By Dale Roberts, Cutthecrapinvesting

Special to the Financial Independence Hub

You’ll notice that in the ETF Model Portfolio page on Cut The Crap Investing I first offer up the core portfolios with the traditional building blocks of Canadian, US and International stocks supported by a broad basket of Canadian bonds.

You’ll notice that in the ETF Model Portfolio page on Cut The Crap Investing I first offer up the core portfolios with the traditional building blocks of Canadian, US and International stocks supported by a broad basket of Canadian bonds.

That’s a core approach embraced by many self-directed investors. You’ll even see that simple asset allocation embraced by Dan Bortolotti of Canadian Couch Potato. In fact, Dan will argue that any additions or ‘complications’ are not necessary.

Many will suggest that we do not need to spice things up much beyond that core ‘meat and potatoes’ asset allocation. A Canadian investor can certainly put together a sensible portfolio with those assets and that investor would have been rewarded with some very solid returns.

There are assets that can deliver the potential of greater returns and greater diversification. REITs and foreign bonds and emerging market equity funds would fall into that camp. You’ll see those holdings in the portfolios of many of the Canadian Robo Advisors. In the game-changing asset allocation portfolios from Vanguard you’ll find US bonds and emerging market stocks.

One Canadian Robo Advisor that employs REITs and foreign bonds is ModernAdvisor. I am a big fan of that firm and I am a fan of their asset allocation moves. Please have a read of ModernAdvisor. A Better Way For Canadians To Invest. The Canadian Robos can also be a great source of education by way of their blogs. Here’s a wonderful REIT primer from ModernAdvisor: Diversify With A REIT ETF.

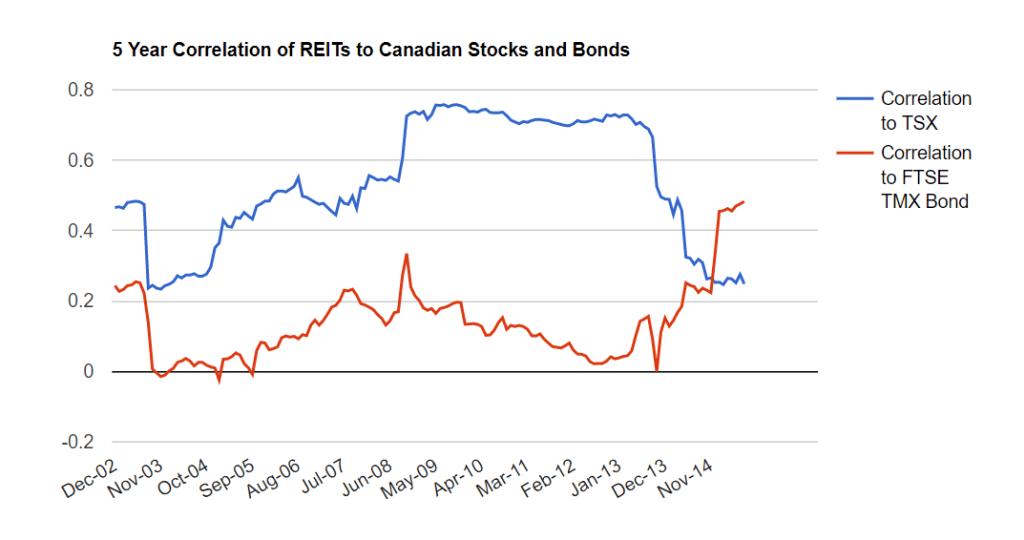

In that post we’ll find the chart that strongly suggest why we should include REITs for greater portfolio diversification.

In addition to the income aspect of REITs, real estate also provides strong diversification benefits for a portfolio already holds stocks and bonds. Since 2002, the 5-year correlation between the S&P/TSX Capped REIT Index with the S&P/TSX Composite Index has ranged between 0.23 and 0.76, averaging 0.55. The correlation with Canadian bonds is even more attractive, ranging between -0.02 and 0.34, and averaging 0.12.

Correlation of 1.0 indicates perfect positive correlation; that is, the two investments move in the same direction. Correlation of -1.0 indicates perfect negative correlation, that is, the two investments move in the opposite direction. Correlation of 0.0 indicates that there is no relationship between the two investments.

