By Aman Raina, SageInvestors.ca

Special to the Financial Independence Hub

The process of trying to determine what stocks to buy and sell is a very repetitive and iterative experience. I’ve analyzed thousands upon thousands of stocks and the process I’ve used for each one has been the same. For any company being evaluated, an investor must ask the same fundamental questions over and over again in order to truly assess the investment opportunity.

The level of detail required to answer these questions are a function of time you have. If you have lots of time, you can dive more deeply into the nuances and intricacies of the company’s business model. For most investors, all that is needed is an understanding of the core elements of the business.

Make no mistake; these questions have to be answered at a basic level at a minimum in order for you to have complete understanding of the company before you commit your hard earned money to buying into it. Most people I’ve had the pleasure to work with and teach often buy stocks without even knowing what the company does or sells yet they can tell you all the specs of about their vacuum cleaner they have researched for 4 months. In my Everyday Investing course I teach, I help investors answer these questions. Below I’ve listed what I’ve determined to be the 8 questions you have to ask each time when evaluating a stock.

As we go through the questions I will put them into practice by using a stock I recently purchased as an example to illustrate. I recently made a decision to buy shares in CVS Health (Ticker: CVS).

1.) What do they sell?

Stocks are pieces of paper representing ownership of businesses. Companies are not created because nature dictated they should be. Profit-generating businesses are created to sell something, be it a product and/or service that the owners perceive society will want in large quantities. When you look at companies, it is the first fundamental question to ask. What are the core products and services that the company sells? Often in larger companies this can be answered by looking at how the company is structured with products and services often having their own separate divisions. In other cases if a company is structured by geography, the product lines will be found under each regional umbrella.

There are many sources from which you can get quick sysnopsis of a company. Here’s one I pulled from Valuentum Securities that describes CVS.

“ … The 2007 merger of CVS Corp and Caremark created the largest pharmacy health care provider in the US. The company has more than 7,800 retail locations and operates in 98 of the top 100 US drugstore markets. Its PBM business serves more than 60 million plan members. The company was founded in 1892 and is headquartered in Rhode Island.

CVS recently acquired Target’s pharmacies and clinics and it will operate the acquired pharmacies in a store-within-a-store format. The deal expands its footprint of pharmacies by ~20% (adding more than 1,660) and clinics by ~8% (adding ~80 clinics)…”

CVS also purchased Aetna Insurance, one of the largest healthcare insurance providers in the US. With this CVS aims to become a one-stop shop for health care services in the US using their drug stores as the prime distribution point.

2.) Who do they compete with?

Chances are the company is not the only one selling the same product or service. There are likely to be other companies offering a similar or slightly similar product at higher or lower price points. Understanding or being aware of the level of competition the company faces can give us insight into how large the demand is for their product and potentially how much revenue, profit and market share they can be expected to take in the future.

In the case of CVS, the company competes with other major pharmacy chains such as Walgreens, as well as the big retailers like Walmart and Costco. The acquisition of Target’s pharmacy footprint essentially makes them de facto direct retailers. With the purchase of Aetna, their competitive universe has now expanded to include the health care insurers, like United Health.

3.) Who buys their products and services?

You know what the company sells. Now you want to know who would actually buy their goods and services. Who are the main customers for the company? What are their characteristics and background? Why do they buy the product?

For CVS, their target market is anyone that is not well or anybody that is well and wants to stay that way. I’m being very simplistic here. Again, you could do a whole market research analysis or market segmentation of their client base if you have the time.

4.) Will they buy it over and over again?

How often will a company’s client base buy their products? Can they be counted on to be repeat customers? Repeat customers mean repeat revenues and the greater the repetition, the greater for long term sustainable cash flow which will ultimately bode well for the stock price.

Medicine and health products are one of those core pillars that each of us rely on a day to day basis with demand rarely tailing off. CVS’s customers have a high likelihood of buying their products and services quite repeatedly. As the company expands into health insurance, a new revenue stream of premiums on policies which are very sticky and predictable will be emerging and has the potential to contribute significantly to the overall financial performance of the company.

