By Gary Gorr, Chartered Financial Consultant

Special to the Financial Independence Hub

Recently I have been doing retirement assessments for several new customers. What amazed me as I spoke with them was how resigned to defeat the clients were. It was like they knew in their guts that they had started saving too little and too late to attain the retirement they wanted.

One answered my question on when do you want to retire by saying “around 120 is the only way I could.”

After the initial meetings I reflected on other circumstances from planning for customers in 2014 and noticed some commonalties.

- Age range: 45-55

- They own homes with attractive Fair Market Values

- Had fairly decent equity positions in homes

- Most would carry a mortgage into retirement

- All had projected incomes at retirement far less than their desired outcome

Many Canadians, including these clients, have grown up with the belief that home ownership is an important goal. The home represents a significant part of their net worth.

Not easy to unlock home equity

The reality is that when someone retires, all that home equity is hard to unlock, especially if they are well short of their retirement goal.

So I asked myself: “What if they treated a home like an expense, not as an investment?” By this I mean they choose to rent rather than own.

Here is what happened in one case I analyzed.

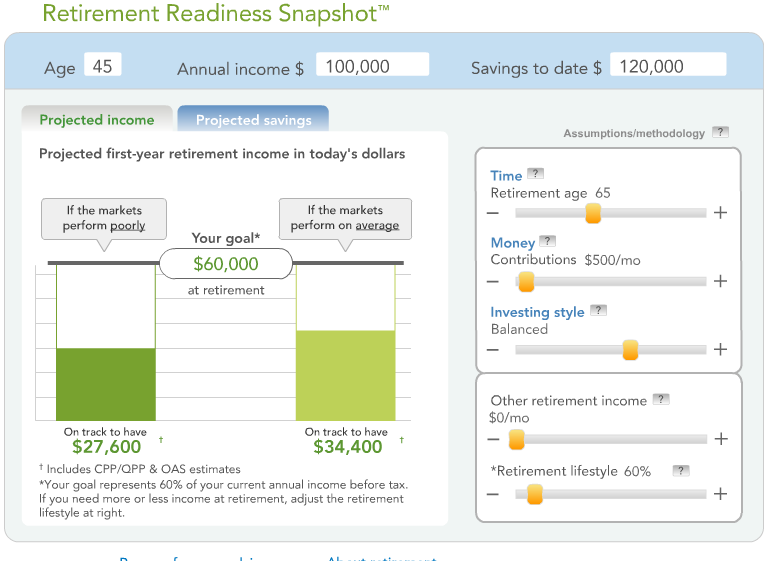

The client was 45, earned $100,000, had saved $120,000. Here is his income picture at 65 assuming a retirement income of just 60% of his earnings. He was saving $500 per month.

You can quickly see he isn’t going to have the retirement he wants unless he saves significantly more. That was unlikely to happen in this case.

So I proceeded to assume he sold the home, rented, and took the equity and accumulated the funds in a corporate class mutual fund. These are tax preferred during the accumulation phase and very tax preferred in the draw-down phase.

He realized $310,000 from the sale tax-free.

