By Aaron Hector, RFP

Special to the Financial Independence Hub

Before July 1, 2013, Canadians had to begin their OAS pension at age 65. After that date, they were given the option of delaying it for up to five years in exchange for a deferral premium. The deferral premium is 0.6% for each month you wait to start your OAS pension after age 65. The maximum enhancement is 36% if OAS was postponed for the full five years (0.6% x 60 months = 36%). If you are over 70, there is zero advantage to postponing your OAS further – so you should apply now!

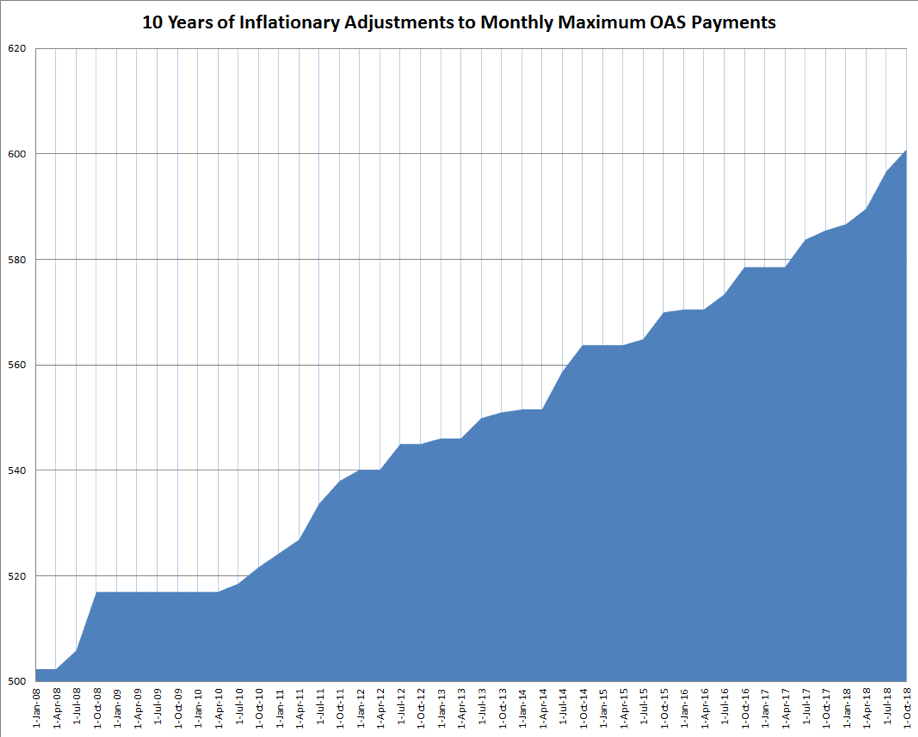

Five years have passed since this change in policy, so those who turned 65 on or after July 1, 2013 and chose to postpone their OAS until age 70 are now finally starting to receive their enhanced pensions. As of December 2018, the ‘typical’ maximum monthly OAS pension is $600.85, or $7,210.20 per year. For those with a 36% enhancement, theirmaximum payments would be $817.16 per month, or $9,805.87 per year. These payment amounts are reviewed quarterly and are adjusted with inflationary increases over time.

The decision to postpone OAS is both personal and financial, but I would argue that the primary reason for postponing OAS is that it covers off longevity risk. In other words, if you live a very long life, you would be better off delaying OAS and then receiving the larger, more robust pension, for a longer period. For those people with financial assets that they can use to bridge their lifestyle between ages 65 and 70, postponement is something to consider.

So long as you have the financial resources to make it work, postponing OAS looks like the way to go, so why do so few people take this option? For many, it comes down to uncertainty about life expectancy. What happens if you plan for the long life, but life doesn’t end up being as long as you’d hoped? Let’s explore a couple of unfortunate scenarios as it relates to OAS postponement.

When Mr. Smith was age 65, he talked with his financial planner and together they agreed on a financial plan which incorporated a life expectancy for him of age 95. Both of his parents were still alive and doing well, and his extended family all had excellent longevity. In his plan, it was determined that he would postpone his OAS to age 70, reaping the rewards of this decision throughout his planned life expectancy.

Unfortunately, on Mr. Smith’s 67th birthday he was diagnosed with a medical condition and his doctor advised that he’d have a shortened lifespan as a result.

What can be done?

If you postpone your OAS and later decide that you should have started it earlier, you can apply and request an effective start date that predates the application date. Service Canada will allow you to reach back 12 months (11 months plus the month you apply) and they will send you a lump sum for the retroactive payment. In the case of Mr. Smith, if he applied for his OAS on his 67thbirthday, then he could opt to use an effective date of up to one year earlier, when he would have just turned 66. He would then be paid a retroactive lump sum payment for the one year and receive monthly payments from that point onward. Because his effective start date would be age 66, he could expect an enhancement of 7.2% (12 months x 0.6% per month) on all his OAS payments.