From the chart we can see that we do gain additional diversification.

Canadian REIT exposure is quite easy. The core Canadian REIT approach is covered by Vanguard with VRE, iShares with XRE and BMO offers ZRE.

- For more on 2019 ETF performance including those REITs you can have a read of this recent post on Cut The Crap Investing.

US and International REIT exposure

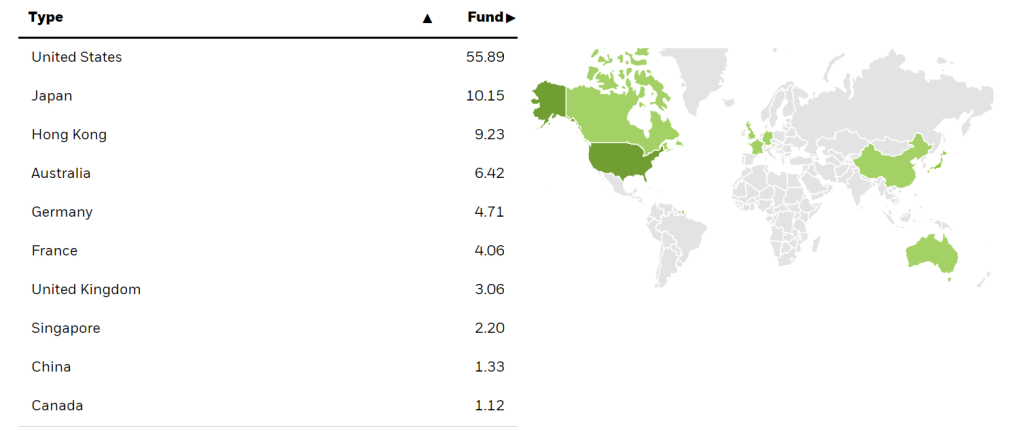

Things get a little more tricky when we leave Canada due to withholding taxes and the potential of currency conversion charges. The go-to Canadian dollar International REIT is iShares CGR. That is a US and Global REIT.

Given that CGR is a Canadian dollar REIT ETF with US and International assets you will face those withholding taxes on income. On that, the folks at ModernAdvisor suggest that you hold that ETF in a taxable account whenever possible as you can claim the tax credit. That said, if you are only investing in registered accounts such as an RRSP and TFSA you might not let the tax considerations drive the bus. The additional diversification and potential of greater returns might rule the day for your portfolio.

Given that CGR is a Canadian dollar REIT ETF with US and International assets you will face those withholding taxes on income. On that, the folks at ModernAdvisor suggest that you hold that ETF in a taxable account whenever possible as you can claim the tax credit. That said, if you are only investing in registered accounts such as an RRSP and TFSA you might not let the tax considerations drive the bus. The additional diversification and potential of greater returns might rule the day for your portfolio.

Hold US REITs in a US Dollar Account

This is a good practice or portfolio approach for your entire equity assets.

It’s a simple call or press of a button or two to open those US dollar accounts with your discount brokerage. The options are then more than ample. You can simply visit the US sites of ETF providers. There are many more options and styles than what you would find available in Canada.

In a recent article for Seeking Alpha I looked at the more complete US and International Equity and REIT growth portfolio. You’ll find some options such as Vanguard’s VNQ for US REITs and REET for US and International coverage.

What is a reasonable level of REIT exposure?

Many portfolio modelers will suggest an additional 5-10%. Of course there is usually some modest REIT exposure in the broad market indices, in the range of 3% ‘or so.’ You might choose to add 5% Canadian and 5% US and International. You may decide to take that up to 10% of each.

If Canadian investors could go back they might add or top up that REIT exposure. Courtesy of portfoliovisualizer.com here’s XRE vs the TSX 60 XIU from January of 2009 to end of June 2019.

I had used REITs in my accumulation stage, but will admit to bailing on them for a more pure dividend growth strategy for my semi-retirement years. I may be writing/talking myself into some modest REIT exposure.

What about you, got REITs? How about foreign bonds? Developing markets?

Thanks for reading. Kindly hit those share buttons. You can reach me at cutthecrapinvesting@gmail.com

Dale

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Dale’s site on July 18, 2019 and is republished on the Hub with his permission.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Dale’s site on July 18, 2019 and is republished on the Hub with his permission.