They say a million bucks or so ain’t what it used to be … but I still think that’s a pile of money.

Which begs the question: does this couple with C$1.2 million in invested assets have enough to retire on?

Before we get into this latest case study however (thanks to a reader question by the way, I’ve changed the names of the readers for privacy reasons), this is a great time to remind you I’ve done other case studies like this on my site before: there are a few on this Retirement page in particular.

Mike and Julie want to spend $50,000 per year. Did they save enough?

This single senior hopes he can retire at age 60 on a lower income. Is it possible?

What is enough for some is not enough for others

Passionate readers of this site will know I believe personal finance is personal. What works well for some investors or families will not work at all for others.

You need to carve your own financial path.

The 4% rule says you should be able to ‘safely’ withdraw 4% of your original portfolio each year, adjusted for inflation, for at least 30 years and have a reasonably high chance of having money left over.

This means, in more practical terms based on this rule, that a $1.2 M portfolio should be able to last ~ 30 years (or more) by withdrawing $48,000 in year 1 of retirement ($1.2 M x 0.04), then increasing that amount over time with inflation.

That said, while having a core spending plan is all fine and good, it’s also having flexibility designed into your plan that is essential for success. You need to consider your spend on travel, hobbies, home renovations but also the ability to cover emergencies and more during retirement.

Rates of return also matter

The potential sequence of many bad years in the stock market could crush a retirement plan if you’re not careful. Also, while less risky portfolios (i.e., more fixed income portfolios) might fluctuate less in the short term, over the long term this will have a big impact on your returns. This means a more conservative portfolio can actually increase the risk of running out of money …

Karla and Toby case study

To help us figure out if this couple, who has a seemingly healthy $1.2 M in the bank, have “enough money” I’ve once again enlisted the help of Owen Winkelmolen, an advice-only financial planner (FPSC Level 1) and founder of PlanEasy.ca.

Owen let’s get into it!

Sure Mark!

Case study overview

First off, I want to say Karla and Toby are in a very good financial position for retirement with over $1M in financial assets in their 50s. That is excellent.

That said, they face some risk in the future. Let’s look at the information and numbers they sent you:

- Karla, was and remains stay at home mom, Age 54.

- Toby, marketing manager, makes $110,000 per year now. Age 56. Toby wants to retire early next year in January when he turns 57. You told me they would love to start their winter renting from a Florida condo: sounds great!

- They have lived in Canada their entire life. (re: they expect CPP and OAS benefits to come).

- They live in Calgary, Alberta and own their home.

- They have no debt other than $19,000 Line of Credit (LOC) balance used for a recent vacation and monies borrowed to fund their adult daughter’s wedding earlier this year.

- Karla has no workplace pension whatsoever although Toby has a small LIRA from a former employer to draw down.

Portfolio assets:

- They have $700,000 in combined assets within their RRSPs; invested in a mix of costly mutual funds.

- Toby has $50,000 in his Locked-In Retirement Account (LIRA). Invested in similar mutual funds above.

- They have $150,000 (combined) invested within their TFSAs. They hold a mix of Canadian REITs and a few Canadian bank stocks.

- They’ve got about $50,000 cash in an interest savings account.

- Toby has $250,000 invested in a taxable/non-registered account that includes a mix of cash, U.S. stocks and some Canadian dividend paying stocks.

All told, they have about $1.2 million in investable assets and their home value is estimated at $550,000. They are considering selling their home as they get older and renting, including renting property in Florida each winter.

You also told me they have one car, now paid for, a 2014 Range Rover SUV and no plans to get a new one until at least five years from now.

Mark those are great details to start some analysis with …

Owen’s analysis

Based on what details you shared with me Mark, because a large portion of their desired retirement spending will come from their investment portfolio, this creates a high risk of running out of money if they were to experience a period of poor investment returns in the future. We’ll get into that in a bit.

For the most part, they’re choosing to retire early, at ages 55 and 57. Based on the spending information Toby and Karla shared they will have a spending target of about ~$70,000 per year after-tax. This is about 80% (give or take) of their pre-retirement income. In using this assumed spend in year 1 of retirement, this represents a 6.1% withdrawal rate in early retirement, which is rather high.

