By John Shmuel, LowestRates.ca

By John Shmuel, LowestRates.ca

Special to the Financial Independence Hub

Canadians love using comparison websites when it comes to booking flights to exotic locales, but when it comes time to make big decisions on major financial products, they’re skipping out.

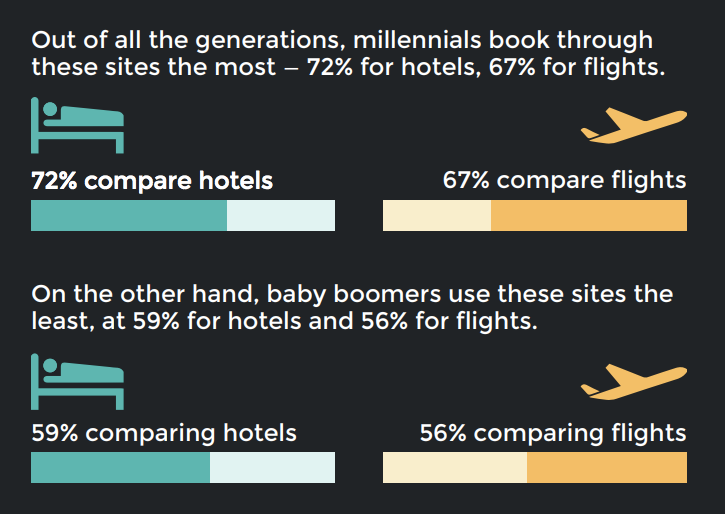

That’s what we found in our latest survey conducted in partnership with Ipsos. The survey found that 60% of Canadians use comparison websites when looking for a flight, and 63% use them when booking a hotel.

Then we started asking about whether they did the same for financial products. We expected to find a gap — but not by such a wide margin.

Less than half of Canadians are really researching their options when it comes to these products. Only 47% do “a lot of” research when they’re buying car insurance, while only 45% do a lot of research when they’re applying for a credit card.

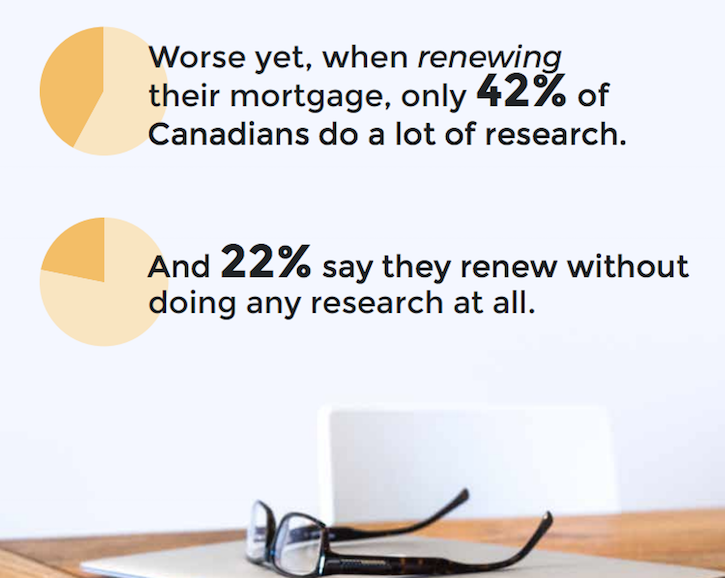

Those numbers rose to 60% when it came to mortgages. Reassuring, right? Not really. It seems that when mortgages come up for renewal, Canadians are just taking the rates their broker or bank hands them. Only 42% did a lot of research into interest rates before renewing their mortgage.

“The massive gulf between Canadians who compare travel options and financial products is disappointing. Because the latter is where you save real money,” says Justin Thouin, CEO and co-founder LowestRates.ca.

The survey did have some good news. Millennials are doing more research before buying financial products than previous generations. 52% are comparing car insurance, 50% compare credit card options and 48% compare mortgages.

That shows improvement over baby boomers. Only 36% of baby boomers research their options for car insurance and credit cards, and only 27% when it comes to mortgage rates.

In the digital age, comparing is a simple task. A number of rate comparison websites exist that offer the ability to compare financial products quickly — and for free. Canadians, unfortunately, are not taking advantage of them as much as they should.

Robert Brown, author of Wealthing Like Rabbits, points out that the lack of comparison is costing all of us — and stopping us from doing more of the things we love.

“Interestingly, those Canadians who do save money by shopping around for their financial products will inevitably find they have more money left over… for things like flights and hotels.”

John Shmuel is Managing Editor and Senior Writer for LowestRates.ca. Before joining the team, he spent seven years covering investing and economics for the National Post. His reporting has taken him around the world — from a lobster fishing boat on the Bay of Fundy to a robot fitness class in Tokyo. John is a graduate of Ryerson University and a board member of the Society of American Business Editors and Writers.