By Steve Lowrie, CFA

Special to Financial Independence Hub

I’ve spent my entire career railing against the dangers of market-timing — i.e., dodging in and out of markets based on current conditions. But there is a time when “timing” of a different sort matters. I’m talking about your investment time horizons.

Today, let’s look at how to use your personal time horizons to successfully separate today’s spending from tomorrow’s future wealth.

Spending and Investing over Time

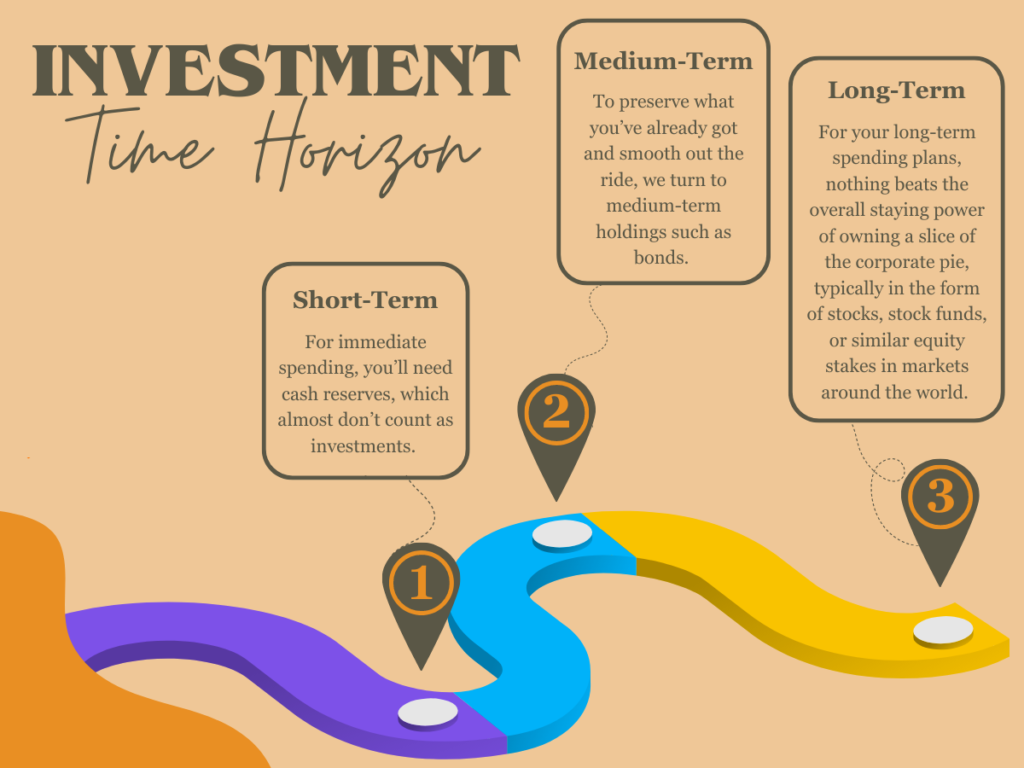

One of the reasons we advocate for holding a diversified investment portfolio is because your investment horizons are diverse as well:

- For immediate spending, you’ll need cash reserves, which almost don’t count as investments.

- To preserve what you’ve already got and smooth out the ride, we turn to medium-term holdings such as bonds.

- For your long-term spending plans, nothing beats the overall staying power of owning a slice of the corporate pie, typically in the form of stocks, stock funds, or similar equity stakes in markets around the world.

On that last point, global equity markets are relatively dependable in one sense: by delivering on the success of collective human enterprise, they’ve delivered strong, inflation-busting returns in the long run. But these same markets are also quite chaotic in the near-term, with big, unpredictable price swings along the way. This means not all your dollars belong in this arena to begin with: only the ones you’re prepared to invest in for a good, long while. In other words:

Your cash reserves are for spending sooner than later. Your long-term investments are there for your future self, rather than as an ATM-like source for immediate spending.

Market-Timing vs. Financial Planning

How do you determine how long is “long-term” for your investments? Unfortunately, many investors use market-timing instead of personalized financial planning to decide when it’s time to move their money in and out of various positions. They pile into the action when markets surge and flee as they plummet. This is a timeless timing tragedy that foils the ability to preserve, if not grow, wealth over time.