5.) Do they make money?

We’ve gone through 4 questions and we have yet to look at any numbers and metrics. It is only now that we can start looking at some financials. At the end of the day, the company can create amazing products and services but if they can’t produce and sell them at a profit, it means very little to me as an investor. It’s at this point that we can do a deep dive into a company’s Income Statement to get a sense of their profitability. We want to know specifically what their operating profit looks like because this number tells us how effectively they are selling their core products and services. We can drill down into looking at sales and profits of the various product segments and look at trends. If the company is not profitable and just as important, cannot demonstrate a consistent ability to be profitable, then your analysis should pretty much stop here.

We’ve gone through 4 questions and we have yet to look at any numbers and metrics. It is only now that we can start looking at some financials. At the end of the day, the company can create amazing products and services but if they can’t produce and sell them at a profit, it means very little to me as an investor. It’s at this point that we can do a deep dive into a company’s Income Statement to get a sense of their profitability. We want to know specifically what their operating profit looks like because this number tells us how effectively they are selling their core products and services. We can drill down into looking at sales and profits of the various product segments and look at trends. If the company is not profitable and just as important, cannot demonstrate a consistent ability to be profitable, then your analysis should pretty much stop here.

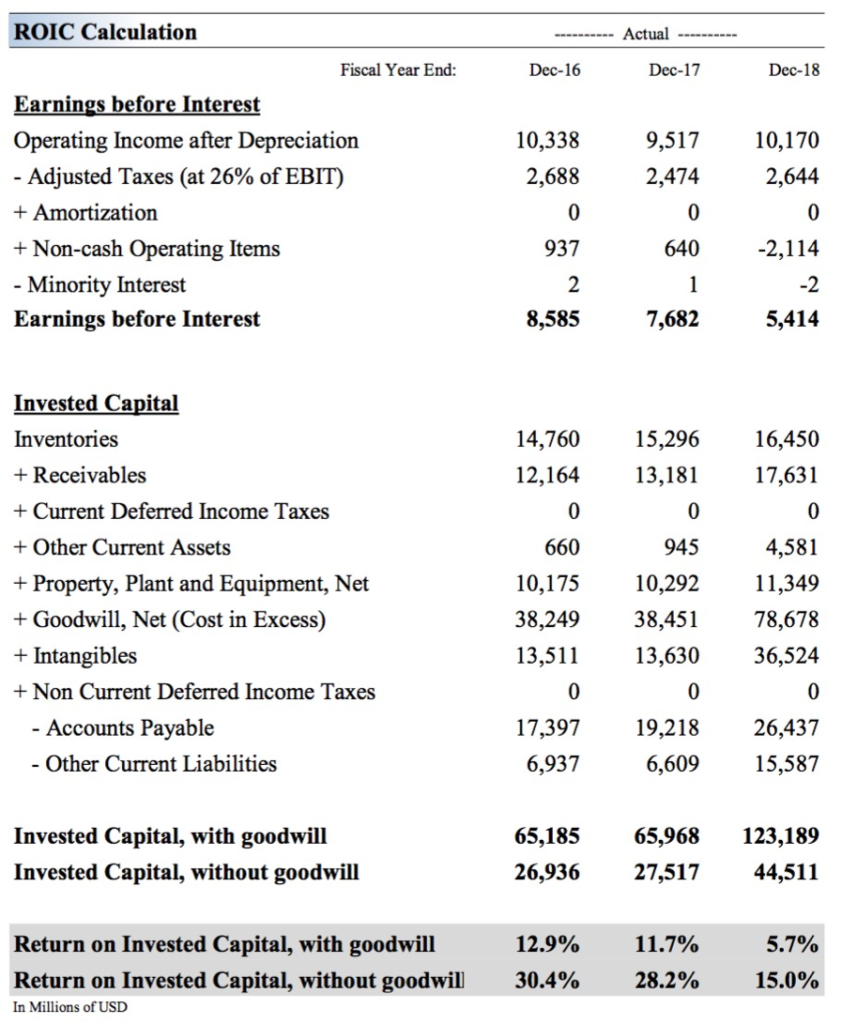

When we look at CVS’s sales and profitability numbers, we can see that it has been generating tangible wealth on a consistent basis. Returns on Invested Capital have tracked around 20-22 per cent while their cost of capital has been around 9 per cent, which implies the company has been creating positive Economic Profit: which is what we want to see as investors.