Now, let’s change our scenario. What if instead of being diagnosed with a medical condition at age 67, Mr. Smith falls victim to a sudden and unexpected accident and dies at age 67. The proverbial bus. He had never received a single dollar of OAS pension income. This is a sad situation but, unfortunately, it does occur time and time again.

Is there anything that can be done in this circumstance? Mr. Smith is no longer around to even apply for his OAS. Are all entitlements simply lost forever?

Something canbe done. The rules are technical, and as such, I will simply quote the Old Age Security Act.

Application for pension by estate, etc.

- 29 (1) Despite anything in this Act, an application for a pension that would have been payable to a deceased person who, before their death, would have been entitled, on approval of an application, to payment of that pension under this Act may be made within one year after the person’s death by the estate or succession, by the liquidator, executor or administrator of the estate or succession or heir of that person or by any person that may be prescribed by regulation.

- Pension payable to estate or other persons

(2) If an application is made under subsection (1), the pension that would have been payable to a deceased person referred to in that subsection shall be paid to the estate or succession or to any person that may be prescribed by regulation.

- Application deemed to have been received on date of death

(3) Any application made under subsection (1) is deemed to have been received on the date of the death of the person who, before their death, would have been entitled to payment of the pension.

The final paragraph quoted above (subsection 3) is important from a planning perspective because it indicates that a retroactive lump sum OAS payment would qualify to file these amounts on a “Rights or Things” tax return. This is an optional tax return that can be filed to include amounts that had not yet been paid to the deceased person at the time of their death, but would have been included in their income when received.

When the optional Rights or Things tax return is prepared, it would include items that are “receivable” at death. Common examples of receivable income would be OAS or CPP payments that are scheduled to be paid in the month of death, but are received after the specific date of death. Other examples would be dividends that have been declared and recorded but not yet paid to shareholders, and wages that have been earned by an employee but not yet paid by the employer.

However, in this situation, we are considering an entire year of retroactive OAS payments being eligible for entry on a Rights or Things return. This is important because in the year of death, deceased individuals (and particularly those without a surviving spouse) will often have large amounts of taxable income in their final tax return from the deemed realization of capital property and the deemed disposition of RRSP or RRIF plans. Under normal circumstances, this high tax base may result in the OAS pension being either partially or fully clawed back. However, because the income is usually minimal on a Rights or Things tax return, it’s likely that in this unique situation the entire OAS lump sum amount could be preserved. This would be a rare tax win in an otherwise unfortunate situation.

At only five years in, and with just one five-year postponement cycle complete, the OAS deferral program is still relatively new. As a result, cases such as these have not yet occurred that often – nor have they gained much media attention. But make no mistake; the scenarios considered here will become an unfortunate reality for many Canadians. So, if you’re planning to postpone your OAS, you should include some precautionary measures in your financial plan.

One solution to consider would be to instruct your executor to make a post-death OAS application and subsequent Rights or Things tax filing. This instruction could possibly be made within your Will, but it would likely be better suited within a Memorandum of Wishes or in an estate administration guide. You could consult with your estate lawyer for their recommendation on the matter.

Similar situations could result from someone postponing their Canada Pension Plan (CPP) payments, which can be taken as early as age 60 at a reduced amount, at age 65 for the baseline amount, or as late as age 70 with an enhanced amount. The difference here is that under CPP legislation an application for retroactive payments can only be made when the deceased passed away at age 70 or older.

There is absolutely no incremental benefit for waiting beyond age 70 to begin taking CPP (or OAS) payments. So, it seems highly unlikely (though not impossible) that someone would be over the age of 70 and not have already applied for their CPP benefits. With OAS, on the other hand, it’s easy to think of common situations where someone could be older than 65 without having applied yet.

If you or a loved one is postponing OAS payments, it’s important to know about the different planning options you can consider in case life doesn’t play out as expected. A qualified financial planner can lay those options out for you.

Aaron Hector has been a consultant at Doherty & Bryant Financial Strategists, a subsidiary of T.E. Wealth, for over a decade. He provides comprehensive financial planning to high-net-worth individuals and families in Western Canada, and has extensive experience in executive compensation plans, retirement planning, and income tax reduction strategies.

This blog originally appeared on his site on Dec. 10 and is reproduced on the Hub with permission.

See also the Financial Post column that ran Dec. 20, 2018 by Jonathan Chevreau that was based on this blog.