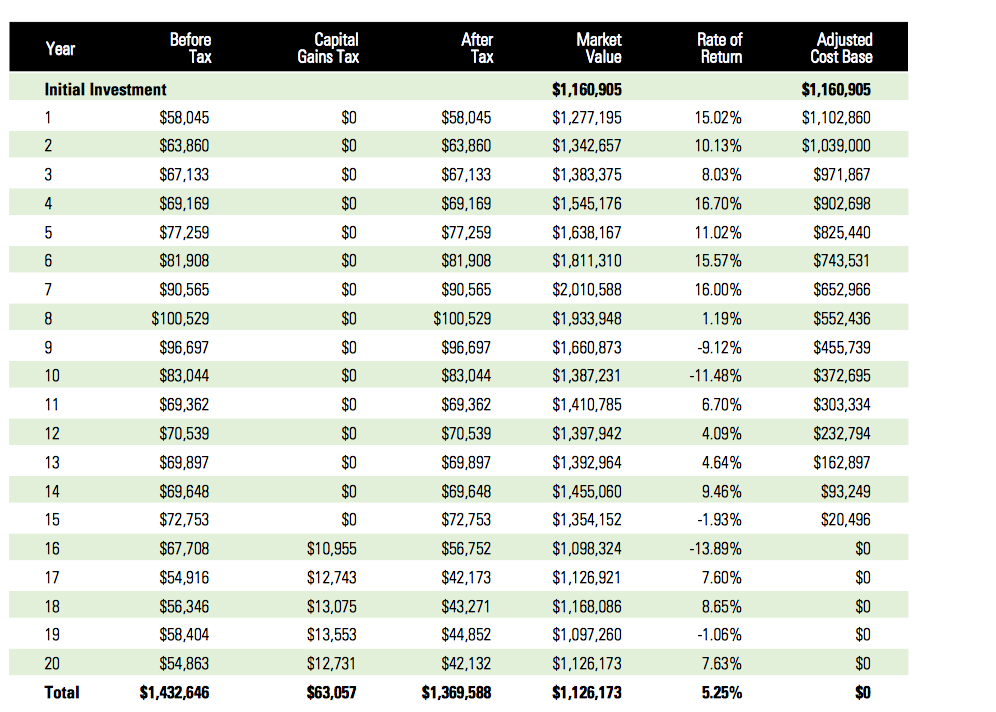

At 65 the value of his funds growing at 7% using a balanced investment option would be worth $1,160,905 without any capital deposits in the future besides the initial $310,000 of equity from his home sale. (It ignores him reinvesting the amount he was paying into property taxes.)

At that time he begins to withdraw 5% of accumulated capital per year. For the first 15 years the withdrawals are 100% tax-free, since they are deemed to be a return of capital.

His income stream in retirement looks like this picture, and remember the income for 15 years is tax-free.

This assumes money was invested in a balanced option using historical return rates and taking an annual draw of 5% of the capital. This is using tax-preferred T-shares, which are 100% tax-free until the Adjusted Cost Basis of the fund is zero. This takes 15 years. After that, income is taxed as capital gains.

So what can we conclude?

- First, for many years his income will grow annually as the underlying investment appreciates and the 5% is a bigger number.

- The income is tax-free for 15 years.

- He will achieve his goal for retirement and then some

He was on track to have somewhere between $27,600 and $34,400 depending upon the performance of the market. See the above image. His goal was $60,000. Add in the first year withdrawal of $58,000 tax-free and he exceeded his goal.

I tested the concept with a real estate agent Carlos Aznar of Homelife Hearts Realty, website- www.housefulhints.com He ran some numbers for me:

Client Scenario

– Equity of $310,000

– Carrying a mortgage until retirement

– Decent equity in homes

His analysis based upon prices and rent in the Durham region

- Current home prices in Centennial ranges from $575,000 – $615,000 for a detached 4 bedroom, 2000-2500 sq. ft. home.

- Using the above figures, he estimated a mortgage of $300,000 at 4% with a 25 yr. amortization; this results in a monthly payment of approximately $1580. Adding property tax ($5000/yr.), heat and water ($300/mth.) results in a monthly payment of $2300.

- If the clients are going to rent moving forward, he wanted to find a property that was equivalent to their current needs; similar properties in the area can be leased for approximately $2,000-$2,500/month + heat and water equates to about the same monthly commitment.

His Findings….

- From a cash flow standpoint, the monthly expense appears to be the same.

- Properties that are available for lease offers similar characteristics and size, which makes for an easier transition for families.

Things clients should consider…

- Making a move is a big change; so try to find a place that’s similar to your current place. That may not be easy, but if you can come close, it will help alleviate some of the stress of moving.

- Have a game plan for your investment … having the money to invest is one thing, but maneuvering in the market and mitigating market risk is another.

- As a renter, you lose some control in your living arrangement. The landlord can decide to sell the property, increase rent and follow some rules stated in the lease agreement.

As I write this I realize there are many variations of what we could do but why end up House Rich and Cash Poor at retirement?

Did we work 35 years only to be financially disappointed for another 30 years? I don’t think so. I think by doing this my clients’ feelings of hopelessness can be replaced by hope, always a good thing.

Maybe it’s time we viewed home ownership differently. Having a successful retirement might depend on it.

Gary B. Gorr, CHFC, has been helping small business owners and professionals create wealth and preserve it for over 39 years. He can be reached at 1-855-552-5136, email at ggorr@ifcg.com or his website at http://www.gorrfinancial.com