While a high withdrawal rate in early retirement isn’t necessarily a concern, especially if government benefits like Canada Pension Plan (CPP) kick in a few years later, a withdrawal rate of 6% could pose a risk for Karla and Toby in the future.

With this high withdrawal rate, again, based on my assumptions of their spending ~ $70,000 per year, this will likely mean they should consider taking CPP and OAS as early as possible.

I know Mark has written about when to take CPP here – a solid analysis.

Delaying CPP can sometimes be an advantage for retirees. Delaying CPP has several benefits but also a few risks. One of the largest risks is that personal investment assets must sustain a higher withdrawal rate for an additional 10-years before CPP begins at age 70.

For Karla and Toby, delaying CPP might not be possible.

Waiting until age 70 to start CPP would mean sustaining a high withdrawal rate of 6%+ for almost 15-years. This is likely not possible, especially if we experience a series of poor investment returns over the next decade. Instead we’ll plan for Karla and Toby to start CPP at age 60 and OAS at age 65. If investment returns are above average they might be able to delay a few years, but we’ll plan more conservatively to hedge any sequence of return risk.

Starting CPP at age 60 and OAS at age 65 would give Karla and Toby $28,823 in government pensions after they both begin. This drops their withdrawal rate slightly but not by a very large amount. The reason the drop isn’t larger is because by the time their CPP and OAS benefits begin, Karla and Toby have already drawn down a large part of their investment portfolio at a higher withdrawal rate based on their target spending.

Karla and Toby have already decided that they will sell their home in the future and move into a rental to free up extra capital, as they vacation more in Florida. The exact timing will depend on actual investment returns, but for the purposes of this case study I’ve planned for the sale of their home at age 75. Although the principal residence exemption (PRE) means there is no tax on the sale, we still need to plan for selling fees of around 5%.

Aside from their initial high withdrawal rate, future home sale costs, and subsequent rental expenses, the other thing working against Karla and Toby is that the average investment fee on their investment portfolio is 1.5% (based on their mix of costly mutual funds predominately in their RRSPs).

At 1.5% their portfolio fee is not even above average for Canada, but it still represents a large drag on their registered assets. To see how investment fees and withdrawal rate impact their plan we’ll first look at their projections using their current 1.5% fee.

Scenario 1 – MER 1.5% – Net Worth Projection

Scenario 1 – MER 1.5% – Spending

As we can see, the projections don’t look that great. Karla and Toby run out of assets in their early 90s and we haven’t even taken variable investment returns into account yet. These projections could look much worse if they were to experience a series of poor investment returns early in retirement.

To close the gap, we’ll look at a second scenario where Karla and Toby move to a self-directed portfolio using an all-in-one ETF with a MER of 0.25%.

We’ll also add an annual fee of $750 for a check-in with an advice-only planner (Mark: no affiliation).

You’ll notice in both projections that we’re moving the non-registered assets into the TFSA as new contribution room becomes available each year. I would encourage all investors consider this, since for Karla and Toby, it will minimize the tax on their portfolio, even if there is some capital gains tax triggered on the sale.

I know Mark wrote a comprehensive post about investing in taxable accounts and what to hold where.

We are not however moving RRSP registered assets into the TFSA, which can sometimes be a good strategy. This is because in Karla and Toby’s case we want to slowly draw down RRSP assets throughout their retirement.

This is something that Mark recently wrote about in his own financial independence journey.

The main benefit of slowly drawing down RRSP assets is we get to fully use any non-refundable tax credits each year. If we were to draw down their registered assets faster, then some of these non-refundable tax credits would be “left on the table” in the future.

