By Alfred Lee, Director, BMO ETFs

(Sponsor Blog)

The 60/40 portfolio has been long considered the prototypical balanced portfolio. This strategy consists of the portfolio investing 60% of its capital to equities and the remaining allocation of 40% in fixed income.

The two segments in the portfolio each have its unique purpose: equities have provided growth and fixed income has historically provided stability and income. When combined, it allowed a portfolio to have stable growth, while generating steady income.

In the last decade, however, the 60/40 portfolio has been challenged on two fronts. The first has been due to the lack of yield available in the bond market, as interest rates have grinded to all-time lows. As a result, many looked to the equity market to generate higher dividends in order to make up for the yield shortfall left by fixed income.

The second shortcoming of the 60/40 portfolio has been the higher correlation between bonds and equities experienced in recent years, which has limited the ability for balanced portfolios to minimize volatility.

However, the resurgence of bond yields in the recent central bank tightening cycle has breathed new life into the 60/40 portfolio. Suddenly, bonds are generating yields not seen since the pre-Great Financial Crisis era. A higher sustained interest rate environment also means a slower growth environment; that means equity risk premiums (the expected excess returns, needed to compensate investors to take on additional risk above risk-free assets) will be lower. This means fixed income may look more attractive than equities on a risk-adjusted basis, which may mean more investors may allocate to bonds in the coming years. Fixed income as a result, will play a crucial role in building portfolios going forward and its resurgence has revived the balanced portfolio.

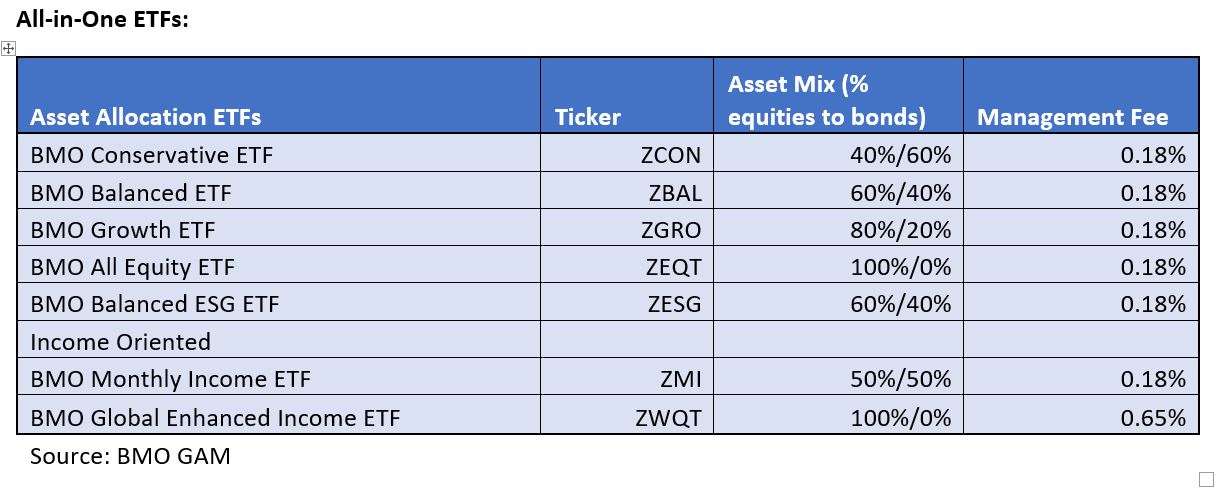

Investors can efficiently access balanced portfolios through one-ticket asset allocation ETFs. These solutions are based on various risk profiles. In addition to the asset allocation ETFs, we also have various all-in-one ETFs that are built to generate additional distribution yield for income/dividend-oriented investors. Investors in these portfolios only pay the overall management fee and not the fees to the underlying ETFs.

How to use All-in-One ETFs

- Standalone investment: All-in-one ETFs are designed by investment professionals and regularly rebalanced. Given these ETFs hold various underlying equity and fixed income ETFs, they are well diversified, and investors can regularly contribute to them over time.

- Core-and-Explore: Investors can use All-in-One ETFs as a diversified base to a portfolio and compliment with other thematic/sector-based ETFs and or individual stocks to potentially generate additional returns or manage risk.

- Foundation to a Modern Portfolio: Some accredited investors have evolved the traditional balanced portfolio to a modern-day portfolio, which includes the use of alternative assets. Alternative assets are any non-traditional assets that have return streams that are different than stocks and bonds. This includes anything from gold, hedged funds, private equity, and debt etc. The addition of alternative assets allows a traditional balanced portfolio to be further diversified, better protecting it from volatility or adverse market events. These investments may also carry more risk than their public market equivalents. All-in-one portfolios can be used as a cost-efficient base allowing investors a one-ticket solution to the traditional parts of the portfolio.

Alfred Lee is a portfolio manager and investment strategist at BMO ETFs, where he currently heads up the index equity team. His team currently manages some of the largest ETFs in Canada. In addition to his portfolio manager duties, Alfred also serves as the investment strategist for the team, putting together trade ideas and model portfolios for institutional and retail clients. Prior to moving to equities, Alfred was a lead portfolio manager on the entire fixed income BMO ETF line up and spent a year seconded to the Bank of Canada, managing their Provincial Bond Purchase Program (PBPP), one of the central bank’s emergency asset purchase programs in 2020. Prior to joining BMO, Alfred worked at two other Canadian banks as a research analyst, focusing on macro-economics and ETFs and worked in an institutional consultant practice of a major bank.

Alfred Lee is a portfolio manager and investment strategist at BMO ETFs, where he currently heads up the index equity team. His team currently manages some of the largest ETFs in Canada. In addition to his portfolio manager duties, Alfred also serves as the investment strategist for the team, putting together trade ideas and model portfolios for institutional and retail clients. Prior to moving to equities, Alfred was a lead portfolio manager on the entire fixed income BMO ETF line up and spent a year seconded to the Bank of Canada, managing their Provincial Bond Purchase Program (PBPP), one of the central bank’s emergency asset purchase programs in 2020. Prior to joining BMO, Alfred worked at two other Canadian banks as a research analyst, focusing on macro-economics and ETFs and worked in an institutional consultant practice of a major bank.

Disclaimer: Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. ®/™Registered trademarks/trademark of Bank of Montreal, used under licence. The views and opinions of the author in this communication do not necessarily state or reflect those of BMO Global Asset Management. This communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.