Side hustling is on the minds of a majority of Canadian women, according to a survey conducted by Angus Reid for Simplii Financial.

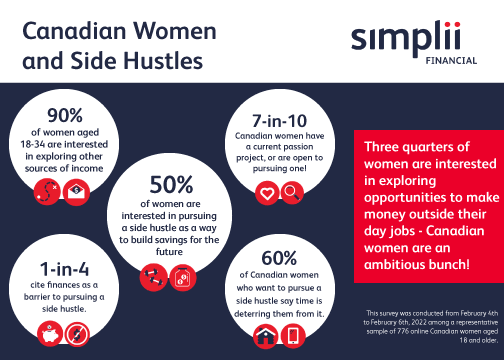

Fully 90% of Canadian women aged 18 to 34 are interested in exploring opportunities to earn money outside their day jobs, the survey found. And across all age groups, 76% are interested in starting a side hustle.

Most of these women are hoping to find more ways to save for major life events, including early retirement, making a down payment on a home, and growing overall savings for their futures.

This Tuesday, March 8th is International Women’s Day, and to celebrate, Simplii Financial will be hosting a special virtual event: the #SimpliiSideHustle panel [Link below.] It brings together three barrier-breaking Canadian women who have launched successful businesses, and who will offer their advice to those looking to start their own side hustles.

The panel features Canadian entrepreneurs Abby Albino (@abbyalbino on Twitter), Avery Francis (@averyfrancis), and Zehra Allibhai (@zallibhai), who will share the challenges they faced in starting their sneaker, consulting and fitness businesses, respectively. They’ll also share how they’ve challenged gender stereotypes that disempower women, to support a more equitable future.

Start-up capital a barrier for women seeking side hustles

Despite the high number of women looking to launch side hustles, more than a third of all women surveyed, and nearly half of those aged 18 to 34, indicated that lack of start-up capital was a barrier to pursuing their side hustles.

“…. we know that making digital banking convenient and accessible to Canadian women supports financial independence and empowerment,” said Rohini Dhowan, Senior Director, Deposits and Investing, Simplii Financial, in a press release, “This is why as we approach International Women’s Day (IWD), we want to provide a forum for women, no matter where they are on their financial or side hustle journeys, to learn from one another.”

She added that by starting with the basics, offerings like Simplii’s no-fee chequing account eliminate the stress of maintaining minimum balances, while high-interest savings accounts encourage everyday savings habits to help slowly build your dream.

When asked about what helped her get to where she is, Abby Albino said “We were tired of seeing a lack of representation for women in sneaker culture along with the stereotype of what it means to be a professional within the sports industry: so my business partner and I broke the bias and decided to open our own sneaker store for women by women.”

Sneaker boutique launched in the pandemic

Makeway is a successful sneaker boutique co-founded by Albino. “It’s an unconventional idea to open a standalone store in the middle of a global pandemic, but we believed in it and knew that ultimately there was no “right time” to take the leap. To be honest, I’ve never been great with money, but I learned that small lifestyle changes and finding simple digital solutions allowed me to save and better manage my money, ultimately making it possible for me to open my shop” said Albino.

Anyone interested is invited to attend the virtual panel this Tuesday, March 8th at 2:00 PM EST by registering for tickets here.

Helen Chevreau is Associate Editor for the Financial Independence Hub.