While 70% of Americans say they saved for retirement in 2016, many are anxious about the level of their savings and the need to direct money towards other goals and expenses, says a Harris Poll of 2,000 American adults conducted by the personal finance site NerdWallet. You can find the full results here.

While 70% of Americans say they saved for retirement in 2016, many are anxious about the level of their savings and the need to direct money towards other goals and expenses, says a Harris Poll of 2,000 American adults conducted by the personal finance site NerdWallet. You can find the full results here.

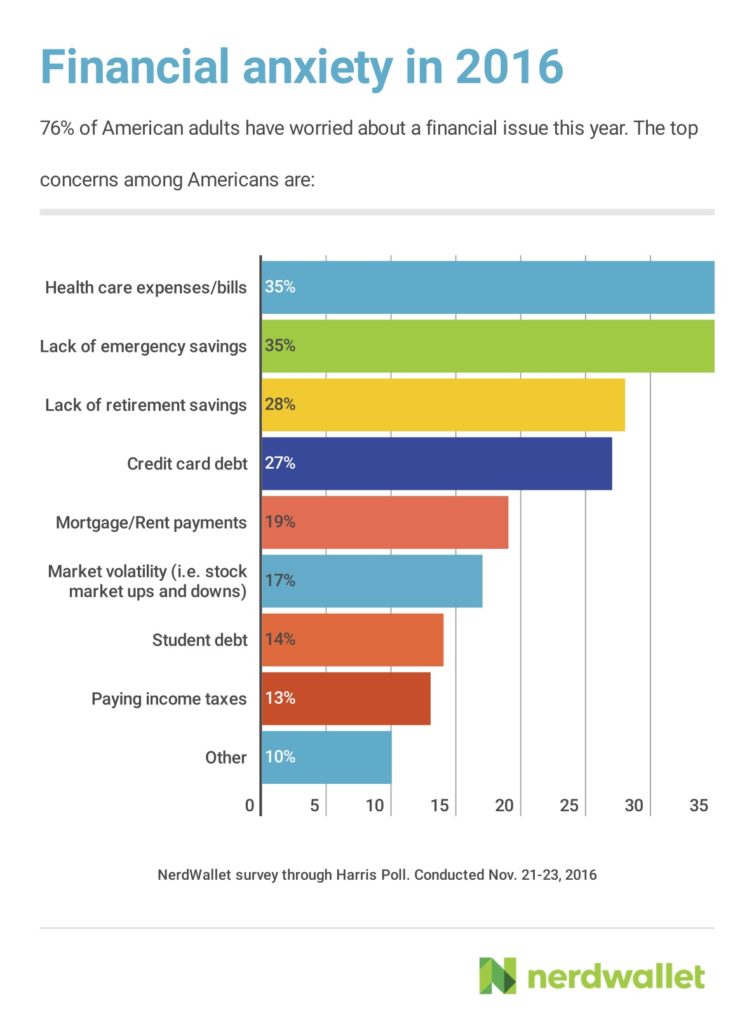

Other major financial concerns include lack of emergency funds (cited by 35%), health care expenses (also 35%)and credit-card debt (27%). Retirement remains the most commonly cited savings priority (mentioned by 28% surveyed) but only 29% feel confident they saved enough in 2016, while one in three aren’t saving for retirement at all (including 43% of Millennials aged 18 to 24). Lesser forms of financial anxiety in 2016 include making mortgage or rent payments (19%), stock market volatility (17%), student debt (14%), and paying income taxes (13%).

Next year may not be much better: of those with workplace pensions, only 32% plan to increase their contributions in 2017. Older Americans aged 45 to 54 are most likely to report concern about lack of retirement savings (40% surveyed), while only 20% are confident they saved enough this year.

Savers should favour tax-advantage accounts over savings accounts

Of those who are saving for retirement, more than half (55%) report they are using a regular savings account. In the cohort between 18 and 34, 63% are saving for retirement in a savings account.

Of those who are saving for retirement, more than half (55%) report they are using a regular savings account. In the cohort between 18 and 34, 63% are saving for retirement in a savings account.

In a press release issued Tuesday, NerdWallet head of investing and retirement Kyle Ramsay suggested US consumers should use IRAs and 401(k)s to take advantage of tax savings and the flexibility for higher potential returns. (The equivalent Canadian vehicles are RRSPs and Defined Contribution pension plans). Nerdwallet also suggests Roth IRAs, which — like Canadian Tax-free Savings Accounts or TFSAs — don’t offer upfront tax deductions on contributions but allure tax-free distributions (or withdrawals) in retirement.

Even if tax-optimized retirement accounts are maxed out for the year, investors can boost their overall rate of savings by using taxable brokerage accounts. If invested in stocks, these should generate historically higher returns than the paltry amounts of interest savings accounts have on offer from most financial institutions. Ramsay noted that low interest rates are particularly harmful to young investors with their long investment time horizons: they will be able to ride out the volatility of stocks over the long run and generate higher compounded investment returns.

While 42% reported having taken steps to prepare for filing taxes for 2016, only 6% reported increasing their retirement account contributions as part of that preparation: 401(k) and IRA contributions can lower taxable income for the current year (as can RRSPs and DC pension payments in Canada). 401(k) contributions must be made by year-end but IRA contributions for calendar 2016 can be made until April 17, 2017. In Canada, the RRSP deadline to reduce calendar 2016 taxes is March 1st, 2017.

Motley Fool blog on Dividend ETFs

P.S. My latest Motley Fool blog has just been posted: Not All Canadian Dividend ETFs are created equal.