By James Gauthier, CIO, Justwealth

By James Gauthier, CIO, Justwealth

Special to the Financial Independence Hub

When investors run out of contribution room in their tax-sheltered investment accounts such as RRSPs and TFSAs, they often continue investing in a non-registered account that does not have the same automatic benefit of avoiding or deferring taxes. Managing investments in a taxable portfolio then becomes a much more complicated exercise: one that attempts to maximize wealth on an after-tax basis instead of a pre-tax basis, which is how investments would be structured in a registered account.

Any investment income that is earned in a non-registered account is subject to taxation annually and can therefore be thought of as a “fee,” similar to the annual fees charged by your financial institution or advisor. As a robo-advisor that provides low-cost investment options for investors, we devote much time and resources to educating investors about the negative impact that investment management fees can have on their overall wealth. But unlike management fees, which are generally easy to identify and compare amongst different investment options, it is virtually impossible to find after-tax rates of returns for making apples-to-apples comparisons between various products and providers.

Most investment providers, including robo-advisors, use the exact same portfolio recommendations for their clients’ non-registered accounts as they do for their registered accounts, as long as the “risk” level is deemed to be the same. To illustrate the true cost of tax inefficiency, we can show how altering a portfolio recommendation, without materially altering the risk level or other characteristics of the portfolio, can improve the after-tax return of the portfolio.

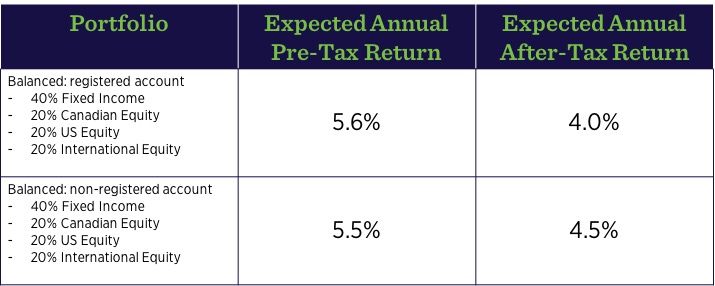

Consider an investor in the top marginal tax bracket who is considered to have an “average” risk tolerance and is invested in a Balanced portfolio of 40% bonds, 20% Canadian equity, 20% U.S. equity and 20% international equity. A reasonable long-term expected annual rate of return on this portfolio, on a pre-tax basis, is 5.6%. Applying tax rates to the interest, dividends (Canadian and foreign) and a conservative estimate for capital gains, the after-tax return on the portfolio is reduced to 4.0%.

By making some minor changes to the portfolio’s asset allocation, such as emphasizing asset classes that receive more favourable tax treatment and finding investment vehicles (ETFs in our case) that are innovatively structured to receive more favourable tax treatment, we can create a new portfolio that is very similar from a high-level asset allocation and risk perspective. The expected pre-tax return on this new, tax-efficient portfolio is slightly lower at 5.5%, but after taxes are applied, the return is a more favourable 4.5%.

The difference of 0.50% in after-tax returns should be considered the MINIMUM cost of tax inefficiency, since we have not yet addressed any other tax-inefficient practices. Extending the analysis across our entire range of investor risk tolerances (from Conservative to Aggressive) shows that the cost of tax inefficiency can vary from a low of 0.40% up to 1.00%. In most cases, the cost exceeds our 0.50% management fee, meaning that you would be better off paying our fee rather than having your assets managed for FREE at any another institution that does not use tax-efficient portfolios!

Next, we will consider the value of tax-loss harvesting and the one-time impact of the ability to accept in-kind transfers. Incorporating these other deficiencies into the analysis shows that the cost can be much greater than 0.50%! In the first half of this article, we examined the tax-inefficient practices of many investment providers, we focused on the tax-efficient structure of portfolios and how that could create savings for investors with non-registered investment accounts. Now we shift the focus to benefits that are applicable to specific individual investor circumstances, which have varying impacts on the cost of tax inefficiency. The two areas that we will consider are in-kind transfers and tax-loss harvesting.

In-Kind Transfers

If you have a non-registered investment account and are considering moving to a new investment provider, the very first question that you should ask is if they accommodate in-kind transfers. If the answer is unequivocally yes, then proceed to your next question; if the answer is anything other than yes, then move on to the next candidate.

The alternative to making in-kind transfers is cash transfers. A cash transfer will turn all unrealized gains and losses into realized gains and losses and will have immediate consequences for the current tax year. Realizing those gains and losses could result in a huge tax bill, a tax refund (if you’re are lucky), or may have little or no impact at all. In the scenario of having higher taxes payable in the current tax year, not only will you lose wealth in the current tax year, but you will also potentially lose a lifetime of compounding of future gains which could very well have an even greater impact on your future wealth!

