Special to the Financial Independence Hub

Like many Canadians, early in my investing career, I was investing in high fee mutual funds and the high fees were eating into my returns. I started dabbling in DIY investing but I didn’t get very serious about it until around 2010.

When it comes to DIY investing, I would group DIY investors into two categories. Investors in the first category are people that rely completely on low cost index ETFs. They purchase ETFs on their own and re-balance them regularly. In the past few years, the emergence of all-in-one ETFs like VGRO and XGRO and all-equity ETFs like VEQT and XEQT have significantly simplified the investing process for these investors.

DIY investors in the second category are people that invest in individual stocks and possibly index ETFs as well. These investors study and research individual stocks and make the requisite buying and selling decisions.

As you’d expect, we fall in the second category. We manage our own portfolio and invest in both index ETFs and individual stocks. We have adopted this approach because we want to be more involved with our money and have more control over it. I also enjoy learning about investment-related topics and how to analyze stocks.

I will admit that I have made A LOT of investment mistakes throughout the years. However, investing mistakes are inevitable. The important thing is that we learn from them. That is the absolutely crucial thing as we all make mistakes; it is the learning from those mistakes that distinguishes the good/great investor from the mediocre/poor one.

So, I thought I’d share my learning from my investment mistakes and hopefully help readers to avoid the same mistakes.

Here are some investment mistakes I have made since I started managing our investment portfolio. They are not specific to only dividend growth stock investing.

Note: These mistakes aren’t in any particular order.

Mistake #1: Not doing proper research

When we first started with dividend investing, I knew very little about how to analyze dividend growth stocks. Like many new dividend investors, I was very much focused on only one metric – high yield. I was not paying any attention to other key metrics like payout ratio, dividend streak, or dividend growth rate. I certainly wasn’t keeping a dividend scorecard.

I stumbled onto a high yield dividend stock called Liquor Store in 2012. At first, I was overjoyed to find a dividend stock in the alcohol industry. Without doing my own research, I assumed that Liquor Store owned and operated all the liquor stores in Canada. I bought $1,500 worth of Liquor Store thinking I had hit the jackpot.

The business certainly wasn’t as rosy as I originally anticipated. The stock price then took a beating when BC introduced legislation to allow licensed grocery stores to sell BC wine.

Due to the deteriorating business environment, Liquor Store cut its dividend in 2016 and we exited this position shortly after, taking around 50% loss, not counting dividends collected.

Although I was deploying the be an owner strategy, I didn’t do my due diligence and learn more about the company. I failed to understand that the company was operating privately owned stores. I also failed to realize the Liquor Store only had a small fraction of the market share and was competing against Crown-owned liquor stores in Canadian provinces.

The biggest mistake? I foolishly assumed that since people would regularly buy alcohol, therefore the company would always be highly profitable, and the dividends would be safe.

I was simply too naive.

What did I learn from this mistake? I learned to always do research about the company regardless of whether I know the company very well or not. Never assume that I know something and never let my ego take over. At a minimum, learn about the company by going over investor presentations that most companies have under their investor relations. It is also important to go over quarterly and annual reports or consult websites such as Morningstar, Yahoo Finance, Marketbeat, Digrin, Seeking Alpha, Simply Wall St, etc.

In case you’re wondering, Liquor Store eventually was de-listed. It is now part of Alcanna (CLIQ.TO).

Mistake #2: Being greedy, not following my own rules

When I graduated in 2006 and entered the workforce, my company’s stock was trading around $15 per share. After my three-month probation period, I enrolled myself in the share purchase program and purchased company stocks with a portion of my pay-cheque every two weeks (the company matched 15% of my contribution).

Then the financial crisis happened and the company stock went down the drain. My company stopped the share purchase program and I owned a few hundred shares at a cost basis in the low teens.

Early in 2009, the company stock went all the way down to just below $4 a share. It sat around that price for a few months. Being young and with some money saved up, I decided to purchase 300 shares at $3.93. I then purchased a few hundred shares more as the stock price climbed its way up to around $10.

Altogether, I owned less than 2,000 of my company shares. Knowing that the company was not profitable at the time and that I could be easily replaced in a blink of an eye, I decided that it was not a good idea to put all my money in one basket, so I invested my money elsewhere (i.e. high fee mutual funds).

My company turned itself around in 2012 and the stock price started climbing. At one point, I told myself that I’d sell everything when the stock hit $20.

Throughout 2013, the stock price kept climbing, reaching a high of $25. The company was firing on all cylinders – we had won many multi-million deals with key customers and we were gaining market shares. I sold a few hundred shares to take in some profit. But I was not satisfied. I believed that the stock price would keep climbing.

I was being greedy and wanted to make more money.

So I kept most of my shares.

The stock price continued to climb. First, it was $30 per share. I told myself I’d wait for a little bit longer and sell when the price hit $35.

The stock price hit $35. Once again, I told myself I’d wait for $40.

Then the stock price hit $40 and I told myself I’d wait for $45 before selling everything.

