Side hustling is on the minds of a majority of Canadian women, according to a survey conducted by Angus Reid for Simplii Financial.

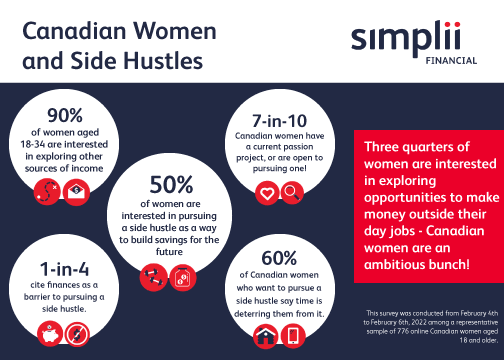

Fully 90% of Canadian women aged 18 to 34 are interested in exploring opportunities to earn money outside their day jobs, the survey found. And across all age groups, 76% are interested in starting a side hustle.

Most of these women are hoping to find more ways to save for major life events, including early retirement, making a down payment on a home, and growing overall savings for their futures.

This Tuesday, March 8th is International Women’s Day, and to celebrate, Simplii Financial will be hosting a special virtual event: the #SimpliiSideHustle panel [Link below.] It brings together three barrier-breaking Canadian women who have launched successful businesses, and who will offer their advice to those looking to start their own side hustles.

The panel features Canadian entrepreneurs Abby Albino (@abbyalbino on Twitter), Avery Francis (@averyfrancis), and Zehra Allibhai (@zallibhai), who will share the challenges they faced in starting their sneaker, consulting and fitness businesses, respectively. They’ll also share how they’ve challenged gender stereotypes that disempower women, to support a more equitable future.

Start-up capital a barrier for women seeking side hustles

Despite the high number of women looking to launch side hustles, more than a third of all women surveyed, and nearly half of those aged 18 to 34, indicated that lack of start-up capital was a barrier to pursuing their side hustles. Continue Reading…