The cost of being unable to make an in-kind transfer will vary greatly from investor to investor, but we can try to illustrate it with a simple example. Consider an investor with a $1,000,000 portfolio that has $200,000 of unrealized capital gains. Assuming a 50% individual tax rate and applying the 50% capital gains inclusion, the investor would stand to lose $50,000 in taxes payable due to capital gains if realized through a cash transfer.

Taking that hypothetical example one step further, assume that our investor is retiring in two years and is able to defer any pension income to start three years from now. This creates a one-year window of no income where the investment gains could be realized at a potentially much lower marginal tax rate. Typically, this kind of attention to detail and service has only been provided by “high-end” Investment Counsel firms, but given our experience in working with such clients, we can also offer this level of service and attention to detail – for substantially less!

Tax-Loss Harvesting

As per the FAQs on our website, “Tax-Loss Harvesting is a strategy used to manage short-term tax implications for investors with non-registered assets. A tax loss harvesting strategy is usually unique to an individual investor and if coordinated properly, can have a large impact on wealth maximization over time.” Implementing a tax-loss harvesting strategy requires a reasonable level of investment sophistication, and knowledge of the relevant tax rules concerning investment income.

Tax-loss harvesting traditionally takes place annually, usually towards the end of the tax year when an investor’s taxable position for the year is reasonably well understood. By selling one or more securities in the investor’s non-registered portfolio that have unrealized losses, and purchasing different, but similar, securities in roughly the same amount, the investor can essentially maintain uninterrupted exposure to markets while realizing capital losses. These losses can be used in the current tax year, applied to the three previous tax years, or carried forward indefinitely to offset capital gains.

More recently, some firms have tried to establish algorithmic methods for tax-loss harvesting. This form of tax-loss harvesting is less personalized to individual tax scenarios and comes with higher trading frequency, likely resulting in increased costs to the client. Wealthfront, a U.S.-based robo-advisor, recently reported the results of an internal study of their algorithmic tax-loss harvesting on behalf of clients. The results appear to be promising, with the claim that the minimum average annual after-tax benefit (measured in performance terms) over the past five years is 0.73%. While we would suggest that the results are far from conclusive and may not be directly comparable for Canadian investors, it does provide a positive result.

At Justwealth, we prefer the traditional approach as it is allows for a much more personalized approach to managing our clients’ assets.

Conclusion

In our experience of performing portfolio reviews for our clients, we have found the same repeat offenders who seem to pay little or no attention to the importance of tax efficiency in their clients’ portfolios. These offenders include large financial institutions, including the big banks, investment companies who employ commissioned sales agents who will purchase poorly-constructed portfolios of high MER mutual funds, and robo-advisors that use the exact same portfolios of ETFs for registered and non-registered accounts, or use just a few different, non-tax-efficient ETFs for ALL client portfolios.

If you have assets in a non-registered account, ranging from a high interest savings account to an aggressive mix of stocks, bonds or funds, you may be able to retain a greater proportion of your investment income each year by investing in more tax-efficient portfolios. Justwealth offers 16 different tax-efficient portfolios across wealth accumulation, income and capital preservation investment strategies. All Justwealth clients also receive the attention of a Personal Portfolio Manager who will work directly with clients to help manage the taxes payable on their investments in a smart and prudent manner every single year.

The true cost of tax inefficiency can be split into annual costs arising from poor portfolio construction and costs resulting from an investment firm’s unwillingness or inability to accommodate in kind transfers or managing taxable positions over time. These costs can be expensive, and potentially greater than the cost of the management fees charged by investment firms!

Justwealth offers free, no-obligation portfolio reviews that can help determine if you may have inefficiencies in your portfolio. Please visit https://www.justwealth.com/portfolio-review/ for more details.

![]() James Gauthier, MBA, CFA, is Chief Investment Officer for Justwealth Financial Inc. James is a highly regarded asset allocator who for nearly 20 years has devised some of the most innovative and sophisticated asset allocation policies for institutions, high net worth clients, and large wrap programs in Canada. He has a Bachelor of Science in Mathematics and an MBA in Finance, and is a member of the Toronto CFA Society and holds the CFA designation. This blog originally appeared on Justwealth’s blog in March and is published here with permission.

James Gauthier, MBA, CFA, is Chief Investment Officer for Justwealth Financial Inc. James is a highly regarded asset allocator who for nearly 20 years has devised some of the most innovative and sophisticated asset allocation policies for institutions, high net worth clients, and large wrap programs in Canada. He has a Bachelor of Science in Mathematics and an MBA in Finance, and is a member of the Toronto CFA Society and holds the CFA designation. This blog originally appeared on Justwealth’s blog in March and is published here with permission.

Would be nice to provide some helpful ideas other than oh my you should call us for business.