Source: Valuentum Securities

Source: Valuentum Securities

6.) What do they own and who do they owe money to?

While profitability is very important, we need to ask about the quality of those profits. The best way to answer this question is to look at the company’s profits in relation to the quality of the company’s assets. The Balance Sheet — which is a statement of how the company has raised money and what investments they have made in assets to generate those profits — can help us answer this question. We want to know the composition of the company’s assets. Are they heavy into intangible assets like Goodwill? Do they have enough cash in the bank to meet short-term operational financial obligations? What is the quality of the company’s buildings, equipment, and factories? Are they brand spanking new or are they due for a rebuild?

On the other side of the balance sheet we find the liabilities and shareholders equity accounts, which tell us how the company has raised capital to finance the business. Did they borrow from a bank or issue bonds (Liabilities) or did they sell ownership in the business in the form of stocks (Shareholders Equity)? How the business is financed can provide us clues in terms of how risky the business is, which we will explore in Question 7.

Prior to the purchase of Aetna, CVS had a very pristine balance sheet, with very little debt. The purchase of Aetna was financed through a lot of debt and it is a source of concern by the market. In terms of liquidity the company has more Current Assets than Current Liabilities so it is decent. The company carries a pretty high level of Goodwill and intangible assets so that is something that could potentially be concerning. They had been using resources to acquire pharmacies to build some scale. Cashflows are rising, which is healthy.

7.) How risky is their business?

At this point of our questioning we should have decent idea of how risky the business is. In other words, how sustainable it will be in the long term. Is the company run effectively and in a line of business that will allow it to compete and be successful or will it go out of business? From looking at the balance sheet we can assess by looking at the debt level and its ability to generate cash how sustainable the company is from a financial perspective. From a business operation perspective we can now determine how effective the company’s products and services are in generating sustainable sales in the future.

Like anything in the retail space these days, the risks CVS faces usually start with Amazon. In the case of selling drugs, Amazon has been for years mumbling about selling drugs on its website. Sure enough, earlier this year the company announced it had bought Pill Pack, a website that sells drugs. Many have speculated that pharmacies are vulnerable to be Amazon’ed. CVS appears to have seen this and many say it was a driving factor to buy Aetna to establish a bit of a defense from Amazon.

Pharmacies besides selling medicine also sell staples type of goods so in a way they can be more like a traditional corner store that sells basic staples at a slightly higher price point to tap into the “grab a few things in a pinch” crowd. Pharmacies are almost like comfort food. They address key demand points we all need; food and health. We know when we’re in a jam for something, they’re right there to bail us out. I’m not sure how an Amazon can fill that insatiable, human need but I know they’re working on it. A game changer moment could be if Amazon or someone like an Uber can figure out how to deliver these “rush” orders cost effectively and in a timely manner.

There appear to be some clouds on the horizon for CVS. The question as an investor is how well do you think the company can address them? With CVS’s size, scale and distribution points, and now an insurance component, it has the potential to build out a healthcare ecosystem that could make it difficult for new players like Amazon to enter.

8.) Is the stock cheap?

It is great that a company can create products and services that society wants and can do so profitably. It can have wonderful management that makes effective decisions on how invest its capital. However, this does not mean the stock is a good investment. Great companies and stock prices unfortunately do not go hand-in-hand. The stock market may have already built these elements into the stock price and as a result, the stock may be already priced at a level that the company is worth and may not go up more. The timeless motto of stocks is to buy them low and sell them high. As an investor you want to buy stocks that are selling at a discount to what the value of the company is worth and sell them when they have reached its intrinsic value.

