By Franklin Templeton

(Sponsor Content)

For those who depend on investments to provide a portion of their yearly income, 2022 has been a tough slog, to say the least; but take heart: it’s almost over.

Of course, no one can say with certainty that 2023 will be better. Persistently high inflation, ongoing central bank monetary tightening and the increasing likelihood of a recession have made for volatile markets, and this uncertainty could continue well into next year.

Under the circumstances, it’s not surprising that weary investors have poured money into GICs (guaranteed investment certificates) and other cash equivalents. Even with today’s higher interest rates, however, returns remain well below the inflation rate, and unless held in registered accounts, they are fully taxable. Liquidity can also be problematic as most GICs require a locked-in period, with penalties for redeeming before maturity. If you need flexibility, you’ll pay for it with lower returns.

Reliable income requires diversification

Without doubt, GICs have their place: but the proverbial advice about placing all your eggs in one basket still applies. Diversification is as important for income portfolios as it is for equities, and the sources of income should be as uncorrelated to each other as possible. One way to easily bump up the level of income diversification is through a managed program (sometimes referred to as a wrap account) which bundles together different investment vehicles, strategies, styles and portfolio managers in one or more “umbrella” portfolios directed by a governing team of portfolio managers.

20 years of income generation

One of the earliest programs managed in Canada was Franklin Templeton’s Quotential program; in fact, this year marks the program’s 20th anniversary. Of its five globally diversified, actively managed portfolios, the aptly named Quotential Diversified Income Portfolio (QDIP) is designed to generate high, consistent income from multiple uncorrelated sources. Canadian and international fixed income assets form the core of the portfolio, but for added flexibility and performance enhancement, about one-quarter of the portfolio is invested in blue-chip Canadian and international equities selected for their income-generating dividend yields and long-term growth potential.

“T” is for Tax Efficient

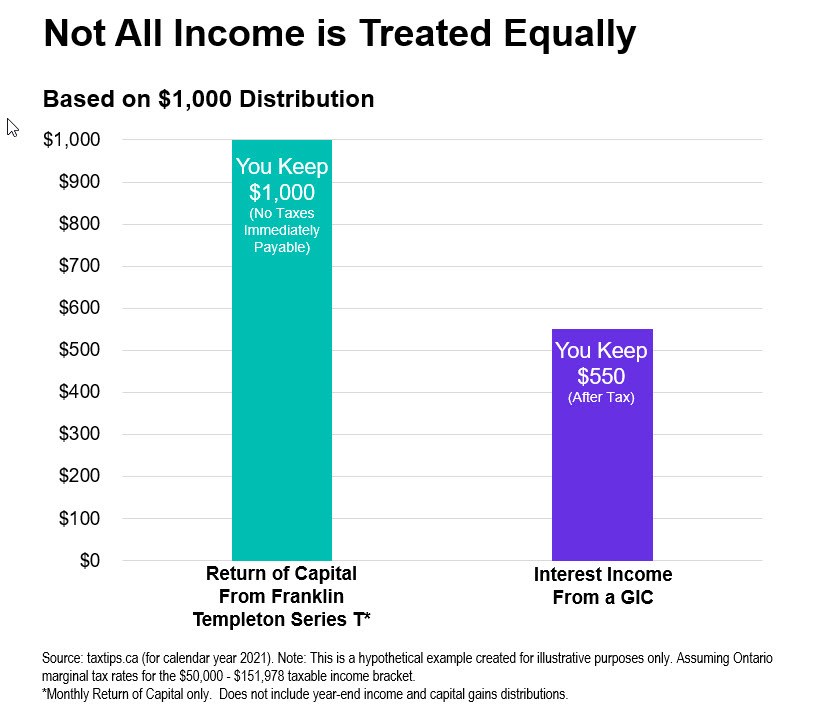

Reliability solves much of the income puzzle, but an important missing piece is the tax burden. Taxes can eat away at the income generated from investments, especially if you are still earning a salary or receiving significant income from other sources. All Quotential portfolios are available in Series T, which offers a predictable stream of cash flow through monthly return of capital (ROC) distributions. From a tax perspective, ROC is treated more favourably than interest or dividend income. The tax efficiency also extends to the tax deferral of capital gains that can help you better plan for when you pay tax. For snowbirds and others who spend extended periods south of the border, distributions from Series T are available in U.S. dollars for a number of funds, including Quotential Diversified Income.

It’s important to stress that with Series T, capital gains taxes are deferred, not eliminated.

Income on, income off as you need it

For some investors, flexibility is at least as important as a consistent flow of income. With Series T, return of capital distributions from all Quotential portfolios can be increased or decreased on request at any time, which can be helpful in years when your income from other sources is higher or lower than usual. As always in matters of taxation, it’s advisable to consult a professional before making any decisions.

More options than you may realize

Income investors need not despair, even if the fixed income environment heading into 2023 remains less than optimal. As this example illustrates, tools to create a reliable stream of income are available for those who know where to look.

Launched 20 years ago this year, the Quotential Program makes investing simple. All Quotential Portfolios are globally diversified with their asset classes and across countries and regions. Speak with your financial advisor to find out which Quotential portfolio is right for you.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Series T distributions are automatically reinvested unless otherwise requested. Series T may also pay a distribution that must be reinvested in December, consisting of income and capital gains. Please indicate your preference to receive cash flow immediately on the application form. The information presented herein is for illustrative and discussion purposes only and does not constitute any offering of any security, product, service, or fund, nor does it constitute any type of investment, tax or legal advice. Maximum target annual distribution rate on Series T varies between 5% to 8%. Investors may choose their desired ROC cash payout rate and the remainder will be reinvested. Important Legal Information This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user. All investments involve risks, including the possible loss of principal. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Equity and Fixed Income prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Franklin Templeton Investment Solutions, part of Franklin Templeton Canada. Franklin Templeton Canada is a business name used by Franklin Templeton Corp.