By John Beck, Franklin Templeton Fixed Income

(Sponsor Content)

An inverted yield curve, historically a harbinger of a recession, lived up to its reputation this year. The beginning of 2020 saw an inverted curve in both the United States and Canada as equity markets reached record highs. Then came the realization that COVID-19 was not simply a regional issue centralized in Wuhan, China, but a pandemic that would turn the global economy completely on its head.

A precipitous drop in stock valuations followed, reaching a nadir in mid-March, but stocks have rallied strongly since then, recovering many of the losses of that late-February/mid-March period. In the bond markets, unprecedented monetary stimulus and across-the-board rate cuts meant yields remained anemic throughout the crisis. That started to change in early June when better-than-expected job and growth numbers saw bond yields edge up. A steepening yield curve with a wider spread between short and longer duration securities is good news for both fixed income investors and the wider economy.

Across the Atlantic, the European Central Bank (ECB) announced in early June that its bond purchasing program would run to at least this time next year, spurring a rally in European bond markets.

Central bank policy

Any macro forecast must come with the caveat that a prolonged economic recovery is entirely contingent on the pandemic. A second wave of COVID-19 this fall or winter will likely mean further lockdown measures across the globe. The French philosopher Voltaire famously said: “Uncertainty is an uncomfortable position, but certainty is an absurd one.” Apt words for the current environment, but investors can take encouragement from the efforts of governments and central banks throughout this crisis.

With central banks worldwide engaging in unprecedented quantitative easing, it is natural for bond investors to be wary of increasing fiscal deficits and the knock-on effect for government bonds. There are also questions on whether Keynesian fiscal stimulus will ultimately lead to huge inflation in the economy.

These are all valid concerns, but given the uncertainty surrounding the ongoing pandemic, central banks are primed to do a lot more if they deem necessary. The impact on employment and the wider economy is still very much in the balance, so central banks have a crucial role to bridge the current uncertainty.

Given the scale of the crisis, heightened bond issuance should not be an immediate concern. It does not appear likely that the recession of 2020 will mirror the last financial crisis in terms of length either. One major difference is that banks have much better capital positions today than in 2008, which will enable them to lend to businesses and individuals, thus spurring economic growth.

Reading the fundamentals

Throughout this crisis and into any recovery, it is important to remain disciplined and to adhere to robust investment processes. While technical factors may drive prices in the short-term, over the long-term, fundamentals and valuations are critical. In this respect, the Franklin Templeton Global Aggregate team see opportunities in high-quality, investment grade credit, which already makes up the lion’s share of our fixed income portfolios. Active rather than passive management stands out during periods of heightened uncertainty, as fund managers have the flexibility to rebalance their portfolios as the markets dictate.

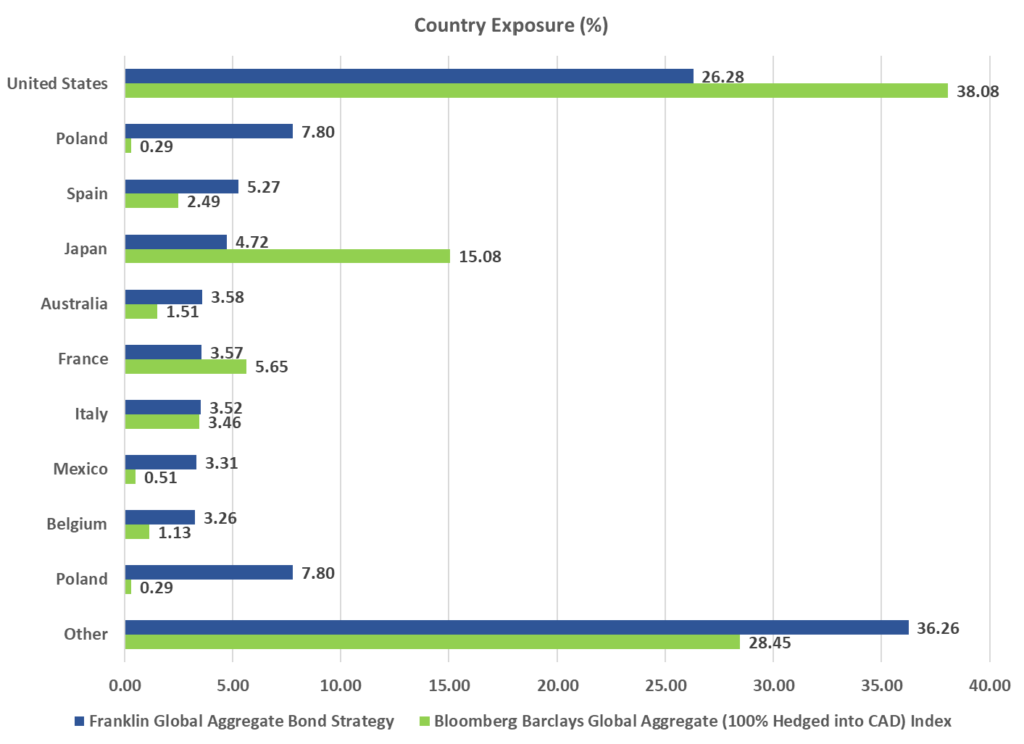

An active global strategy like Franklin Liberty Global Aggregate Bond ETF (CAD-Hedged) (FLGA) or Franklin Global Aggregate Bond Fund is designed to provide diversification for your portfolio and the kind of yields not available in domestic credit markets. This is achieved through incorporating top-down macro views and bottom-up analysis to find the best fixed income opportunities worldwide. You can learn more about these funds at Franklin Global Aggregate Bond Strategy.

Active Decision Making in Action

As of June 30, 2020

Source: Franklin Templeton and Bloomberg.

John W. Beck is Senior Vice President and Director of Fixed Income, London for Franklin Templeton Fixed Income Group. In this role, he coordinates the London-based fixed income teams that manage the group’s European Fixed Income and Emerging Markets Debt opportunities strategies. Mr. Beck is the lead portfolio manager responsible for Global Aggregate Strategies and manages portfolios for major institutions, including multinational pension funds and supranational organizations. He is a member of the Fixed Income Policy Committee.

Prior to joining the firm in 1990, Mr. Beck was with Saudi International Bank. He holds an M.A. from Exeter College, Oxford University.

Displayed portfolio information of the Franklin Global Aggregate Bond Strategy is represented by that of the Franklin Liberty Global Aggregate Bond ETF (CAD-Hedged) (FLGA). Franklin Global Aggregate Bond Fund invests substantially all of its assets in securities of FLGA. Market value figures reflect the trading value of the investments. Notional exposure figures are intended to estimate the portfolio's exposure, including any hedged or increased exposure through certain derivatives held in the portfolio (or their underlying reference assets). Portfolio breakdown percentages may not total 100% and may be negative due to rounding, use of any derivatives, unsettled trades or other factors. Information is historical and may not reflect current or future portfolio characteristics. All portfolio holdings are subject to change.