65% of Americans say their partner having too much debt is a dealbreaker in deciding to get married. Little wonder that the national marriage rate in the United States has declined 60% over the last 50 years.

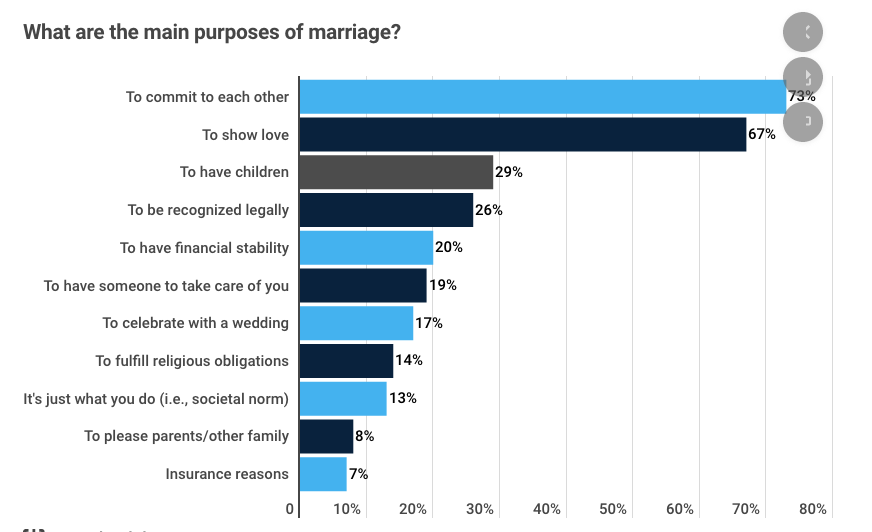

According to the Marriage Survey of 1,000 American adults conducted by Clever Real Estate in May (see graph above), financial stability is a primary purpose for marriage, as reported by 1 in 5 Americans (20%). In fact, 19% admit they would marry solely for money reasons (19%). Entering into the calculation are factors like high inflation, escalating living costs, and an expensive real estate market.

While marriage positively impacts finances for 66% of couples, only 54% of married couples discuss finances regularly, and 7% never broach the topic. 53% favor separate bank accounts. However, married women are 10% less likely to manage finances in their marriage than men. Money-related issues contribute to about 1 in 6 divorces (16%). Looking back at their lives, 10% of married respondents wish they chose a partner more financially responsible.

For more on Americans’ views on marriage, read the full report: 2023 Data: 1 in 4 Americans Think Marriage Is an Outdated Concept

Here are other highlights: