By Steve Lipper, Senior Investment Strategist, Managing Director, Royce Investment Partners

By Steve Lipper, Senior Investment Strategist, Managing Director, Royce Investment Partners

(Sponsor Content)

Companies with small market capitalization make up one of the more overlooked parts of the global equity markets. This could be attributed to a lack of coverage of their stocks by analysts, but whatever the reasoning, being overlooked creates opportunities for those investors who know where to look among small-cap equities.

Royce Investment Partners has more than 45 years of experience in the small-cap space. Such longevity brings with it a high level of expertise, allowing the firm to build assets under management (AUM) of US$17.6 billion.1

This has been achieved through a combination of specialization in small-cap investments and a commitment to ownership among the firm’s portfolio managers. With an average tenure of 22 years, Royce’s seasoned group of PMs have substantial ownership in the strategies they manage; in fact, 89% of the firm’s assets are in funds where the portfolio manager has invested at least US$1 million themselves.2 In this respect, Royce stands apart from its competitors: 37 asset managers in the U.S. have more than US$5 billion in small-cap assets, but only Royce has more than 95% of its total AUM invested in the space.3

While developing expertise in small-cap investing is complex, the reasoning for specializing in this area is quite simple: quality small-cap companies have been proven to deliver for investors.

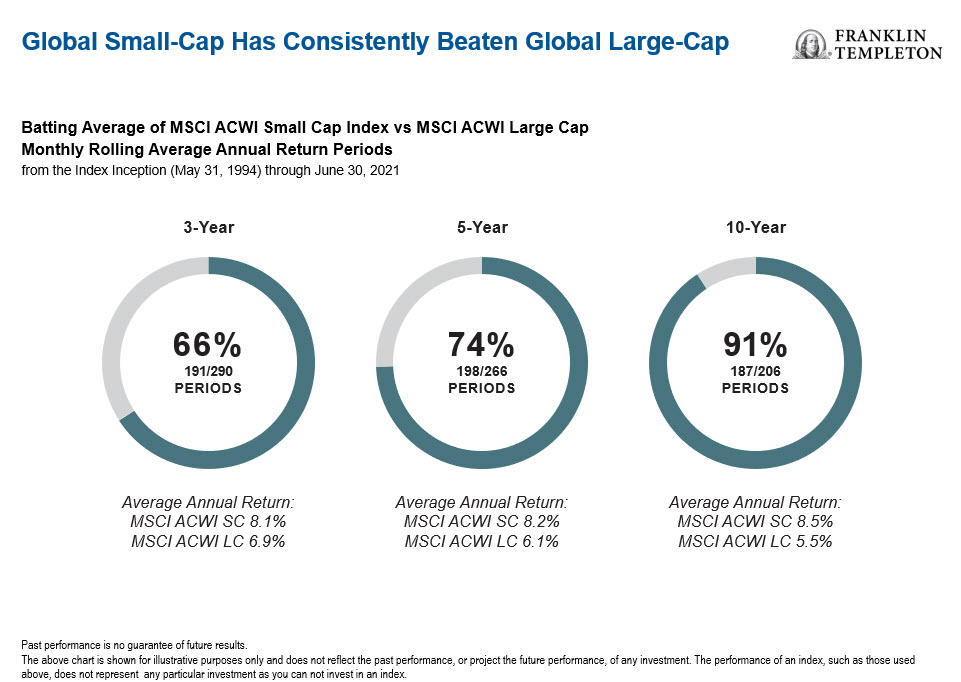

In fact, small-cap stocks have consistently provided meaningful outperformance compared to their large-cap counterparts over the long term. Using the MSCI ACWI Small Cap and MSCI ACWI Large Cap indices as proxies, it shows that small caps have delivered higher annual returns over most multi-year time periods (see chart below). In addition, small caps not only provide a much larger set of companies to invest in (approximately four times the amount in large caps), but with valuations that often understate their true worth. This is an important point to consider, especially given some of the pretty elevated valuations in equity markets right now.

The opportunities that small-cap stocks present for investors were a key factor in introducing our new strategy for the Canadian retail market, Franklin Royce Global Small Cap Premier Fund.4

This strategy invests primarily in global small-cap stocks that Royce believes are “premier” companies, have discernible competitive advantages, high returns on invested capital, and a sustainable franchise. While the investment team looks to buy growing companies at attractive valuations, in selecting “premier’’ companies, the primary focus in always placed in investing in firms with high and sustainable returns on invested capital (ROIC). The investment team prioritizes returns on invested capital (ROIC) as that is the primary driver of long-term shareholder value creation. Global small caps, as a large and inefficient asset class, are also ideal for a quality approach, which is strategic and effective at different stages of the market cycle.

