By Mark and Joe

Special to the Financial Independence Hub

Many people feel you need to save a bundle for retirement, and that can be true, depending how much you intend to spend. So, can you retire with a $500,000 RRSP? Can you retire without any company pension plan?

Read on to learn more, including how in our latest case study we tell you it’s absolutely possible to retire with no company pension while relying on your personal savings.

Financial independence facts to remember

You may recall from previous case studies on our site while achieving financial independence (FI) is desired by many it may not be possible for most to achieve.

Realizing FI takes a plan, some multi-year discipline, and ideally one or both of the following:

- For every additional dollar you save, you can invest that money so it can grow your wealth faster, and/or,

- You can realize financial independence by consuming less.

Here at Cashflows & Portfolios, we suggest you optimize both options above: if you can.

Check out these previous, detailed case studies, to see if you fall into any of these retirement dreams:

Check out how Michelle, a 20-something software engineer, plans to retire by age 40, including how much she’ll need to save to accomplish that goal.

This couple plans to retire by age 50 by using their appreciated home equity.

Here is how much you need to save to retire at age 60 rather comfortably.

There are different roads to any retirement

Members of our site have already learned the powerful math behind any retirement plan:

The more you save, the faster you are likely to achieve your goal.

However, life is not a straight line. Everyone has a unique path to retirement. Twists and turns abound. Depending on the path you took in life, including what decisions you made, your retirement planning work could be vastly different than anyone else’s.

Can you retire with a $500,000 RRSP?

Not every person has a high savings rate. In fact, most don’t.

Not every person has a company pension plan to rely on either. In fact, increasingly, many don’t!

Our case study participant today was unable to have a high, sustained savings rate and he didn’t have any company pension plan to buy into either. Is he doomed for retirement? Will $500,000 saved inside his RRSPs in his 60s be enough (in addition to $100,000 in his TFSA)?

Let’s look at his case study.

In our profile today, is Tom.

Tom is aged 63 and wonders if he can retire with $500,000 invested inside his RRSP and $100,000 in his TFSA. Here are some snippets from his email to us:

Hi there,

I was hoping you can help since I know you perform some financial projections for clients … I was just wondering if you have any articles or would you know the answer to this question. I’m a single guy with a simple life. Let’s say I have only my RRSP (for the most part) to rely on for retirement beyond government benefits. I have almost $500,000 invested there. I have no non-registered account although my TFSA is maxed and now worth $100,0000. (I don’t want to use my TFSA for retirement spending right now, I consider it a big safety net as I get older so maybe you can help me run some math?) Anyhow, I am wondering if I could start taking money from my RRSP, and retire soon. Any money I don’t need for retirement, I would move in-kind into my TFSA. (I know from reading your site I cannot make a direct transfer from my RRSP to TFSA – thanks guys but I will take any excess cash I don’t spend and likely move it there. We’ll see.) I have very modest spending needs. I have no debt. I own my home in rural, small town Ontario.

What do you think?

I make decent money now, definitely not $100,000 per year but “enough” to meet my needs and to continue to invest inside my RRSP and TFSA for the next couple of years.

Do I have enough to retire and spend about $3,000 per month well into my 80s and 90s?

Thanks very much!

Thank you Tom!

To help Tom out in the future, we shared some low-cost investment ideas for his TFSA and RRSP:

Here are the cash flow and investing assumptions for Tom beyond what he told us above.

- We’ll assume by retiring “soon” Tom means at age 65. He has a couple of years to work full-time.

- We’ll also assume 2% inflation for Tom for future spending needs over time.

- We’ll be conservative (for the most part) with his investments: his RRSP earns 4.90% annually (60% equities/40% fixed income) and his TFSA earns about 6.5% (100% equities).

- We already know he has no debt (which is great to enter retirement with) and in owning his home we’ll assume that desired $3,000 per month covers everything he needs.

- Tom didn’t speak about any cash savings so we won’t add any. Of course, we think he should consider some sort of cash wedge at minimum to mitigate any sequence of returns risk.

