Let’s face it; pandemics can be exhausting. Earlier this year, you may not have loved your daily routines, but at least you were familiar with them; they took little energy to implement. Then, along came the coronavirus. Suddenly, many of even our simplest tasks required rigorous rethinking. You are not alone if you ended up feeling overwhelmed by what behavioural psychologists call decision fatigue.

On Investing and Jelly Jars

Decision fatigue isn’t just for troubled times. It can happen whenever you’re faced with too many choices, whether we’re talking about your life’s savings or free jars of jam.

What does jam have to do with being a successful investor?

In a landmark 2000 study, a pair of academics tested the widespread belief that more choices were more motivating for most of us. Offering free samples of a variety of jams in a high-end grocery store, they found that patrons who could sample up to 6 flavours were far more likely to subsequently purchase a jam than those who could sample up to 24 flavours.

In a landmark 2000 study, a pair of academics tested the widespread belief that more choices were more motivating for most of us. Offering free samples of a variety of jams in a high-end grocery store, they found that patrons who could sample up to 6 flavours were far more likely to subsequently purchase a jam than those who could sample up to 24 flavours.

Since then, other academics have published a litany of similar studies, all substantiating this important finding: Choice overload creates decision fatigue, which can generate poorer outcomes.

Simplifying the Menu

Your financial decisions are not immune from choice overload. For example, in the U.S., employees typically decide how to invest their employer-sponsored retirement plan contributions by selecting from a menu of funds that can range from lean to large. Through the years, multiple studies have looked at how to optimize these menus. Two academics from The Wharton School of the University of Pennsylvania published one study in 2016. This article summarized the results (emphasis ours):

“Decreasing a blizzard of options to a more manageable list reduced participants’ self-defeating buying and selling, cut the expenses the average participant paid and, in typical cases, could increase the size of the account over a 20-year period by $9,400 per participant … Moreover, participants’ portfolios were less risky after streamlining than before.”

To prevent decision fatigue from damaging your investments, we can apply what Yale University’s Laurie Santos calls the science of psychology, or “how to make wiser choices and live a life that’s happier and more fulfilling.” In short, just because you CAN invest in “a blizzard of options” does not mean you SHOULD.

A “Simple” Two-Fund Solution

Fortunately, there are sensible, low-cost solutions available to help you avoid choice overload in your investment portfolio.

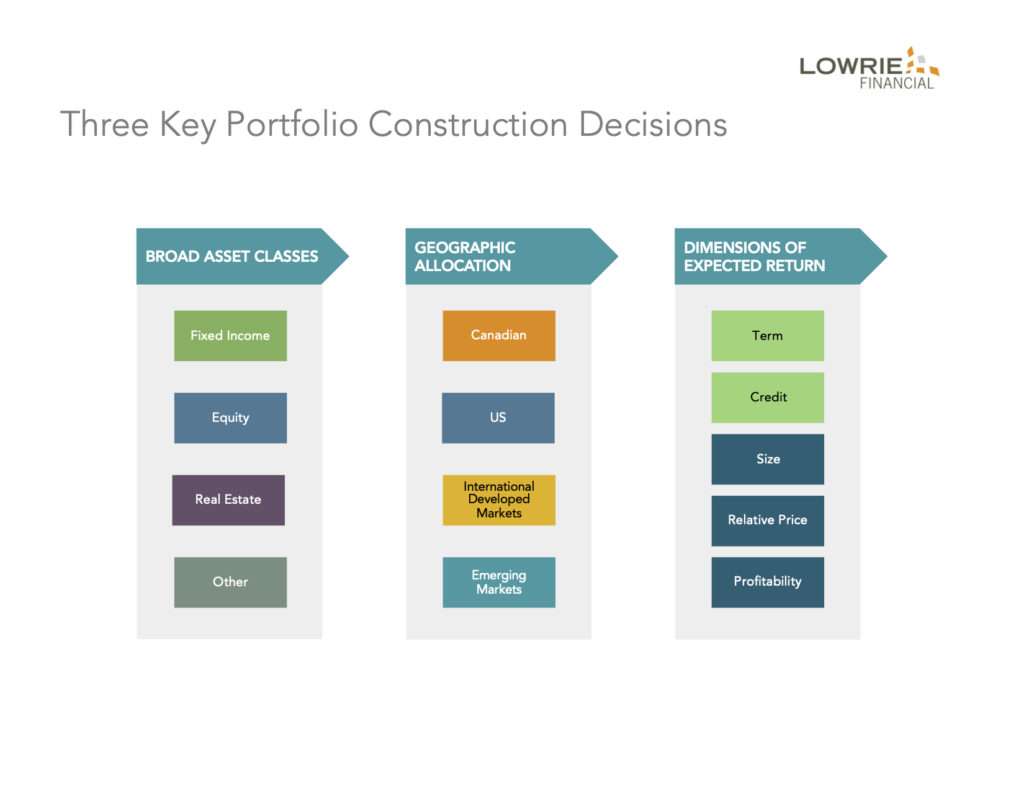

First, plan your own ideal investment mix according to these three key decisions:

Next, build a low-cost, globally diversified portfolio that best embodies your personalized plan. A perfectly good solution can contain two well-built index or enhanced index funds: one for global fixed income, and the other for global equities.

Technically, you could even invest in one balanced fund that includes both stock and bond exposure. However, separating the fixed income and equity offers more flexibility if you want or need to change your stock/bond allocations over time. Also, separate fixed income and equity make it easier to make minor adjustments to best reflect your liquidity (spending), tax management, and similar financial planning needs.

I hope you’ll remember this post next time you’re fretting over whether you should have more or less immediate exposure to U.S. stocks, Canadian bonds, REITs, energy sector stocks … etc., etc., etc.

Buying and holding a couple of low-cost, well-managed funds is probably your best choice for achieving your personal financial goals. Beyond that, too many choices can put you in a jam.

PS: To learn more, I recommend listening to Dr. Laurie Santos’s eye-opening podcast: Choice Overload. It’s just one 30-minute episode, and it’s what inspired today’s post.

Steve Lowrie holds the CFA designation and has 25 years of experience dealing with individual investors. Before creating Lowrie Financial in 2009, he worked at various Bay Street brokerage firms both as an advisor and in management. “I help investors ignore the Wall and Bay Street hype and hysteria, and focus on what’s best for themselves.” This blog originally appeared on his site on June 9, 2020 and is republished here with permission.

Steve Lowrie holds the CFA designation and has 25 years of experience dealing with individual investors. Before creating Lowrie Financial in 2009, he worked at various Bay Street brokerage firms both as an advisor and in management. “I help investors ignore the Wall and Bay Street hype and hysteria, and focus on what’s best for themselves.” This blog originally appeared on his site on June 9, 2020 and is republished here with permission.