By Mark Seed

Special to the Financial Independence Hub

Welcome to another Then and Now post, a continuation of my series where I revisit some older blogposts and either rip them to shreds (because my thinking has totally changed on such subjects) or I’ll confirm my position on some subjects including some specific stock or ETF investments.

Today’s post is yet another departure from any top-stocks that I/we own.

Here are my thoughts and current postion on low-cost, ex-Canada ETF: XAW. This includes how I might add more of this ETF in 2024! I’ll come back to that. 🙂

You can read about my previous Then and Now posts on certain stocks (good and bad!) at the end of this post.

Then – XAW

Long-time readers of this site will recall I really ramped up my DIY investing journey, around the time of the Great Financial Crisis. I’ve managed this blog and chronicled my/our journey to financial independence ever since ….

Even before that market meltdown, I was transitioning to becoming a DIY investor and My Own Advisor following the tech/dot-com crash that occurred about a decade prior. It was during that crash that I learned a few valuable personal finance lessons:

- Nobody cares more about your money than you do/you will.

- The same assets that could make you wealthy could also make you poor.

What I mean by #2 is you can have too much of a seemingly “good investing thing.” I can’t tell you specifically what stocks will rise or fall in value over time. I don’t know what inflation may or may not be next year. I have no idea what new taxation rules or legislation could be years down the line – although my hunch is taxation will get higher and more complex to navigate!

Jokes aside, unlike Warren Buffett of late, I believe diversification matters.

There are simply too many unknowns for me as a DIY investor to go all-in on Apple, let alone all U.S. tech stocks, let alone just the U.S. market.

For fun, I’ve compared the returns of U.S. tech (via QQQ ETF), vs. our top-TSX stocks (via XIU), vs. a popular U.S. international index fund that many experts tout. See below.

The financial future will always be cloudy but hindsight can be a wonderful woulda, coulda, shoulda game…!

Sources for charts: Portfolio Visualizer.

I started off my DIY investing journey, and chronicling our path to financial independence, with a focus on buying and holding Canadian and U.S. stocks that pay dividends, although I’ve always had some international assets in our portfolio too. I simply don’t disclose everything I own.

Earlier this year, I updated this post below, highlighting some important lessons learned in diversification, what matters as we progress towards realizing some major financial milestones…

Over the years, I have purchased XAW for lazy ex-Canada investing and I continue to add more.

Now – XAW

- XAW now makes up a good portion of our total portfolio value, and growing.

- I tend to reinvest all XAW distributions paid to buy a few more XAW units commission-free.

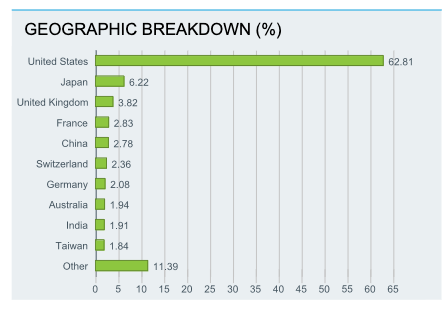

- I own XAW to earn ex-Canada returns from a global pool of stocks, without any individual stock risk.

The reason for owning some ETFs beyond some dividend growth stocks is simple: I cannot predict for certain which stocks will truly succeed long-term.

So, owning low-cost ETFs is a hedge against how I’ve largely unbundled my Canadian ETF for income, beyond holding a few U.S. stocks for mostly portfolio defence.

Then and Now – XAW Summary

Until I decide that XAW does not fit my/our investment objectives, I will continue to own it and buy more of it. That includes buying more of this low-cost ETF inside our TFSA for 2024, as $7,000 of new Tax Free Savings Account contribution room opened up on January 1st.

As 2024 begins, I continue to believe our hybrid approach to investing (via owning some stocks and some low-cost ETFs) delivers two key benefits to help fund our semi-retirement dreams:

- Dividend income, earned today, to reinvest (or eventually spend) the money as I please.

- Low-cost, global growth, beyond Canadian borders.

Will post again, soon!

In the meantime, I welcome all comments or opinions about our approach even if you invest differently.