There are various methods to determining if value of a company’s stock. You can value them on a relative basis (compare them to other similar companies in terms of Price/Earnings multiples) or you can value them on a future discounted cash flow basis, where you project a company’s earnings and discount them back to a present value. Each has its pros and cons, however what is key is that you need to establish whether the stock is trading at a discount because you ideally don’t want to buy stocks when they are full price or marked up. In investing you never want to pay full price. Frugality is more often than not rewarded. You want to buy stocks of great, well run, well managed companies that have a manageable level of risk when they are on sale.

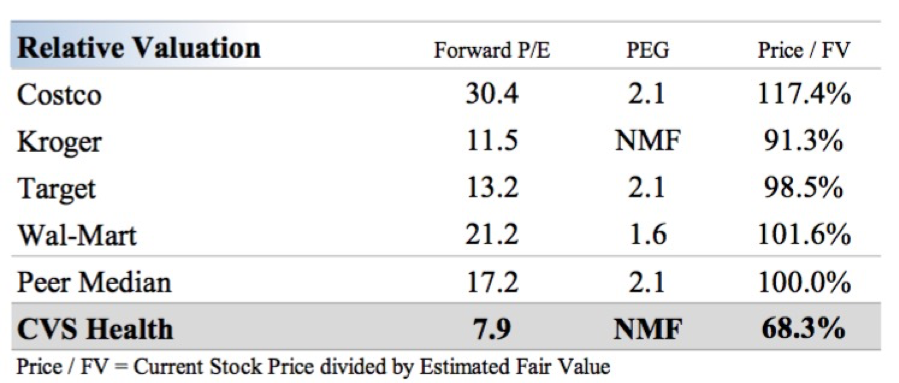

In the case of CVS, from what analysis I could gather, the stock on a relative basis is cheaper than similar businesses, trading at forward price/earnings multiple in the 7.9 range compared to its peers which are trading at a forward price/earnings multiple in the high teens. On a discounted cash flow basis, the stock value comes in at between $59 and $99, which is higher than its current $56 range; so there appears to be some upside on the stock.

Source: Valuentum Securities

Decision Time

So we have a company that provides a service that is a core need for consumers in terms of health and food related goods and services. It is one of the largest companies in their sector. The company is making healthy economic profits. The balance sheet, while not pristine is decent enough. There is enough liquidity in the business. While there are risks with the pharmacy model, they don’t appear to be imminent threats and finally the stock appears to be cheap on a relative and discounted cash flow basis. The stock is a bit out of favour right now by investors, hence the lower price.

With the Mad King backing off any meaningful changes to health services, the stock could see a move up. To me this is a basic staple kind of business that is somewhat boring but continues to generate decent cash flows. Factoring these elements gave me comfort level to buy a little bit of stock and to slowly build up the holdings.

Making a decision to buy a stock requires that you ask and answer these 8 questions. By answering them you can rationally formulate a better understanding of what is driving the stock price of a company and use that understanding to make an educated investment decision. There are no guarantees that every decision you take by answering these questions will be successful but the chances are good you will make more successful decisions than you will unsuccessful ones.

Good luck!

Aman Raina is an Investment Coach and Founder of Sage Investors. Aman teaches and engages with people on how to make more educated and successful investment decisions. Aman works with people who are new to investing but feel intimidated and frustrated by investing and don’t know where to start as well with experienced investors who are not getting any traction with their portfolios. Aman has developed a series of online courses in investing in stocks and ETF’s and this September will be delivering his Everyday Investing course live and online for the first time.

Aman Raina is an Investment Coach and Founder of Sage Investors. Aman teaches and engages with people on how to make more educated and successful investment decisions. Aman works with people who are new to investing but feel intimidated and frustrated by investing and don’t know where to start as well with experienced investors who are not getting any traction with their portfolios. Aman has developed a series of online courses in investing in stocks and ETF’s and this September will be delivering his Everyday Investing course live and online for the first time.