By Patricia Campbell, Cascades Financial Solutions

(Sponsor Content)

Retirement planning used to be less complex. People would spend their career working for a company, retire after 25-30 years, receiving a watch and a pension that would be enough to live on. With people changing jobs every 2.7-4.5 years, more individuals becoming self-employed or freelancing, retirement has gotten a lot more complicated.

Unfortunately, it’s all too easy to make mistakes when planning for retirement. Here are 4 mistakes to avoid:

1.) Expecting the government to look after you

1.) Expecting the government to look after you

If you’re at least 60 years old and have contributed to CPP, you’re eligible to receive the Canada Pension Plan (CPP) benefit. The payments won’t start automatically, you would need to apply to the government to start receiving it. The Old Age Security (OAS) pension amount is determined by how long you have lived in Canada after the age of 18. As of July 2022, seniors aged 75 and over will see an automatic 10% increase of their Old Age Security pension.

The Canada Pension Plan (CPP) and Old Age Security (OAS) are guaranteed incomes for life but not necessarily enough to live securely in retirement. Assuming you’re 65 today and are starting payments for both, the combined total is $1,345.32 every month.

For the CPP, the maximum amount is $1,253.59 (2022), although most individuals don’t qualify to receive the full amount. The average amount for new beneficiaries (October 2021) is $702.77.

2.) Applying for government benefits too early

2.) Applying for government benefits too early

You could receive 8.4% more every year when delaying your CPP payment beyond age 65. That’s a 42% increase if deferred to age 70. For OAS, you receive 7.2% more for each year of deferral beyond age 65. That’s a 36% increase if deferred to age 70.

It seems like a good idea to wait, but before you decide, consider this: If you compare 3 individuals who are the same age, where Mark takes the CPP at age 60 and Tonya takes it at age 65 and Natasha at age 70. The break-even point where Mark and Tonya will both have received the same amount of money is age 74. Natasha, on the other hand, will not catch up until age 80. At this point, Natasha will begin to outpace the others considerably. But keep in mind, she would need longevity to actually use and enjoy the money. With this being said, the later you start, the higher your monthly payments will be.

3.) Spending Too Much Money Too Soon

3.) Spending Too Much Money Too Soon

Do you really know how much you spend each month? Unlike working, you will have a fixed income in retirement. Therefore, it’s important to plan your retirement including any vacations or large purchases. An important part of retirement income planning is knowing how much income you can achieve based on your savings. Cascades Financial Solutions is an excellent tool to use when determining your after-tax income.

4.) Paying more tax than you need to

4.) Paying more tax than you need to

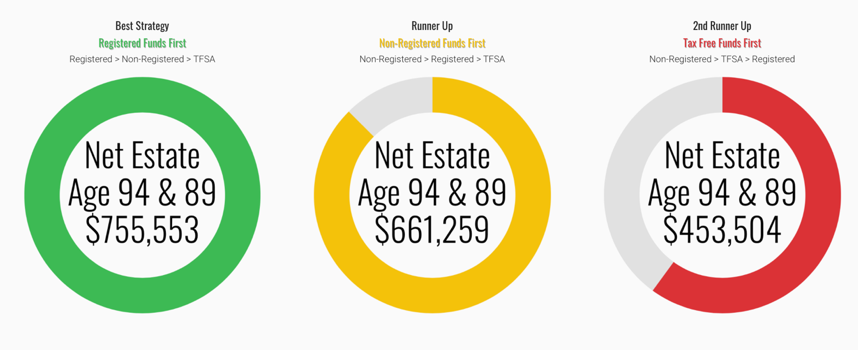

The sequence of withdrawal matters. Your withdrawal strategy could be the difference of paying tens of thousands more in taxes over the span of your retirement.

For example: Baily and Amaka were told long ago that withdrawing non-registered funds first is the best option for retirement income. They received poor planning advice over 20 years ago and failed to revisit the topic of retirement income planning when the time came. As a result, they unknowingly ended up paying over $302,000 more in taxes over the span of their retirement. Proper scenario analysis for Baily and Amaka could have avoided this crucial financial mistake.

KEY TAKEAWAYS

- Depending on government programs such as CPP and OAS is not sustainable.

- Applying for government benefits too early can lower the amount you could receive.

- Spending too much without knowing your after-tax income could lead to not having enough money to last the length of your retirement. Cascades can help.

- Poor planning advise could lead to paying a considerable amount of taxes. See how Cascades can help you save money on taxes.

Sources:

Statistics Canada Life expectancy

Government of Canada CPP retirement pension: How much you could receive

Government of Canada OAS Old Age Security payment amounts

Patricia Campbell directs Operations & Marketing at Cascades Financial Solutions.

Patricia Campbell directs Operations & Marketing at Cascades Financial Solutions.