But just because you might need an advisor does not mean you have to pay some of the highest investment fees in the world. And yes the fees are important. We know that the fees typically and greatly impact the returns. From Justwealth the chart at the top is a comparison of the potential portfolio returns impact over longer periods, based on an initial $100,000 investment.

We can see that the effect of high fees paid can become exaggerated over time. Remember you pay investment fees every year, throughout the year, and as your portfolio grows over time you pay more in fees as the fees are based on your portfolio value. That’s a nasty kind of negative compounding.

So just what is a robo advisor?

Yup, just as per the image, a robo advisor is an investment advisor that’s well, not human. But don’t be scared. If you want to talk to a human the companies that offer robo advisory services can also put you in touch with real flesh and blood advisor types.

So if a robo advisor is not human, just what is “it”? A robo advisor is simply an online platform that asks you questions to help you get into the right investment portfolio. A robo advisor will ask the same type of questions as would a human advisor. Based on your answers the robo advisor will put you in the appropriate portfolio.

So what type of questions will the robo advisor ask you?

The robo advisor platform may try and gauge your investment knowledge. There may be questions on your net worth and salary and employment status, basic personal details. Each robo advisor offering has its own nuances and I will dig deeper into that in future articles. But most importantly a robo advisor wants to know …

- Your time horizon for the monies that you are about to invest.

- Your tolerance for risk (the amount or percentage that the portfolio could decline).

- Your objectives for the investment, whether you’re looking for more growth, a more balanced approach or a very conservative approach that might include a lot of bonds and fixed income.

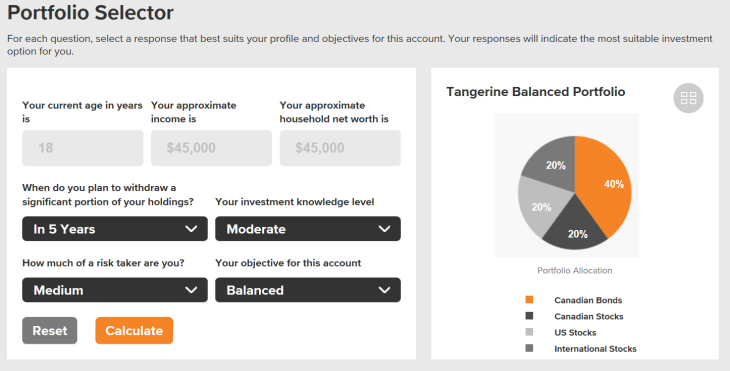

And once again, each robo advisor will have its own methods (robo personality?) for asking those questions and discovering your investment personality and needs. If you want to ‘play around’ with a basic robo question and answer process have a look at Tangerine Investments’ Portfolio Selector Tool.

Here’s what it can look like, robo’s are not so scary eh?

You see, you input the answers and the online robo model (yes you can’t see him or her) suggests the appropriate mix of Canadian companies, US companies, International companies and Canadian bonds. A more growth-oriented portfolio will have more stocks, a more conservative portfolio will hold a more generous amount of bonds. When I was an advisor (human) at Tangerine Investments I would call those bonds “shock absorbers” for the portfolio. That was a simple analogy to help investors understand how bonds work and why they are in most portfolios. You can see that this portfolio is right down the middle with a Balanced approach and a Balanced Portfolio recommendation.

Once again, each robo advisor will have its own nuances when it comes to the types of stock and bond funds it recommends, but the basic principles of sensible investing hold true. We should invest within our risk tolerance level (our comfort level for the portfolio changing in value) and we should keep our fees low. As we like to say: concentrate on what you can control. We can control our asset allocation (our mix of stocks and bonds) and our costs, our fees. At times it’s not a bad idea to check in with your accountant as well on taxation issues. It’s not just what you make, but what you keep. You may be able to get some help on that front as well from those human advisors that share the halls with those robo’s.

Robo advisors are a much superior choice compared to traditional high fee mutual funds in Canada. Most robo advisors keep it simple enough, and they keep the fees low. They also differ to traditional mutual funds in that they (almost exclusively) follow an Index Investing approach. What is Index Investing and why is it superior? You can have a read of my previous blog that is entitled, not by surprise, What is Index Investing?

Once your portfolio is set up (whether you exclusively use the online robo or with help from a traditional human advisor) the robo will take over and handle your investments for you. These are managed portfolios meaning there’s nothing for you to do but add those monies on a regular schedule. The robo will direct those new monies and will rebalance the portfolio for you to keep things in order and to keep the portfolio within your desired level of risk. Keep in mind that each robo offering is different on this front; at some robo’s the portfolio managers (those humans behind the scene) will move in and make changes to the asset mix based on market conditions.

You’ll find a list and links to the Canadian robo advisors on the Managed Portfolio Solutions page on my site. So which robo is right for you? It may not always be the robo with the lowest fees. If you want the comfort of a larger bank you may choose to go that Tangerine route or the BMO Smartfolio option. You can check in on fee comparisons for the full robo advisor gang at autoinvest.ca. And you can find a very useful overview on the Canadian robo advisors in this moneysense article. Of course the robo making the most noise and perhaps having the most success is Wealthsimple.

If you have any questions about what might be the right robo for you, please send me a note and I will do my best to point you in the right direction. In the end it may come down to you contacting a few robo’s so you can explain your goals and needs.

Thanks again. Don’t be shy. Post a comment. Send an email to cutthecrapinvesting@gmail.com

Happy Robo Investing

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on his site on June 22, 2018 and is reproduced here with his permission.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on his site on June 22, 2018 and is reproduced here with his permission.