Billy Kaderli, RetireEarlyLifestyle.com

Special to Financial Independence Hub

It’s everyone’s nightmare: watching retirement assets vanish in a bear market, especially in or just before retirement.

Many of you will remember the severe market downturn of 2000-2002, the Dot Com Bubble, when the Standard & Poor’s 500 Index fell 37%.

We’d be lying to say that this declining market didn’t affect us. Our finances dropped about the same as most others on a percentage basis. As retirees, with no regular paycheck coming in on Friday, this event could have spelled disaster for our future plans of maintaining our financial independence.

Then there was the 2007-2009 “Great Recession,” where the market fell by almost 50% lasting 17 months, testing our courage.

The 2020 Covid scare shook the market’s foundation, earning the title of the “shortest bear market” in the S&P 500 history, lasting only 33 days.

And now here we are again in 2023, where the market is in the grip of a bear. How much longer will this last? How low will we go?

What should we do? How do we cope?

First, we’ve learned from past bear markets the importance of some cash flow. Having aged a bit and now receiving Social Security we have adjusted our portfolio to a more balanced one adding DVY, iShares Select Dividend ETF as a dividend-producing asset as well as increasing our cash holdings.

Then, there are regular chats about our finances and the state they are in, in hopes of averting a possible worst-case meltdown. We have discussed the fiscal facts and tried to extrapolate them out into the future.

One obvious problem: No one can predict the future.

Friend asks “Billy, why are you investing now? You know the market is crashing, right?” Same friend 10 years later: “Hey Billy I heard you retired early. How did you do that?”

Using history as a guide

Researching bear markets, we take heart from the knowledge that past downturns always ended.

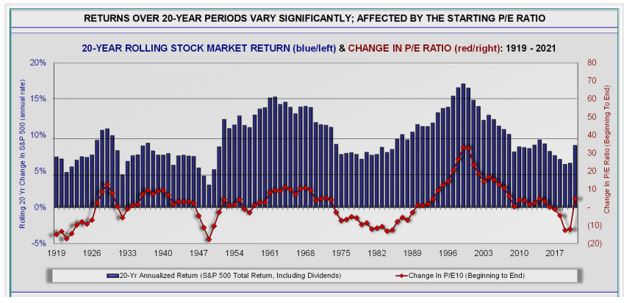

Retiring is definitely easier when markets are rising as compared to when they are falling. But how do you know if you are in a rising or falling market? That depends on your starting point and there has been no 20-year rolling negative returns.

Another question to ask – is this is a good time to buy equities? For every buyer there is a seller and they both think they are right. Maybe the cure for cancer will be announced tomorrow or the global economy will collapse. We just don’t know.

That’s the point.

This is why you need to create the mental confidence to ride out these fluctuations and not panic out of the market.

What we don’t do is lock ourselves in, mentally or creatively. In our experience, it hasn’t proven useful to recede into fear or exaggerated “what if” scenarios. It is necessary for us to be clear-headed and have fun, with the degree of freedom that our lifestyle requires.

We have survived the past bear markets and are now into our 33rd year of financial independence.

We plan on surviving this one too.

Weathering these financial storms strengthens our fortitude and it’s comforting to know that since our retirement in 1991, our net worth has grown through these ups and down well above the annual inflation rate after expenses.

Billy and Akaisha Kaderli are recognized retirement experts and internationally published authors on topics of finance, medical tourism and world travel. With the wealth of information they share on their award winning website RetireEarlyLifestyle.com, they have been helping people achieve their own retirement dreams since 1991. They wrote the popular books, The Adventurer’s Guide to Early Retirement and Your Retirement Dream IS Possible available on their website bookstore or on Amazon.com.

Billy and Akaisha Kaderli are recognized retirement experts and internationally published authors on topics of finance, medical tourism and world travel. With the wealth of information they share on their award winning website RetireEarlyLifestyle.com, they have been helping people achieve their own retirement dreams since 1991. They wrote the popular books, The Adventurer’s Guide to Early Retirement and Your Retirement Dream IS Possible available on their website bookstore or on Amazon.com.