered retirement income fund (RRIF). To provide a sustainable retirement income and minimize your income and estate taxes, we’ve calculated an average annual RRIF payment of $28,112 starting at age 70. At an assumed rate of return of 5%, this investment will deplete to $0 at age 88.

Overspending in retirement without a clear withdrawal strategy can quickly erode savings, leaving retirees vulnerable to financial shortfalls during their later years. This Alberta couple’s story highlights the importance of proactive planning and the difference a tax-efficient approach can make. By leveraging tools like Milestones Retirement Insights, retirees can maximize their after-tax income, preserve their nest egg, and enjoy a more secure and fulfilling retirement. Without such strategies, the risk of outliving one’s savings becomes a real and pressing concern a scenario no retiree should face.

Ian Moyer is a 40 year veteran of the financial services industry. He is a long-term member of the MDRT, as well as Court and Top of the Table. In 2013 he started developing Cascadesfs.com with his business partner Jonathan Kestle. Cascades’ focus is to illustrate the value of advice, by revealing the tax difference of comparing withdrawal strategies.

Ian Moyer is a 40 year veteran of the financial services industry. He is a long-term member of the MDRT, as well as Court and Top of the Table. In 2013 he started developing Cascadesfs.com with his business partner Jonathan Kestle. Cascades’ focus is to illustrate the value of advice, by revealing the tax difference of comparing withdrawal strategies.

About Milestones Retirement Insights

Milestones Retirement Insights provides individuals with free access to its innovative software, a comprehensive solution designed to simplify and optimize retirement planning. Focused on after-tax retirement income, Milestones helps users create personalized withdrawal strategies that maximize income while minimizing taxes, identify annual excess cash flow, and compare net estate values. By providing a clear understanding of how to make the most of your retirement assets, Milestones empowers users to make confident, informed financial decisions.

To get started, visit www.milestones-retirement.com