By Jeffrey Schulze, CFA, Director, Investment Strategist with ClearBridge Investments, a Specialty Investment Manager of Franklin Templeton

By Jeffrey Schulze, CFA, Director, Investment Strategist with ClearBridge Investments, a Specialty Investment Manager of Franklin Templeton

(Sponsor Content)

There are times to follow the herd and there are times to stray away from the pack. Investors must learn this lesson. Sometimes, it can be beneficial to follow a larger group, but there are moments when it can make sense to chart one’s own course. In the early and middle stages of an economic expansion, running with the herd can be a beneficial and safe proposition.

As the U.S. recovery unfolds, some investors may be tempted to break off, worried about the formation of a bubble. Indeed, many investors are concerned that the market may be overheating, based on metrics such as the forward earnings of the S&P 500 Index.

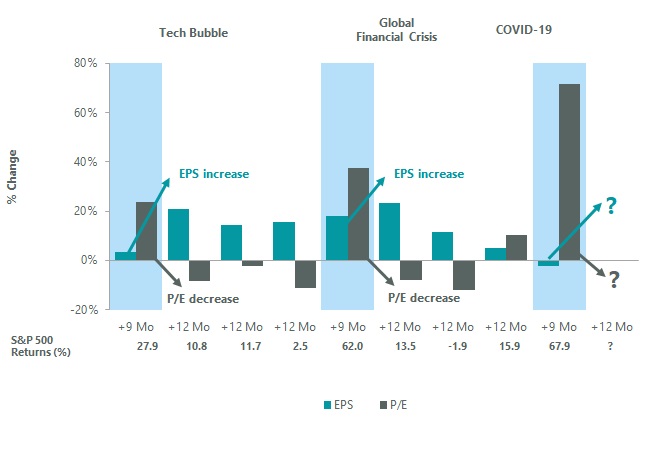

Importantly, an increase in equity multiples is not uncommon during the early stages of an economic expansion. Following recessionary troughs, market returns tend to be driven by price-to-earnings (P/E) multiples during the initial market rally (approximately nine months) as investors anticipate an eventual earnings rebound. As the recovery matures over the subsequent two years, the opposite dynamic occurs, with multiple compressions on the back of stronger earnings growth. Put differently, earnings typically make a significant contribution toward stock returns during this second phase of the rally and declining P/Es become a modest drag on returns (see Exhibit 1 below).

As we move through 2021 and eventually into 2022, we expect this same pattern to unfold; however, multiples may remain elevated.

Higher multiples not uncommon early in Expansion

Valuations are elevated in part because investors correctly sniffed out the budding U.S. economic recovery. Unprecedented stimulus actions (both monetary and fiscal) short-circuited the typical bottoming process, as policymakers formulated a response that rapidly ended the economic crisis and fueled an upturn in financial markets.

ClearBridge Investments has been tracking the scope of this improvement, and we see an overall expansionary green signal since the end of the second quarter of 2020. In our view, it has become clear that a durable U.S. economic and market bottom has formed, with the S&P 500 up 67.9% from the lows and a third-quarter GDP rebound of +33.4%, as of December 2020.

Investor focus has begun to swing toward the beginning of the next recession with some fearing a double dip in 2021. Economic growth appears to be slowing in the U.S. as an increase in the spread of the COVID-19 virus has led to tighter social distancing restrictions and economic retrenchment. This soft patch is evident in data such as initial jobless claims, which have stumbled recently following the weakest payroll gains of the recovery in November.

Our Recession Risk dashboard

We use a Recession Risk Dashboard, comprised of a group of 12 indicators, to examine the health of the U.S. economy and the likelihood of a downturn. The dashboard monitors data points across three economic fault lines for recessionary tremors: Consumer Health, Business Activity and Financial Stress. At present, the overall signal is flashing a green expansion signal. As a result, we believe the current soft patch is just that, and that the U.S. economy should be able to weather the COVID-19 winter storm.

Herd Optimism

Although we retain our positive outlook for U.S. equities into 2021, it would not be a surprise to see a period of consolidation following the tremendous move off the March lows. Several sentiment gauges show elevated levels of optimism, and positioning looks to be stretched. Similarly, bull/bear sentiment ratios are at a level consistent with elevated optimism that preceded past pullbacks. However, we believe any pullback in the first quarter would be an attractive entry point for long-term investors given our expectations that U.S. economic growth will remain robust in the coming years, which should support earnings growth and further upside for equities.

Jeffrey Schulze is an Investment Strategist at ClearBridge Investments and oversees capital market and economic research, contributing thought leadership on these topics that is frequently quoted in the financial media, including the Wall Street Journal, CNBC and CNN. He joined ClearBridge Investments in 2014 and has 15 years of investment industry experience. Prior to joining ClearBridge, Jeffrey was a Portfolio Specialist at Lord Abbett & Co., LLC. He received a BS in Finance from Rutgers University. He is a member of the CFA Institute.

Jeffrey Schulze is an Investment Strategist at ClearBridge Investments and oversees capital market and economic research, contributing thought leadership on these topics that is frequently quoted in the financial media, including the Wall Street Journal, CNBC and CNN. He joined ClearBridge Investments in 2014 and has 15 years of investment industry experience. Prior to joining ClearBridge, Jeffrey was a Portfolio Specialist at Lord Abbett & Co., LLC. He received a BS in Finance from Rutgers University. He is a member of the CFA Institute.

ClearBridge Investments is a Specialty Investment Manager of Franklin Templeton, based in New York. ClearBridge is a leading global equity manager with US$158.1 billion in assets under management as of Sept. 30, 2020.

This commentary is for informational purposes only and reflects the analysis and opinions of Franklin Templeton as of December 31, 2020. Because market and economic conditions are subject to rapid change, the analysis and opinions provided may change without notice. The commentary does not provide a complete analysis of every material fact regarding any country, market, industry or security. An assessment of a particular country, market, security, investment or strategy is not intended as an investment recommendation nor does it constitute investment advice. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.