The stock price went higher and higher. It was exhilarating. Everyone in the company was excited and happy about the stock price.

In early 2015, the stock price hit a high of just below $55. I thought about selling all my shares at the time but decided to reset my selling target to $60.

I was crunching numbers and imagining how much money I’d profit if I sold all my shares at $60.

But the stock price never got anywhere close to $60. In about three months’ time, the share price quickly tumbled from a high of around $55 to just below $20.

I was kicking myself for not selling my shares at higher prices. A year later the stock price eventually climbed back up. Seeing that I missed the boat the first time and didn’t want to miss my chance again, I sold a few hundred shares at a time as the stock price climbed its way up to $35.

Investing has a lot to do with being patient, setting and executing strategies as flawlessly as possible, and not letting your ego get in the way. In this instance, I totally got my ego in the way. I needed to learn to have an exit plan and execute this exit plan according to it, rather than continuously deviating from it.

Mistake #3: Not thinking long term

I purchased a number of Google shares in October 2012, a few days after Google announced a terrible quarterly result and the stock price went for a slide. At around $340 a share, I thought the per-share price was high but when I looked at the PE ratio and how much cash Google had, I thought I purchased Google shares at a discount (remember, you can’t just look at the stock price alone and claim it’s expensive).

I’ve always wanted to own Google shares, ever since I started using Google for internet searches in the late 1990s. I was amazed at how good and efficient Google was compared to other search engines like Yahoo, Altavista, and Excite (remember them?). As a teenager, I was convinced that Google would be extremely profitable. In the early 2000s, on several occasions, I told my dad to invest in Google if the company was to go public.

I was really happy to finally own a few Google shares, although looking back, I wished I purchased more shares (don’t we all?).

In late 2014, Google announced a 2 for 1 split. Two classes of shares were created – the voting class GOOGL shares and the non-voting class shares GOOG.

After receiving my new shares of GOOG, I decided that I would sell them and only hold onto my GOOGL shares. In my mind, I thought it wasn’t worth holding onto no-voting shares. More importantly, for some unknown reason, I had the impression Google had stopped growing and stopped innovating.

This impression was something I created completely on my own. Looking back, it was probably because Google’s stock price was bouncing around $600 throughout 2014 and I was losing my patience. I failed to do much research into Google’s businesses and didn’t realize that Google was getting into the Cloud, artificial intelligence and home automation with their acquisition of DeepMind and Nest. I also failed to value the huge revenue potentials from Android and Android apps.

Essentially, I failed to look at the long term potentials of Google. I was being narrow-minded and only looked at Google as an internet search engine and generating money from advertising. I failed to realize that Google was bigger than just the internet search engine. I was only thinking about the short term.

In fact, Google CEO Larry Page and his teams were acquiring and building other segments of business and broadening the Google empire.

Nowadays, Alphabet is even bigger than ever. We are even more dependent on Alphabet products than ever. Just recently, Alphabet announced a 20 to 1 split, the second split in company history since 2014.

I can’t help but kick myself for being shortsighted and selling my GOOG shares back in 2014. On the bright side, I did keep my GOOGL shares and do not plan to sell any time soon.

Therefore, when analyzing a company, always look at the big picture (i.e. macro environment). Always consider the company’s long term profitability and growth potential.

Mistake #4: Only look at dividend growth rate

Enter Laurentian Bank (LB.TO) for mistake #4.

A few years ago, I was looking at dividend stocks that were growing dividends at a high rate. After looking at the Canadian Dividend All Star list and the respective historical dividend growth rate, I narrowed it down to Laurentian Bank as one of the dividend growth stocks to add to our dividend portfolio. Per my 2018 dividend consideration:

“Laurentian Bank has seen its share price retreating the last little while. At a PE ratio of 9.9, it is one of the cheapest Canadian banks available from a PE ratio evaluation point of view. With a 10-year dividend payout increase streak and a 10-year dividend growth rate of 7.8%, LB has a solid dividend track record.

LB certainly isn’t as big as the big 5 Canadian banks, with most of its branches in eastern Canada. So from a future growth point of view, LB may not grow as quickly compared to its Canadian peers.

One of the concerns with Laurentian Bank is that it has high exposure to residential mortgages. In the fourth-quarter earnings, LB disclosed that an internal audit found some documentation issues on some mortgages it had sold to a third-party company. As a result, the bank has decided to buy back $392 million of problematic mortgages from the third-party.

Having said all that, I think at the current share price, it may make sense to purchase some shares of LB, collect dividend income, and see what the future holds.

Furthermore, it also makes sense to expand our banking exposure to outside of the Canadian big 6. Laurentian Bank of Canada is relatively small compared to the Canadian Big 6. If LB manages to grow outside of eastern Canada and possibly internationally in the future, the earnings will up.”

We started purchasing LB shares in January 2018 and nibbled on more shares throughout 2018. By the end of our purchases, we owned just under 150 shares at around a $46 cost basis.