- We have no idea what Tom’s estate plans are, so we’ll assume he has a die-broke plan. We’ll leave his house as an estate.

So, those are the essentials.

Can Tom from rural Ontario retire with a $500,000 RRSP?

Let’s see what the financial projections tell us:

Can you retire with $500,000 saved for retirement – results

The great news for Tom is, based on various assumptions, he can retire at age 65 – with some additional comfort!

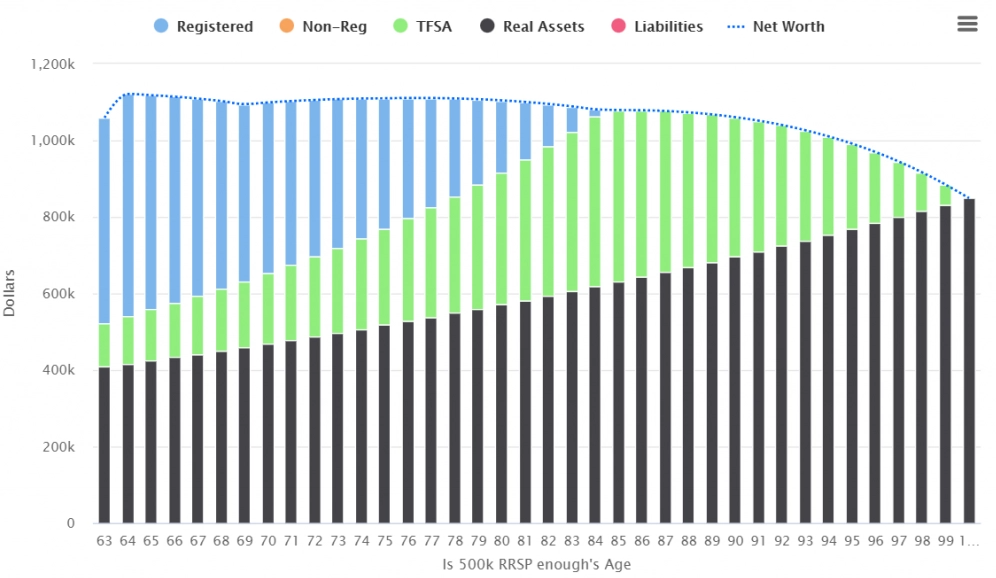

You can see from Tom’s net worth, he’s in great shape:

