By Alyssa Furtado, RateHub.ca

By Alyssa Furtado, RateHub.ca

Special to the Financial Independence Hub

Skipping a mortgage payment can seem like a good option, especially in an emergency if you don’t have a rainy day fund or savings to dip into. If you lose your job, your car breaks down, or you have any other type of unexpected expense, the option to skip a mortgage payment may look enticing. But is it worth it?

Some mortgage lenders allow you to skip a payment. Here’s what you need to know before deciding whether or not you should choose that option.

What does skipping really mean?

Sounds like a simple fix on a month when everything’s gone south, right? Not so fast. When you skip a payment, you’re not just pushing the expense back a month, you’re still racking up interest.

On a day-to-day basis, it looks like a simple monthly payment. But your mortgage payment actually has two component parts: The principal (the actual payment of the debt itself) and the interest. You don’t pay the principal, but your mortgage lender still charges you interest.

By skipping a month, you lose the chance to pay down the principal and you add on that month’s interest, which gets added to the total amount left on your mortgage.

You wind up with a higher mortgage rather than the number staying the same. The skip doesn’t freeze time. Any scenario where you add more interest should be looked at as borrowing more money.

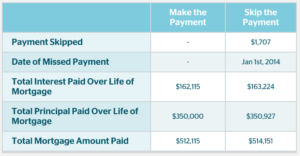

Looking years down the line, the interest you pay after skipping will be even higher since your loan itself becomes larger. The increase won’t be huge, but if you just took on a mortgage with a 25-year amortization period, the additional interest will add up over time. If you’re close to paying off your mortgage, the interest costs won’t be as high.

Am I allowed to skip?

Each mortgage is different. Not every product will have this option built in so first find out if it’s available. If it is, most mortgages will allow for one monthly payment skipped per year. Some mortgages allow you to divide the skip between shorter terms. For example, if you’re making payments on a weekly basis, you could skip four weekly payments at various times throughout the year, adding up to the same monetary equivalent of a month.

Usually, there will be certain caveats to make sure you qualify. For example, your mortgage can’t be in arrears (you haven’t missed payments before now), so find out the specifics of your exact agreement beforehand.

How much will it cost you?

When you skip a mortgage payment, you’re quite literally buying time. Many lenders have an online mortgage payment calculator to show you how much it’ll cost. If you’ve just taken on a mortgage, adding extra interest to your loan could be more than you bargained for. If you happen to have one of the best mortgage rates, the added cost could turn out to be relatively reasonable.

What’s the best way to catch up?

Most lenders will allow you to pay back the skipped payment at any time. But in order to fully reverse the effects of skipping a payment, you must make the regular payment plus the additional interest accumulated on the interest portion of the skipped payment. So it’s best to do this sooner rather than later in order to avoid paying additional interest.

If you’ve been paying down more than required before you run into a financial snag, try to pay the full skipped amount back fast or you’ll lose the savings on interest you made in the first place.

Is it worth skipping a payment?

Given how much skipping a payment could cost you over the long run, you should carefully evaluate whether you have other options. If you find you need to skip a payment on a regular basis, try to find other expenses you can cut. If that doesn’t work, you may want to consider refinancing your mortgage to get a lower rate and reduce your regular payments.

Alyssa Furtado is a passionate entrepreneur, financial expert, digital marketer and educator, and founder of RateHub.ca, a website that compares mortgage rates, credit cards, high-interest savings accounts, chequing accounts, and insurance with the goal to empower Canadians to search smarter and save money.

Alyssa Furtado is a passionate entrepreneur, financial expert, digital marketer and educator, and founder of RateHub.ca, a website that compares mortgage rates, credit cards, high-interest savings accounts, chequing accounts, and insurance with the goal to empower Canadians to search smarter and save money.

If you’re skipping a payment to pay off a higher interest debt then it makes sense as you’ll pay less in the long run.