“Sometimes it’s necessary to go a long distance out of the way in order to come back a short distance correctly.” — Edward Albee (1928–2016), American playwright

“Sometimes it’s necessary to go a long distance out of the way in order to come back a short distance correctly.” — Edward Albee (1928–2016), American playwright

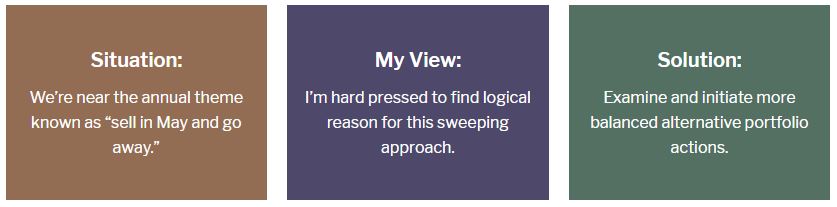

Investing plans that pursue flavours of “sell in May and go away” are not vanishing anytime soon. Simply said, the catchy tune is about to ignite the annual rounds once again. Strategies that believe stock investing from November to April have better prospects than other months.

Keen followers of this practice typically sell their equities around May, such as stocks, mutual funds and ETFs. They then repurchase equity investments near November.

“I don’t recommend clearing the deck willy-nilly. Drastic actions are seldom wise replacements for long-term strategy.”

I’m fully on board with the excitement of getting away to a variety of travel destinations. That is the “go away” part. On the other hand, I just don’t buy into the questionable wisdom of selling the nest egg. For me, the “sell in May” part needs much closer scrutiny. Particularly, outlays of disposition and acquisition. Income tax implications also play a part.

Let’s be clear about the strategy. An investor unloads the entire portfolio, then acquires the new version a few months later. This process is repeated year after year, after year. Sounds like quite a heap of cash to shell out for transactions and tax implications.

Potential pitfalls

If only investing were that simple! Examining these pointers helps assess the prudence of wholesale selling:

- Commissions may be incurred to sell and repurchase investment selections.

- Deferred Sales Charges (DSC) may apply on mutual funds sold.

- Front loads or DSC fees starting at high rates may apply to new mutual funds bought.

- Tax is payable on capital gains realized this year when current investments are sold.

- Earning less interest income than dividends from equities you sold.

- Paying more tax on that interest versus on dividends you gave up on selling.

- Review the remaining DSC on mutual funds you sell, say 2% to 3%.

- DSC on newly purchased mutual funds may rise near the 6% ballpark.

- Current dividend yields given up may range in the 3% to 5% ballpark.

- Interest rates on cashable deposits now hover near 1%.

- An unknown is whether repurchase prices will be lower or higher than today.

- Consider the short-term speculation and portfolio upheavals this strategy creates.

While they might seem appealing, such strategies are not straightforward. Add up all the costs, fees and implications of your round trip before you sell the farm in May.

I don’t recommend clearing the deck willy-nilly. Drastic actions are seldom wise replacements for long-term strategy. They feel more like demolitions. Embracing a more balanced investing approach may better suit your needs.

I propose these ideas instead:

- Migrate to a comfortable, long-term asset mix.

- Adopt diversification and rebalancing measures.

- Dollar cost averaging is fitting for some.

- Arrange an independent portfolio opinion.

Be extra careful when contemplating sweeping changes, like “sell in May.” You can easily create lasting and costly portfolio damages. Keep in mind that you are depending heavily on so many things going right, while you follow a very narrow investing path, every year. It’s a recipe fraught with disappointments and disruptions.

My investing philosophy emphasizes making logical decisions. Followed by a sensible game plan that aims at achieving the long run objectives. I have yet to find a logical reason or plan of action to simply “sell in May.”

Have you?

Adrian Mastracci, Discretionary Portfolio Manager, B.E.E., MBA started in the investment and financial advisory profession in 1972. He graduated with the Bachelor of Electrical Engineering from General Motors Institute in 1971, then attended the University of British Columbia, graduating with the MBA in 1972. This blog is republished here with permission from Adrian’s website, where it appeared April 24.

Adrian Mastracci, Discretionary Portfolio Manager, B.E.E., MBA started in the investment and financial advisory profession in 1972. He graduated with the Bachelor of Electrical Engineering from General Motors Institute in 1971, then attended the University of British Columbia, graduating with the MBA in 1972. This blog is republished here with permission from Adrian’s website, where it appeared April 24.