The double whammy of Inflation and rising interest rates are starting to be reflected in higher debt levels for Canadians, according to data released by TransUnion on Tuesday.

The Q2 2022 Credit Industry Insights Report reveals that Canadians are vulnerable to payment shock as a result of high interest rates and inflation challenges: “While there have still been gains in GDP growth and low unemployment, they are being offset by higher interest rates and cost of living. This lead to higher credit balances and increased costs of mortgages and loans.”

The report shows total debt grew to an all-time high at $2.24 trillion, up 9.2% year-over-year (YoY) and up 16.4% from pre-pandemic levels observed at the end of 2019. The number of consumers with a credit balance has increased by 2.1% YoY to 27.6 million and is up 2.5% from pre-pandemic levels (Q4 2019).

You can find the full press release here.

Among the highlights:

- Household finances were worse than planned for 41% of consumers, with 48% reporting they had cut back on discretionary spending. A startling 26% of consumers expect to be unable to repay their bills and loans.

- Total debt grew to an all-time high at $2.24 trillion, up 9.2% from the same time in 2021 and up 16.4% from pre-pandemic levels at the end of 2019.

- Consumer delinquency on personal loans has returned to pre-pandemic levels, up 19 base points (bps) YoY to 0.93%. Credit card delinquency is also up six bps from the prior year same quarter.

- Increased balance growth was observed across all risk tiers, with super prime consumers continuing to build overall outstanding balances (+5.1% YoY).

In the release, TransUnion director of financial services research and consulting Matt Fabian says: “With the combination of higher cost of living and higher spend driving up credit balances, along with the recent surge in mortgages and auto loans, many Canadian consumers are under pressure from higher debt service obligations … We’ve seen an increase in miminum payment amounts of up to 10% in the first half of 2022, depending on the combination of products consumers hold, along with a slight deterioration in payment behaviours.”

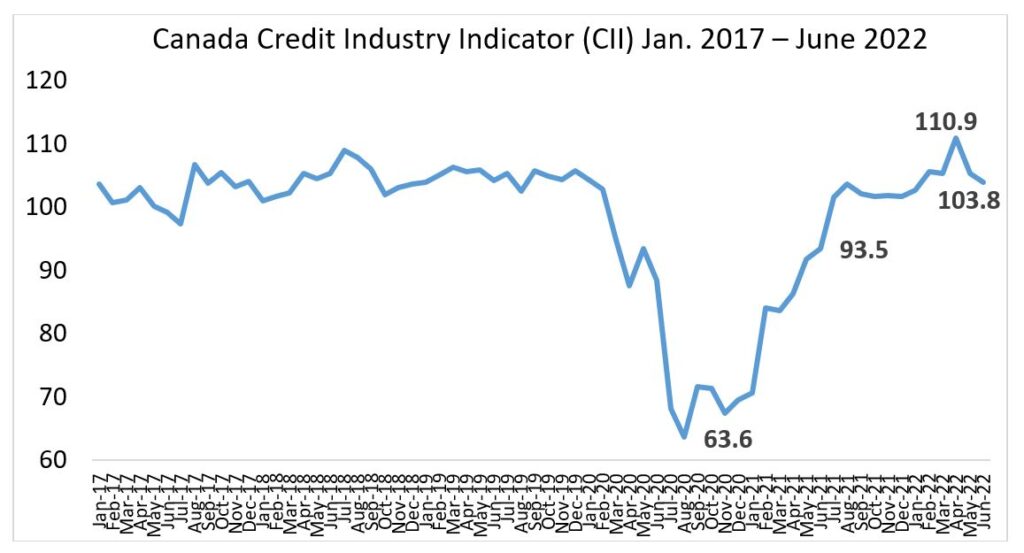

As shown in the chart below, all major credit products saw an increase in average balance per borrower, which TransUnion says indicates the consumer need to leverage credit.

Fabian added that “During the pandemic we saw a decline in credit participation among below prime consumers, so this marks a re-engagement of this segment as potentially the effects of inflation and interest rates have driven demand, while lenders have increased their risk appetite in this space.”

The report shows that overall, consumer-level delinquencies (borrowers more than 90 days past due on any account) increased by four basis points (bps) over the prior year same quarter, but still remain below pre-pandemic levels. “Consumer delinquency on personal loans has returned to pre-pandemic levels, up 19 bps YoY, to 0.93%.” Credit card delinquency (90 days or more past due) is higher by six bps from the prior year same quarter.

TransUnion says the increase in consumer delinquencies is partially explained by accelerated lender origination activity, especially in the below-prime space: “The YoY rises in delinquencies are generally small and not a major concern, given the increased credit activity observed post pandemic. As credit activity recovers and grows further, consumer credit performance is expected to return to near pre-pandemic levels.”