By Sandi Martin

Special to the Financial Independence Hub

If you’re planning for retirement and make the mistake of scrolling through any finance section in a slow news week, you have to ask yourself: what kind of questions are they asking to produce breathless headlines like these?

- Half of Canadians don’t think they’ll be able to retire comfortably: poll

- Many Canadians believe they will run out of money 10 years into retirement, poll finds

- Retiring Canadians will see ‘steep decline in living standards’: CIBC

If a friendly pollster called you in the middle of dinner and asked “Have you saved enough for retirement?,” how would you answer if you were only given the choice between “yes,” “no,” and “I don’t know” and wanted to get off the phone and back to your family?

I doubt that the statisticians or infographic designers would be happy if “it depends on what you mean by ‘enough’” were added as a fourth option, but I’d bet a lot of money that it would be the single most frequent response if were presented as an option.

Leaving aside that most of these studies and polls are commissioned by banks and mutual fund shops whenever their managed asset levels get lower than they’d like, let’s talk about how silly it is to frame retirement planning around the concept of “enough,” as if “enough” was something we could universally, quantitatively measure.

What people mean when they talk about “having enough for retirement”

Most of time, in my experience anyway, people who begin a retirement planning conversation at “do I have enough to retire?” end up at:

- I’m worried that there will be a market crash and I’ll have to change my lifestyle so I don’t run out of money, and/or

- I’m worried that I won’t be able to manage my own finances as I age, and that I’ll get stressed out by decisions that used to be easier to make, and/or

- I’m worried that I won’t be able to do all the things in retirement that I’ve been looking forward to my whole life, and/or

- I’m worried that I’ll need expensive nursing care and won’t have enough to pay for it, and/or

- I’m worried that I won’t get my fair share of government benefits, and/or

- I’m worried that I’ll pay too much in taxes because of the way my investments are set up, and/or

- I’m worried that I’ll be too frugal at the beginning of retirement out of fear, and end up with more money than I can spend when I’m too old to spend it, and/or

- I’m worried that I won’t be frugal enough at the beginning of retirement and end up with not enough money in my later years, and/or

- I’m worried that I’ll leave nothing behind for the kids, or – worse – end up needing them to pay some of my bills

… which is where the real work begins.

All of this would be the perfect lead-up to unveil my trademarked What’s Your Enough? calculation and patented five-point planning process to guarantee you a worry-free, tax-efficient, easy-to-manage, comfortable, and sustainable retirement …

… if I had one. If a universal solution were even possible. If any of the above worries could be resolved with a single number.

Listen, as far as I’ve been able to work out – and I’m wide open to the possibility that I’m wrong, since it’s a relatively frequent occurrence – there’s no way to put every single retirement worry completely to rest. Any retirement income strategy that perfectly solves one worry will do so at the expense of another one.

Pick your poison

Here are a couple of easy – if extreme – examples:

You can avoid the risk of spending too much out of your investments in a market decline by keeping your money in GICs, provided you’re prepared to spend less than you probably could have if you had been invested in mix of higher-risk assets.

You can spend as much as you want in early retirement provided you don’t mind living on just CPP, OAS, and GIS if you live any longer than an average Canadian.

You can guarantee that you’ll have enough money to pay for long-term care if you give up on a lot of other spending to pay for an insurance policy or set aside an untouchable reserve earmarked only for nursing costs.

You can guarantee an inheritance for your kids by paying into a permanent life insurance policy of some variety, provided you’re willing to not spend the money you paid as premiums, and provided that absolute certainty is more important to you than the possibility that those premium payments, invested in a straight portfolio, might result in more money for your kids than the insurance policy.

What all of these worries and polls and studies have in common is uncertainty. You’re worried about retirement because you’re not totally sure what to expect, and the advice you’re getting essentially boils down to some combination of “save more money/invest with a particular company or in a particular product or according to a particular style/don’t let your kids move back in.”

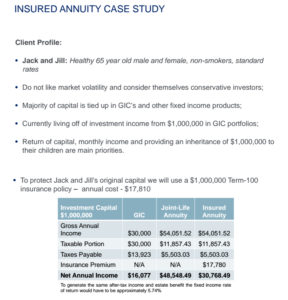

Often, especially when there’s a financial product to be sold, your continued uncertainty is exactly what the sales team is aiming for, so they can set up a restrictive, (false) dichotomy, avoid addressing any other potential trade-offs that ought to be considered, and sell you an insured annuity as the answer to all of your problems.

Exhibit A: a slide from a wealth management seminar put on (with oysters) by one of the big banks that a colleague of mine attended recently. Note the clever and misleading comment about required fixed-income rates of return in the very fine print, as if fixed income and annuities were the same kind of animal and can be compared based on rate of return alone.

(P.S. This isn’t a case study, it’s a sales pitch.)

When uncertainty is one of the only certainties …

In the face of uncertainty about spending, investment returns, interest rates, the housing market, inflation, and your own health and longevity, the uncomfortable truth is that you have to pick your poison. You can protect yourself against some risks, even optimize your plans for some set of probable outcomes, but you can’t avoid every risk and optimize for every outcome.

You certainly can’t build a water-tight, perfectly optimized retirement plan for a single point in time and expect that it will tick all the same risk and trade-off boxes forever, or even that the things you worried about most at the beginning of retirement will be the same things that worry you halfway through.

The best you can do is identify the risks that seem most relevant to your particular circumstances based on the information that’s currently know-able, make the most palatable trade-offs to address those risks … and expect to re-evaluate and adjust as you move further into retirement and your values and worries change (or don’t).

—-

I naturally have a lot of conversations about retirement income planning with a wide variety of folks, each with a different set of risks they want to avoid and trade-offs they’re willing to make. If you’d like to hear a longer articulation of this idea of trade-offs in retirement planning, you can listen to this podcast episode I had the pleasure of recording with Kornel Szrejber a few months ago. Below, I’ve provided some additional reading for those of you who are interested:

On including annuities when planning for retirement

On retirement “success” and “failure”

Renaming The Outcomes of a Monte Carlo Retirement Projection: Michael Kitces has a good post about re-wording the concepts of portfolio “success” and “failure,” since in most historical cases portfolio “success” actually means “high probability that you’ll not spend as much as you could have,” and “failure” means “high probability that you’ll adjust your spending downwards at some point in your retirement,” though the reason the spending changes isn’t clear.

On how retirement spending changes over time (but not so much on why)

On the spectrum of strategies between “spend only income” and “spend down to zero”

On sequence of return risk, the Trinity Study and how the 4% rule has evolved over time:

Sandi Martin is an ex-banker and fee-only/advice-only financial planner who specializes in working with regular folks who suspect their money might be a bit of a mess. She lives in beautiful Muskoka with her husband and three children, and works online and by phone with clients across Canada. (You can also find her listed here at the Hub under the Getting Help tab). This piece is adapted with Sandi’s permission from one that appeared on July 28, 2016 on her Spring blog.)

Sandi Martin is an ex-banker and fee-only/advice-only financial planner who specializes in working with regular folks who suspect their money might be a bit of a mess. She lives in beautiful Muskoka with her husband and three children, and works online and by phone with clients across Canada. (You can also find her listed here at the Hub under the Getting Help tab). This piece is adapted with Sandi’s permission from one that appeared on July 28, 2016 on her Spring blog.)