Instead, use your own goals and investment timeframes to decide how much of your wealth to invest in pursuit of higher expected returns, as well as how much to shelter against the uncertainty.

- For upcoming spending needs, your money may be best kept in cash or similar humdrum holdings. That way, it’s there when you need it. The catch is, cash and cash-like reserves aren’t expected to keep pace with inflation over time, which means your spending power gradually shrinks. So …

- For spending that’s still years away, you’ll want to own positions that are expected to generate new wealth, rather than just maintain a status quo. That’s where the wonder of global enterprise comes in — aka, stocks. The catch here is, you must commit to keeping your future money patiently invested and ride out the downturns along the way.

Estimating your Time Horizon

Even if you’re committed to financial planning, it’s surprisingly common to underestimate how much time you’ve actually got to invest. For a couple retiring at age 65, there is a 50% chance one of you will live past age 90, which means your retirement timeline could be 25–30 years, or more. Extend it even further if you’d also like to leave a substantial financial legacy.

What’s the harm in being too conservative about your time horizon? You may assume a shorter time horizon means you should aggressively reduce your stock market exposure, and create a more conservative portfolio of cash, GICs or short-term government bonds. The logic is reasonable enough. But eventually, inflation will decrease the spending power of these supposedly safer investments.

Essentially, you can prioritize your financial legacy by extending your time horizon outward. Or you can emphasize your retirement income sustainability by shortening it. You then plan your short-term/long-term portfolio mix accordingly. Everyone’s different, so it’s worth consciously deciding what balance is right for you.

Incorporating Lifestyle Reserves

Here’s one more powerful tip often overlooked in all the investment excitement: Consider having a sizeable lifestyle reserve. This is NOT the same as shifting your assets from fewer stocks and real estate to more bonds. It means setting aside substantial cash or cash equivalents outside of your long-term investment portfolio.

For example, say you’re in retirement, or similar circumstances. If you need $100,000 annually to maintain your lifestyle, you might consider having $200,000–$300,000 in essentially uninvested reserves, preferably in an accessible, taxable (non-registered) account. You can then invest the rest of your assets more aggressively, without being tempted to interrupt their progress for current spending needs.

As a bonus, we’ve more recently been receiving improved rates on our cash reserves. I’m not suggesting you increase your reserves as a result. That’s market-timing. But now that we’re at least earning a little more money on our money, you may feel better about maintaining your reserves at the right level for your current lifestyle.

Establishing your Investment Time Horizon

To sum up, your driving force for when to invest — and stay invested — is ideally based on the timing of your own spending plans, rather than external market moves. You can further strengthen your experience by:

- Understanding your personal investment time horizons.

- Investing in appropriate global wealth generators such as stocks, bonds, and real estate … but being prepared to stick with your investments over the long haul.

- Establishing a large enough cash reserve to leave your long-term investments alone.

- Writing down your plans and strategies, for you and your advisor to reference whenever you may question your resolve.

None of these best practices are likely to eliminate every bit of uncertainty you may have as an investor. But they’ll at least give you pause whenever you’re tempted to react in ways that no longer align with your stated goals and timelines.

What are your own investment time horizons, and how can you make best use of them to create and sustain a lifetime of abundant wealth? More precise answers call for more personalized financial planning. Let us know if we can help.

Steve Lowrie holds the CFA designation and has 25 years of experience dealing with individual investors. Before creating Lowrie Financial in 2009, he worked at various Bay Street brokerage firms both as an advisor and in management. “I help investors ignore the Wall and Bay Street hype and hysteria, and focus on what’s best for themselves.” This blog originally appeared on his site on July 10, 2023 and is republished here with permission.

Steve Lowrie holds the CFA designation and has 25 years of experience dealing with individual investors. Before creating Lowrie Financial in 2009, he worked at various Bay Street brokerage firms both as an advisor and in management. “I help investors ignore the Wall and Bay Street hype and hysteria, and focus on what’s best for themselves.” This blog originally appeared on his site on July 10, 2023 and is republished here with permission.