“Books are the bees which carry the quickening pollen from one to another mind.” — James Russell Lowell, poet and author

“Books are the bees which carry the quickening pollen from one to another mind.” — James Russell Lowell, poet and author

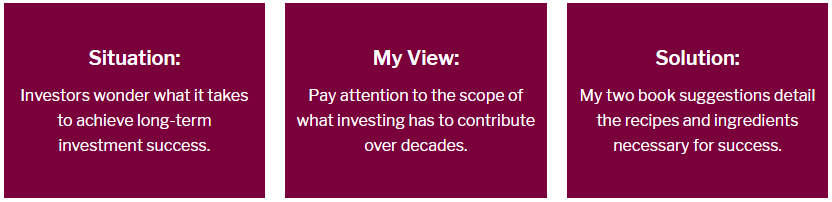

Last week I highlighted two books that help manage your family’s retirement aspirations. This week I turn my sights onto two books that shape investment success over the long run: all about taking charge of investing in your self-education through quality reading.

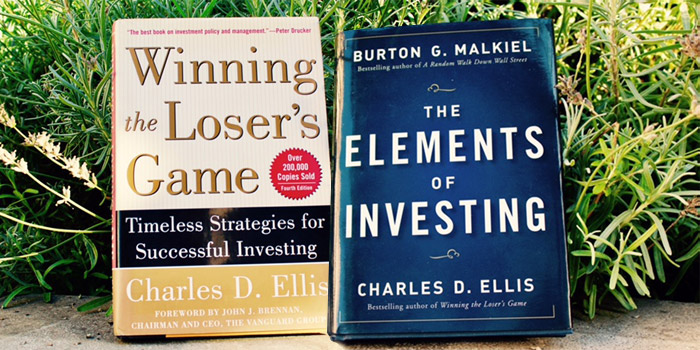

I’ve selected two books that provide great insights into stewarding your long-term wealth. The authors are well known in the wealth management profession.

The books emphasise simple, yet fundamental recipes of investing: something for everyone’s investment toolbox when the bulls and bears make their presence known.

My initial pick is a gem written by two leading, seasoned authors of many books. Both have contributed heavily to the profession of managing wealth. The investing process is condensed into five short chapters, all in layman’s language.

The authors make the point that everything starts with savings. It is their position that each of us can make sound investing decisions. The process does not have to be complicated.

Rather, it is a highly disciplined approach to investing. All the rules you need to know and implement are explained. I visualise the book as a clear, concise and practical guide for the long road ahead.

The easygoing writing style emphasises keeping the approach to investing as simple as possible. My perspective concurs with the view that the book is a prudent, logical road map.

Charles D. Ellis

This book is a true classic. It details policies and procedures for successful investing. It’s one of the best books on the simple, proven, investment strategies that are easily incorporated into any game plan.

I especially value the summary quotes found on several pages. For example, “Investment policy is the foundation on which portfolios should be constructed and managed.” In addition, “After a sound investment policy has been formulated and implemented, changes should be made to it carefully and infrequently.”

Understanding the timeless concepts covered in this book provides plenty of examples of how investors can successfully interact with the markets. The summary quotes alone are worth the price.

This classic reference is filled with straightforward concepts. Think of it as a blueprint that sets out the game plan for successful investing. It drives home the point that managing market risk is the primary objective of investment management.

I interviewed Dr. Malkeil on another topic at the 2008 CFA conference. I’m looking forward to catching up to Mr. Ellis one day.

It is important to me that the two books focus heavily on investing fundamentals. Extensive planning is required to navigate the family’s investing needs over the ever-changing long term. Plenty of patience is a quality to behold for all investors.

Concepts found in these two books are both timeless and proven. Their straightforward wisdom helps you make better decisions for the longer run. They also complement last month’s two books on Retirement.

Total cost of this exercise is under $50. Well worth the investment. I recommend these two books for your shelf. They too are the bees that carry the quickening pollen from one to another mind.

Adrian Mastracci, Discretionary Portfolio Manager, B.E.E., MBA started in the investment and financial advisory profession in 1972. He graduated with the Bachelor of Electrical Engineering from General Motors Institute in 1971, then attended the University of British Columbia, graduating with the MBA in 1972. This blog is republished here with permission from Adrian’s new website, where it appeared on September 12th.

Adrian Mastracci, Discretionary Portfolio Manager, B.E.E., MBA started in the investment and financial advisory profession in 1972. He graduated with the Bachelor of Electrical Engineering from General Motors Institute in 1971, then attended the University of British Columbia, graduating with the MBA in 1972. This blog is republished here with permission from Adrian’s new website, where it appeared on September 12th.