Scenario 2 – MER 0.25% – Net Worth Projection

Scenario 2 – MER 0.25% – Spending

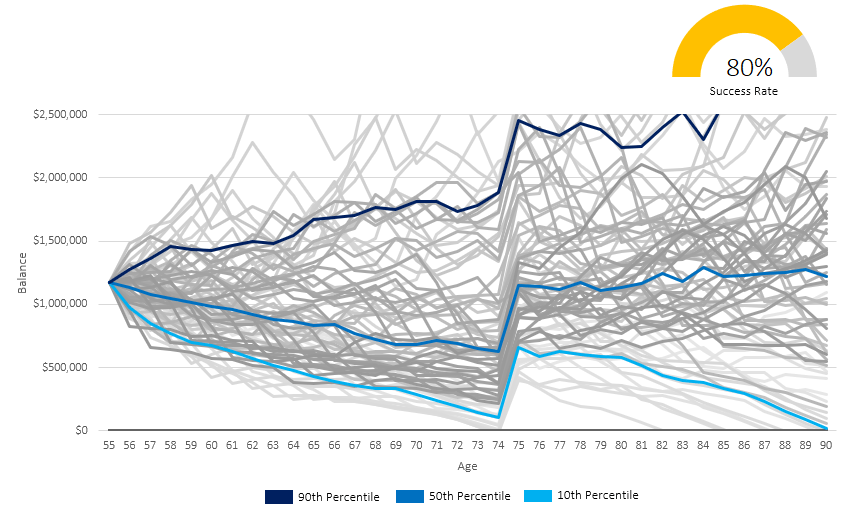

Sequence of returns risk

With a lower investment fee this couple’s projections look much better, but we haven’t yet taken into account variable investment returns.

The projections above were built assuming a healthy retirement spend with a constant rate of return. The latter is not realistic. In reality, this couple like every couple will face some sequence of returns risk, especially in early retirement when their withdrawal rate is higher.

To evaluate this sequence of returns risk we’ll take Karla and Toby’s plan through a number of historical periods of stock, bonds and inflation rates. This will give us a sense of how successful their plan might be. Past returns are a good test of a retirement plan, but they may not fully capture the range of returns we could expect in the future.

Scenario 2 – MER 0.25% – Success Rate

Unfortunately, even with $1.2 M in financial assets, Karla and Toby’s plan is only successful in 4 out of 5 historical periods, and even the successful periods are highly dependent on the sale of their home in the future.

If they were to experience a period of good investment returns early in retirement, they may not have any issues reaching their spending goal, however if they experience average or below average returns then they may need to make changes to their spending to ensure success.

Again, we have assumed a fairly generous $70,000 per year after-tax spend in retirement for them – keep that in mind!

Therefore, by making a permanent reduction to their average spending target by ~ $10,000 per year (or an equal increase in their net income for some years), I certainly feel having a $1.2 million-dollar nest egg and no debt is outstanding for retirement success.

Scenario 2 – MER 0.25% – Success Rate With $10,000/Year Less Spending ~ $60,000 per year

What does this case study mean for you?

Karla and Toby have significant assets to spend in retirement, but they would need to analyze how much they will spend on a year-over-year basis to confirm if $1.2 million saved is enough.

For a couple that just intends to spend $40k-$50k per year on average, we can see from above this nest egg amount is plenty regardless of the stock market returns they might face.

For a couple like Karla and Toby that might aspire to spend about $70,000 per year from this amount, they will face some retirement risk depending on actual investment returns.

To make any retirement plan a great plan, including yours, I suggest you really get into the details about what you intend to spend per year, be adaptable with that spending plan if faced with below average investment returns, and try to reduce your investment costs as much as possible. If you do those three things plus build-in some contingency money for emergencies, I think you’ll be well on your way to retirement success.

I hope to come back to Mark’s again for more case studies!

Owen Winkelmolen (no affiliation) is a fee-for-service financial planner (FPSC Level 1) and founder of PlanEasy.ca. He specializes in budgeting, cashflow, taxes & benefits, and retirement planning. He works with individuals and young families in their 30’s, 40’s and 50’s to create comprehensive financial plans from today to age 100.

Disclosure: My Own Advisor, and Owen, have provided this information for illustrative purposes. This is not direct investing advice nor should it be taken as such. Assumptions above are for general case study purposes only. If you have specific needs, please consider consulting a fee-only financial planner to discuss any major financial decisions.

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on Nov. 18, 2019 and is republished on the Hub with his permission

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on Nov. 18, 2019 and is republished on the Hub with his permission

Mark,

Why write a detailed analysis of a story that doesn’t hold water at all.

Clearly, the family is likely lived/living beyond means (Range Rover SUV, vacation loan, wedding loan) on an income of 110K? Most people cant afford this even at higher incomes.

Retiring on 1.2M assets at 57…in any country with a decent quality of living this is impossible.

And now this family wants to rent a place in Florida every winter.

Someone needs to sit down to talk with them.