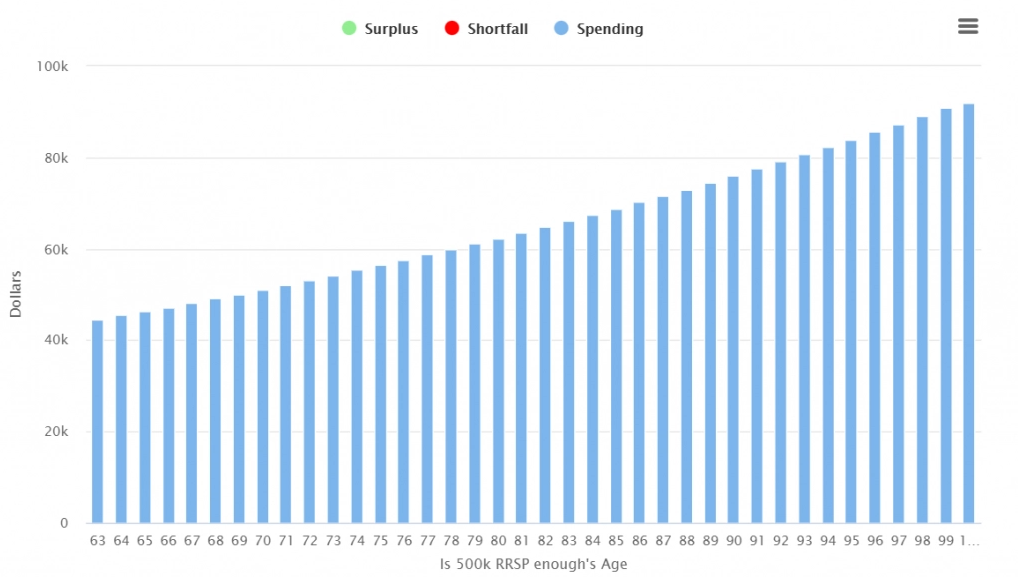

When we look at Tom’s spending plans, again, all good – to meet his desired $3,000 per month and then a bit more. In fact, we calculated Tom’s max spend to be closer to $44,500/year, on average, increasing with 2% inflation over time. Even when we stressed-tested his portfolio with the worst 20-year returns (and repeating), the maximum spending is still $40,500/year, so it looks like Tom is in good shape for retirement!

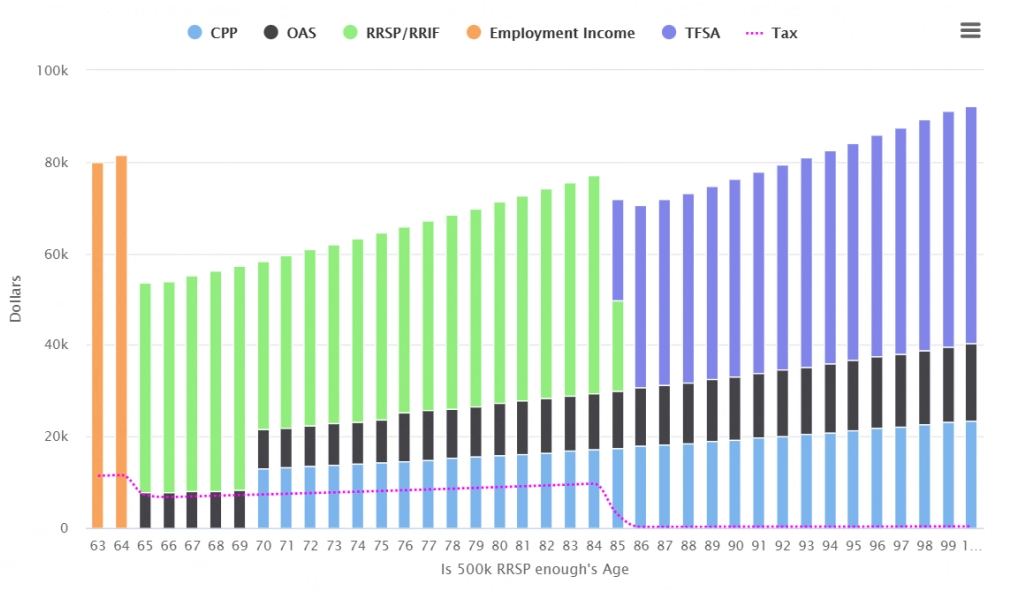

And finally, some nice sources of income for Tom – a blend of personal and government benefits.

Without any company pension plan, we’ve assumed for Tom to help fight longevity risk and reduce any personal investment risk, he will get the most out of his ~ 73% maximum contributions to CPP if he delays his Canada Pension Plan benefit to age 70. He does however take his OAS benefit at a more traditional age of 65 since a) that’s his retirement date, b) he will need the money then to live from, and c) if any retiree is going to defer any government benefit, CPP is better than OAS to do so.

Check out Tom’s retirement income sources below:

For further reading on when to take CPP, check out this other case study – When to take Canada Pension Plan (CPP) in retirement.

Can you retire with a $500,000 RRSP?

Absolutely!

However, any retirement plan on this sum of money will essentially boil down to flexible spending plans and modest income needs. Many retirees in Canada still think they need $1 million (or more) to retire on.

Well, this case proves it all “depends.”

We wish Tom well and we thank him for his email, allowing us to publish yet another informative case study for Canadians.

Cashflows & Portfolios is a free resource providing a beginning-to-end guide for Do-It-Yourself investors. The journey begins with how to budget and generate cash flow; how best to invest that cash flow; onto using the nest egg to fund the next phase of life – retirement. The site is owned and managed by Mark and Joe, established personal finance bloggers in Canada. This blog first ran on Oct. 1, 2021 and is republished with permission.