Special to the Financial Independence Hub

You want to retire soon. How should you set up your retirement income?

You talk with some friends, read about it on the internet, and talk with a financial advisor. Are you actually getting good advice?

When it comes to retirement income, most financial advisors rely on a few rules of thumb handed down from one generation of advisors to the next. The rules appear to be common sense and are usually accepted without question.

Do these rules of thumb actually work?

Before giving clients this advice, I tested them with 150 years’ history of stocks, bonds and inflation. I wanted to see if these rules were reliable for a typical 30-year retirement. (The average retirement age is 62. In 50% of couples that reach their 60s, one of them makes it to age 92.)

These five rules are the “conventional wisdom” – the advice typically given to seniors:

- “4% Rule”: You can safely withdraw 4% of your investments and increase it by inflation for the rest of your life. For example, $40,000 per year from a $1 million portfolio.

- “Age Rule”: Your age is the percentage of bonds you should have. For example, at age 70, you should have 70% in bonds and 30% in stocks.

- “Sequence of returns”: Invest conservatively because you can’t afford to take a loss. You can run out of money because of the “sequence of returns.” You can’t recover from investment losses early in your retirement.

- Don’t touch your principal. Try to live off the interest.

- Cash buffer: Keep cash equal to 2 years’ income to draw on when your investments are down.

The results: NONE of these rules of thumb are reliable, based on history.

Let’s look at each to understand this.

1.) “4% Rule”: Can you safely withdraw 4% of your investments plus inflation for the rest of your life?

Based on history, the “4% Rule” was safe for equity-focused investors, but not for most seniors.

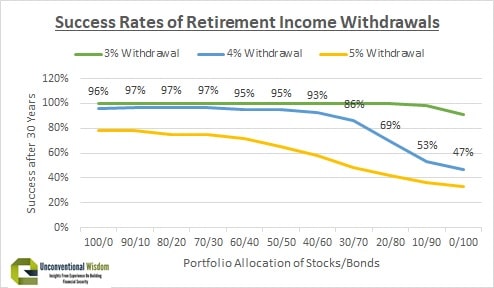

In the results shown in the graphic at the top of this blog, the blue line is the “4% Rule,” showing how often in the last 150 years a 4% withdrawal plus inflation provided a reliable income for 30 years.

The “4% Rule” only works with at least 50% in stocks.

The “4% Rule” worked only if you invest with a minimum of 50% in stocks. Even safer is 70-100% in stocks. It is best to avoid a success rate below 95% or 97%. They mean a 1 in 20 or 1 in 30 chance of running out of money during your retirement.

Most seniors invest more conservatively than this and the 4% Rule failed miserably for them.

A “3% Rule” has been reliable in history, but means you only get $30,000 per year plus inflation from a $1 million portfolio, instead of $40,000 per year.

These results are counter-intuitive. The more you invest in stocks, the safer your retirement income would have been in history.

To understand this, it is important to understand that stocks are risky short-term, but reliable long-term. Bonds are reliable short-term, but risky long-term. Why? Bonds get killed by inflation or rising interest rates. If either happens during your retirement, you can easily run out of money with bonds.

The chart below illustrates this clearly. It shows the standard deviation (measure of risk) of stocks, bonds and cash over various time periods in the last 200 years. Note that stocks are much riskier short-term, but actually lower risk for periods of time longer than 20 years.

Stocks are more reliable after inflation than bonds after 20 years.

Ed’s advice: Replace the “4% Rule” with “2.5% +.2% for every 10% in stocks Rule.” For example, with 10% in stocks, use a “2.7% Rule.” If you invest 70% or more in stocks, then the “4% Rule is safe.

2.) “Age Rule”: Your age is the percentage of bonds you should have. For example, at age 70, you should have 70% in bonds and 30% in stocks.

History shows that the “Age Rule” directly conflicts with the “4% Rule” Based on the “Age Rule,” a typical retirement from ages 62 to 92 would average almost 80% in bonds. The “4% Rule” ran out of money 31% of the time with 80% in bonds.

Ed’s advice: The “Age Rule” works with a “3% Rule.” There is nothing wrong with investing conservatively with the Age Rule, but then reduce your retirement income to withdraw only 3% of your investments each year.

3.) “Sequence of returns”: Should you invest conservatively to avoid losses because you can’t recover? Will you run out of money if you have some investment losses early in your retirement?

The “sequence of returns” is not supported at all by history.

Can you be confident in the stock market? Over the long-term – yes (based on history). Short-term or medium-term – no.

The chart below shows actual history of the 4% Rule with 100% in equities. Each line is a 30-year retirement. Note that there was a market recovery within a few years of the majority of market declines, even though you continued with the same retirement income and increased it every year by inflation.

There were quite a few market crashes in the last 150 years, but only once would you have run out of money because of a market crash (retiring in 1929).

There are 118 retirements of 30 years on this graph. Investing 100% in stocks, you would have run out of money only 5 times – 4 because of very high inflation and only one because of a market crash.