After all, a company’s size in isolation is not a signal of its quality; rather, a sustainable high ROIC derives from its market structure, competitive position and operational efficiency. Companies with persistently high ROIC and effective reinvestment therefore generate attractive long-term shareholder value through the power of compounding, or as Albert Einstein famously said: “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Steve Lipper oversees the production of published research at Royce, focusing on the small cap asset class and the firm’s investment strategies. He provides regular commentary on Royce’s current views on the small cap market, as well as areas where Royce’s portfolio managers see opportunities. He also authors research that examines historical tendencies in long-term small cap performance and identifies factors that have affected returns through a variety of market environments. Steve joined Royce in 2014 and began his investment career in 1985. He is President of Royce Fund Services and holds a bachelor’s degree in Economics from the Wharton School of Business at the University of Pennsylvania. He is also a CFA® charterholder.

Steve Lipper oversees the production of published research at Royce, focusing on the small cap asset class and the firm’s investment strategies. He provides regular commentary on Royce’s current views on the small cap market, as well as areas where Royce’s portfolio managers see opportunities. He also authors research that examines historical tendencies in long-term small cap performance and identifies factors that have affected returns through a variety of market environments. Steve joined Royce in 2014 and began his investment career in 1985. He is President of Royce Fund Services and holds a bachelor’s degree in Economics from the Wharton School of Business at the University of Pennsylvania. He is also a CFA® charterholder.

Royce Investment Partners

The firm is a pioneer in small-cap investing, actively managing portfolios since 1972. Small-cap investing is Royce’s primary business and this distinguishes it from most other asset managers. The firm specializes in actively managed strategies that invest in the broad and diverse small-cap universe, calling on unparalleled knowledge and experience gained through more than four decades of investing in this area.

- Data as of June 30, 2021

- The percentage of mutual fund assets with manager investment of more than $1 million shows the portion on an investment adviser’s open-end mutual fund assets where at least one fund manager has invested more than $1 million in fund shares.

- Includes Morningstar data of all open-end and closed-end equity funds domiciled in the U.S. as of March 31, 2021, narrowing the list to include only those companies with at least one U.S. equity fund. From that group of 665 fund companies, products were included in at least one of the following categories: U.S. Fund Foreign Small/Mid Blend, U.S. Fund Foreign Small/Mid Growth, U.S. Fund Foreign Small/Mid Value, U.S. Fund Small Blend, U.S. CE Small Blend, U.S. Fund Small Growth, and U.S. Fund Small Value. This resulted in 249 firms with small-cap assets. We narrowed the list again to include only firms with more than $5 billion in small-cap assets and more than $10 billion in total assets, which resulted in 37 firms’ metrics.

- Effective August 9, 2021, Royce & Associates, LP (operating as Royce Investment Partners) (“Royce”) replaced Templeton Investment Counsel, LLC as the sub-advisor to Franklin Royce Global Small Cap Premier Fund (formerly Templeton Global Smaller Companies Fund). Royce is an affiliate of the Manager. Effective August 9, 2021, Templeton Global Smaller Companies Fund has been renamed Franklin Royce Global Small Cap Premier Fund. The investment objective of the fund remains the same. Certain investment strategies have changed. Please refer to Amendment No.1 to the Simplified Prospectus for the fund, dated June 24, 2021, for further details.

This commentary is for informational purposes only and reflects the analysis and opinions of Royce Investment Partners as of September 1, 2021. Because market and economic conditions are subject to rapid change, the analysis and opinions provided may change without notice. The commentary does not provide a complete analysis of every material fact regarding any country, market, industry or security. An assessment of a particular country, market, security, investment or strategy is not intended as an investment recommendation nor does it constitute investment advice. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Commissions, trailing commissions, management fees, brokerage fees and expenses may be associated with investments in mutual funds and ETFs. Please read the prospectus and fund fact/ETF facts document before investing. Mutual funds and ETFs are not guaranteed. Their values change frequently. Past performance may not be repeated. Royce Investment Partners, part of Franklin Templeton Investments Corp.