By Mark Seed, myownadvisor

Special to Financial Independence Hub

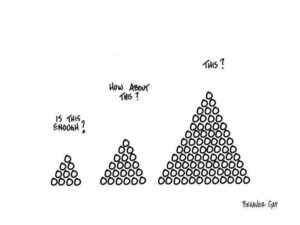

Some time ago on this site I wrote one of the biggest retirement questions is: how much is enough?

What might be our income sources, needs and wants be in retirement?

The answer to such questions are usually: it depends.

This updated post will share those details and outline how such needs and wants might be funded in our upcoming semi-retirement days – planned for sometime in 2024.

Read on and let me know your thoughts, questions or comments!

What are your income needs and wants in retirement?

It largely depends on what you’ll spend in retirement.

That’s always been step #1 in our book.

Whether you’re 35, 45 or 55, I believe it’s essential to figure out what retirement might look like to you.

Here are a few questions we’ve been working through:

1. When do we want to retire or semi-retire?

Math is helpful but I also believe we want to retire to something.

Both of my parents stopped all form of work around age 60. That may or may not work for me – literally. I like to be busy and instead of stopping work cold-turkey per se I would rather glide into semi-retirement/work on own terms and then slowly ease off the gas pedal per se whenever I want. At least that is my thinking now …

Sure, math helps: the later you retire from full time work, the longer you have to accumulate that retirement nest egg. But I believe there is also the work-optional option of part-time work in our 50s when the debt is gone and most of the assets needed for full-on retirement spending have already been accumulated.

Your mileage may vary. :-)

2. Where do we want to live in retirement or semi-retirement?

Likely Ottawa, as a home base still.

Our family is here. Most of our good friends are here or in the immediate area.

We don’t aspire to own a second home in the sunny south – too many liabilities.

We do however want to travel more/live some time abroad.

Our thinking could always change but it will be nice to have our condo bought and paid for without any debt on the books very soon and maintain it as a home base.

This means all income we do intend to make, including during semi-retirement, is for us to spend as we please.

3. What will our expenses be?

The general wisdom is that you will need somewhere between 70-80% of your current salary for living expensses in retirement. That means, if you make $100,000 combined per year, you should plan to have $70,000 to $80,000 in combined retirement income spending, as an example.

This general wisdom includes the logic that you are likely to spend less as a retiree – since you’re not commuting to work, you might have downsized your home, and/or you’re not supporting dependents.

I think these rules of thumb (like the 4% safe withdrawal rate/rule while valuable to a point) don’t make much sense when you dig further into your personal details, needs and wants. Rules of thumb are a starting point – only.

I far prefer to calculate what our fixed expenses will continue to be, during retirement, including inflationary spending, adding in some variable spending needs and wants as well.

Here is a snapshot on the former:

| Key expenses | Monthly | Annually | Semi-retirement comments ~ end of 2024??? |

| Mortgage | $2,240 | $26,880 | We anticipate the mortgage “dead” before the end of 2024. |

| Groceries/food | $800 | $9,600 | Although can vary month-to-month! |

| Dining/takeout | $100 | $1,200 | |

| Home maintenance/expenses | $700 | $8,400 | Represents 1% home value per year, increasing by inflation. |

| Home property taxes | $500 | $6,000 | Ottawa is not cheap, increasing by inflation or more. |

| Home utilities + internet/TV/cell phones, subscriptions, etc. | $400 | $4,800 | |

| Transportation – x1 car (gas, maintenance, licensing) | $150 | $1,800 | May or may not own a car long-term! |

| Insurance, including term life | $250 | $3,000 | Term life ends in 2030, will self-insure after that without life insurance. |

| Totals with Mortgage | $5,140 | $61,680 | |

| Totals without Mortgage | $2,900 | $34,800 | As you can see, once the debt is gone, we’ll be in a much better place for financial independence! |

Add in other spending/miscellaneous spending to the tune of $1,000 per month and that’s our base budget.

Travel and Major Entertainment = our $X factor.

