Hub Staff

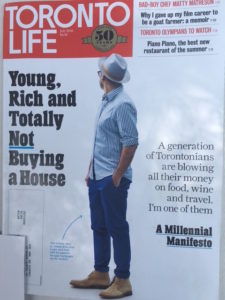

The cover story of this month’s Toronto Life magazine caught my eye straight away. “Young, Rich, and Totally Not Buying a House” it boldly claims.

As a young, not-yet-rich millennial who has no immediate plans to get into the housing market, I was intrigued. The article is written by 31-year-old Tony; a pharmacist who lives with his parents and eschews the traditional rites of passage of his peers, like home ownership.

Before I actually read the article, I was sure I wouldn’t like Tony, wouldn’t relate to him. Growing up in Toronto I’ve seen his type countless times. Money is no object, and he’s not shy to show it. A common defence from this kind of person is that ‘normal’ or ‘rational’ people who are judging him are jealous or boring (or both).

What I found interesting about this piece is that Tony seems very self-aware about his spending and lifestyle choices. He’s accepting of his friends who do choose to be “shackled to a monstrous mortgage for the next 30 years,” and he understands that sometimes it just isn’t possible to have it all.

Though much of what Tony talks about in this article is out of reach for most normal millennials (last minute trips to Asia, $200 bottles of wine), I appreciate the sentiment. He isn’t overloading himself with debt and living beyond his means. He is taking advantage of the resources life has given him, and he’s making a conscious choice to live the way he does. He mentions multiple times throughout the article that he’s expecting to receive a lot of negative backlash for the choices he makes, and fair enough, many readers will probably feel the initial bristle of resentment hearing about the extravagance with which he lives.

A happy middle ground

My point of contention isn’t with the way he spends his money, though. I’m all for ‘living the dream’ if it’s within reach. I do, however, believe that everything should be done in moderation. There is, as with most things, a spectrum of spending habits. On the one end there is Tony, spending without thinking twice (and ignoring the momentary twinge of guilt), and on the other end there are those that miss out on a lot of experiences for fear of ‘wasting’ their hard earned money.

Admittedly, I bear the burden of being the offspring of parents who strongly believe “the foundation of financial independence is a paid-for home.” (Now where have I read that before?)

I’d like to advocate for a happy middle ground: somewhere between throwing down $1,500 on a meal and stealing toilet paper from the bathroom of the bar to save a few bucks (trust me, that’s a thing). Instead of spur-of-the-moment trips to visit friends in far-flung locales, why not plan ahead a little? Spend time looking for the best deals and cheapest flights. It can actually become a sort of hobby in itself, and you will definitely save some cash!

Maintain some boundaries

Instead of having the motto to never say no, decide beforehand what you’re willing to part with, and have some boundaries. I find that for myself at least, always saying yes can get overwhelming, and though it can lead you out of your comfort zone, it can also lead you into situations that aren’t really all that fun.

Overall, I think Tony will be okay. He’s got a well-paid job in a stable field, and $80,000 in savings. He’s got a plan for his future that will help secure his happy retirement. It is important to remember while reading his story. though, that he is the exception to the rule. For the majority of us millennials, we need to focus on saving, budgeting, and saving some more, whether it be to eventually dive in and tackle a mortgage, or to be able to afford a (well researched, well planned) vacation.

Helen Chevreau is a student teacher, blogger and global adventurer. She also happens to be the daughter of Hub CFO Jonathan Chevreau. She has a B.A. in English and has been blogging for four years. Her next stop is Scotland for postgraduate studies in education.

Helen Chevreau is a student teacher, blogger and global adventurer. She also happens to be the daughter of Hub CFO Jonathan Chevreau. She has a B.A. in English and has been blogging for four years. Her next stop is Scotland for postgraduate studies in education.