Retirement Income Withdrawals in History – 100% Equities & 4% Withdrawal + Inflation

Because of the “sequence of returns,” the typical advice is to invest more conservatively with more bonds. This is not safer!

The chart below is the 4% Rule with 100% in bonds. There are 118 retirements of 30 years on this graph. Investing 100% in bonds meant you would have run out of money in 63 of them – more than half the time! If you retired almost any year between 1890 and 1980, you would have run out of money with 100% in bonds. Note how many of these lines drop below $0:

Retirement Income Withdrawals in History – 100% Bonds & 4% Withdrawal + Inflation

Ed’s advice: Invest within your risk tolerance. But do not think more bonds make your retirement safer. If you invest more in bonds, reduce your retirement to a reliable level of 2.5-3% withdrawal rate. Fixed income is lower income.

4.) Don’t touch your principal. Can you live off the interest?

This rule of thumb completely ignores inflation. In a typical 30-year retirement, the cost of living triples.

This means you effectively take a cut in your income every year. Over a 30-year retirement, your income has dropped to only 1/3 of your income in the first year.

When you hear seniors complaining about being on a “fixed income,” it is usually because they are trying to live off the interest.

Ed’s advice: Any reasonable retirement income plan needs to include consideration for inflation increases most years.

5.) Cash buffer: Is it safer to keep cash equal to 2 years’ income to draw on when your investments are down?

This seems to make some sense, because you can live off the cash whenever your investments are down, giving them time to recover. You can avoid selling when prices are low, right?

Sorry. History does not support the Cash Buffer at all. “No cash” has consistently been the safest:

In fact, I have been unable to find even a single example where holding any amount of cash was safer than no cash. I found studies using global stocks and UK stocks with many different strategies of how to use the cash. No study I found had even a single example of a benefit of cash.

The drag on your returns from holding cash sometimes caused you to run out of money, but holding cash never protected you from running out of money.

In addition, if you held cash, you died with a significantly smaller estate to pass on to your loved ones.

This might be counter-intuitive. The reason is that retirement is long – say 30 years. Stocks usually recover from declines. Holding cash for 30 years means you lose out on a lot of income, plus the loss of purchasing power due to inflation.

Ed’s advice: Forget the cash buffer. Just choose your investment allocation and stick with it.

New Retirement Rules of Thumb (supported by history)

The 5 rules of thumb about retirement income on which the advice for most seniors is based are not supported by history. What new rules of thumb give you the maximum reliable retirement income?

- Equities are safer. Don’t feel that you should invest more conservatively just because you are retired. Retirement is for 30+ years. Consider keeping the same allocation you had before retiring. Equities are taxed at much lower rates than bonds & GICs, as well.

- Replace the “4% Rule” with “2.5% +.2% for every 10% in stocks Rule”. Instead of withdrawing 4% of your retirement assets, use the formula if you have less than 70% in stocks. Fixed income is lower income. The more conservatively you invest, the lower your retirement income should be.

- The “Age Rule” works with a “3% Rule”. There is nothing wrong with investing conservatively with the Age Rule, but then reduce your retirement income to withdraw only 3% of your investments each year.

- Be smart about your risk tolerance. Invest with the highest amount in stocks that is within your risk tolerance. The more conservatively you invest, the more likely you will run out of money (at any withdrawal amount). Get educated on stock and bond market history, so you have an accurate picture of risks and returns.

- Inflation is huge. Inflation typically makes the cost of living triple during your retirement. You need a rising income, not a fixed income. Inflation kills bonds, but not stocks.

- It is safer NOT to hold cash. Holding cash does not protect you and may increase your risk of running out of money. It almost definitely means you die with a smaller estate.

- You can have all 3 – Higher income, lower risk of running out of money, and less tax. You can have a higher reliable income, if you can manage your income effectively or are working with a financial planner who knows how to manage it effectively.

For an example of these principles, read the story of John & Jennifer:

Can we retire now? Ed Rempel tests retirement income rules of thumb

Ed Rempel has helped thousands of Canadians become financially secure. He is a fee-for-service financial planner, tax accountant, expert in many tax & investment strategies, and a popular and passionate blogger at www.edrempel.com. Ed sees what actually works based on 24 years of writing nearly 1,000 comprehensive financial plans. He has been featured in the Globe & Mail, National Post, Toronto Star, Business Insider, Yahoo! Finance, Seeking Alpha, Costco Connection, Canadian Real Estate Magazine, Money Magazine, Findependence Hub, The TaxLetter, Investment Executive, Advisor.ca , Advisors’ Edge, Benefit & Pensions Monitor, many financial blogs, and the Build Wealth Canada podcast.

The blog above originally appeared on Canadian MoneySaver as well as Unconventional Wisdom and is republished on the Hub with Ed’s permission. Click there to monitor a discussion that has begun on this topic.

This was the most worthwhile article I have read in 2018 – thanks!