4. What will our income be each month?

Over the last few years, I’ve started to take a much deeper dive into the world of retirement income funding – not only because we need to figure this out for ourselves but I enjoy supporting others too!

Knowing how and when to fund our semi-retirement income needs and wants is key to know our that our plan is largely accurate, attainable, sustainable, while also mitigating risk for the unexpected.

And the answer is …

Figuring out how much you need for retirement or semi-retirement can be complicated but we’ve got a decent plan IMO. This next section is going to break down how we are largely going to fund our income needs and wants each month.

Key income sources in retirement – beyond any part-time work:

Source # 1 – Workplace pensions

At the time of this post, when I started my job with my current employer well over a decade ago I was offered a choice for my pension plan – defined contribution (DC) or defined benefit (DB). I chose DB. When my wife started her job she was offered the same choice and chose the DC plan instead (based on advice from her Investors Group Financial Advisor before I knew her. Yes, this is a true story). Our hope is that pension income will fund a good portion of retirement expenditures in our 60s and beyond…

Source # 2 – Registered Retirement Savings Plans (RRSPs)

Ever since I read David Chilton’s The Wealthy Barber it reinforced the lesson of pay yourself first. In my 20s the RRSP contributions were rather lean but I made up for some lost time in my 30s. Later this year I hope my RRSP will be fully maxed out. We hope to contribute more money to my wife’s RRSP in the years ahead.

I figure we’ll need a nest egg of >$500,000 inside our RRSPs (combined) to help fund semi-retirement with. I figure that should allow us to withdraw a solid $15,000 – 20,000 combined per year for a few decades, but start with “living off dividends and distributions” and eating capital along the way.

Source # 3 – Non-Registered and TFSA Dividend Income

Investing in stocks that continually pay dividends is a lovely thing.

Investing in stocks that continually increase their dividends year after year is even better!

Not only does this provide investors like myself with a steady passive income stream but also an increasing passive income stream.

We’ve been on a long-term journey to earn tax-efficient (non-registered) and tax-free (TFSA) dividend income for semi-retirement, a goal of earning $30,000 per year I’ve been blogging about for years now …

That goal is now very close in fact at the time of this post.

Given that, I’ll be sharing (soon) how I intend to change my monthly dividend income updates in the coming year, to better align with our semi-retirement drawdown plan. More to come in 2023!

Our long-term goal has always been: once we earn about $30,000 in dividend income from these accounts by around age 50-55, we can consider working part-time and scaling back given other assets we own or expect.

That brings me to our final income source …

Source # 4 – Government Programs

Based on recent information, here are the average Canada Pension Plan (CPP) and Old Age Security (OAS) payment benefits:

| Maximum annual Benefits | As of January 2022 | Projected Benefit* |

|---|---|---|

| Old Age Security (OAS) | $7,707 | $11,452 |

| Average annual Benefits | As of October 2021 | Projected Benefit* |

| Canada Pension Plan (CPP) | ||

| Retirement | $8,433 | $12,531 |

We figure very conservatively CPP and OAS combined will pay us about $1,000 per month, each, at age 65+ and we’re planning on that = a minimum of $24,000 total per year at age 65+.

Income Sources, Needs and Wants in Retirement Summary

When I add up our future, smallish workplace pensions, along with our RRSP income/drawdown plans in our 50s and 60s, in addition to growing non-registered and tax-free dividend income, and then finally government benefits later in life – the sum of these investing parts should continue to put us in decent financial shape for retirement providing multiple income streams for retirement needs and wants.

That said our retirement plan includes a host of assumptions, hopes and savings goals. Lots of things need to converge in the coming year or so to keep the Financial Independence Plan intact.

I’ll keep you posted on that progress and financial organization this year.

“…Plans are worthless, but planning is everything…” – Dwight D. Eisenhower.

If you’re in retirement, how did you determine your enough number?

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on Jan. 10, 2023 and is republished on the Hub with his permission.

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on Jan. 10, 2023 and is republished on the Hub with his permission.