Unfortunately, the stock price never went back up to $46 again. To make matters worse, when the COVID-19 global pandemic started, Laurentian Bank reduced its dividends by 40% from $0.67 to $0.40 per share and the stock fell dramatically.

We ended up exiting this position in late 2020, taking quite a bit of a loss as a result. In case you’re wondering, we switched from LB.TO to one of the big six so overall we did pretty well.

Looking back, I can’t help but return to my original statements like “Laurentian Bank isn’t as big as the big 5 Canadian banks,” “LB may not grow as quickly compared to its Canadian peers,” and “LB has a high exposure to residential mortgages.”

Most importantly, I failed to look at the big picture and the macroeconomics of Canadian banks. Being a smaller bank and having high exposure to residential mortgages, Laurentian Bank was already a riskier bet to begin with. It didn’t take much to set the entire business upside down.

While the uncertainties of the global pandemic had sent the global stock market on a free fall, many stocks have recovered since. However, Laurentian Bank has yet to recover. If we had held onto our LB shares, we would still be in the red!

Mistake #5: Not believing my investment thesis

This is the last mistake I’ll write for this post but it’s certainly not the last mistake I’ve made or will make…

When I started investing in Potash Corp in mid-2014 and Agrium in mid-2015 I came up with a simple investment thesis on why I’d invest in these companies – People need food. With an increasing world population, more food is needed and therefore, the demands for fertilizer will only increase over time.

The fertilizer business seems like an easy to understand business. Start a mine, dig out fertilizer from the mine, sell it, and rack in the profits.

For some reason, both Potash and Agrium struggled with their share prices. Since the fertilizer sector was very cyclical, we also encountered a dividend payout reduction of 60% by Potash a few years ago.

Through all the turmoils, we continued to hold both Potash and Agrium shares because I believed in my investment thesis. I continued to believe that the demand for fertilizer will only increase over time and the need for more food to supply the global population will be extremely important.

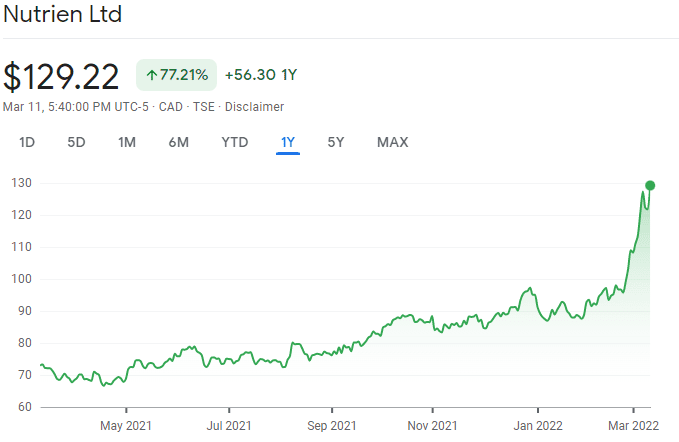

Eventually, Potash and Agrium merged together into Nutrien. The merger created one of the largest producers of potash and nitrogen. We decided to continue to hold Nutrien shares.

That all changed when the global pandemic started in March 2020. With the idea of reducing the number of stocks in mind, we closed out several positions throughout 2020, and we decided to sell all of our Nutrien shares in 2021.

My reason? Nutrien’s stock price had done very little over the last few years. I thought we’d do better by investing our money elsewhere. I stopped believing in my investment thesis completely.

Well, as our luck would have it, Nutrien stock price went for a run shortly after we sold everything. The climb in share price was mostly caused by strong demand and higher prices for fertilizers, supported by the strengthening of global agriculture markets.

Nutrien’s stock price really went for a ride when Russia invaded Ukraine with aid from Belarus. Since Russia and Belarus are the world’s second and third largest potash producers after Canada, the economic sanctions placed upon Russia and Belarus have caused a major and long-lasting disruption to the fertilizer market.

Given all the major global supply constraints, I expect Nutrien’s stock price to continue to soar.

Did we make a major mistake in selling Nutrien and not believing in our investment thesis?

Most definitely!

But when it comes to investing in individual stocks, you win some and you lose some. The important part is to have more winners than losers. This is very different from investing in a low cost index fund where you’re tracking the market performance minus fees.

Summary – Learn from my own investment mistakes

As you can see, I have made many investment mistakes and I will most likely continue to make these mistakes. While mistakes are usually painful and lead to leaving money on the table – or losing it – it is far more important to learn from these mistakes, so we don’t keep repeating them.

I hope I can help readers learn a few lessons by sharing my own mistakes.

Hi there, I’m Bob from Vancouver, Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month. This post originally appeared on Tawcan on Mar. 28, 2022 and is republished on the Hub with the permission of Bob Lai.

Hi there, I’m Bob from Vancouver, Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month. This post originally appeared on Tawcan on Mar. 28, 2022 and is republished on the Hub with the permission of Bob Lai.

What a great article – I appreciate your ability to be humble and admit that mistakes can be made by anyone!!